Lorem

Add Your Heading Text Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

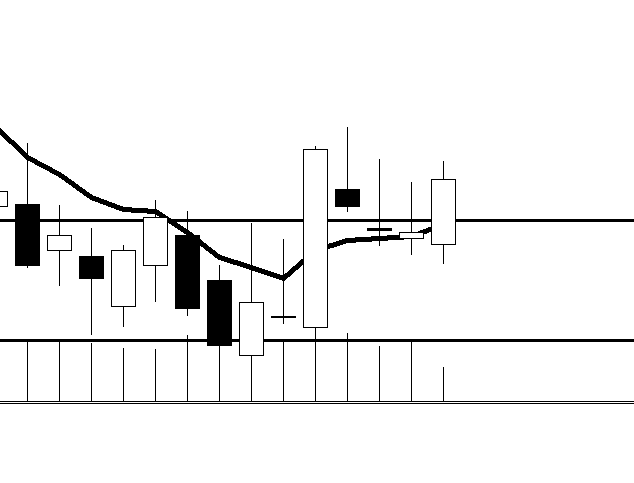

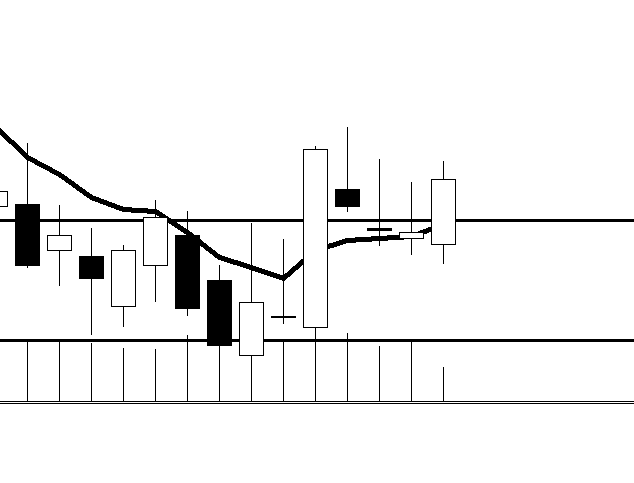

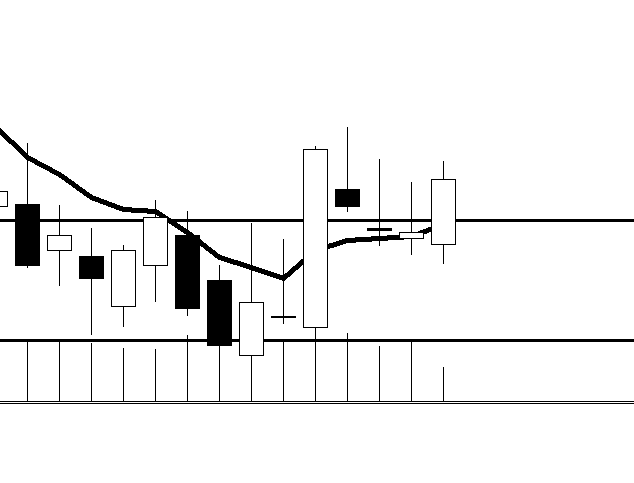

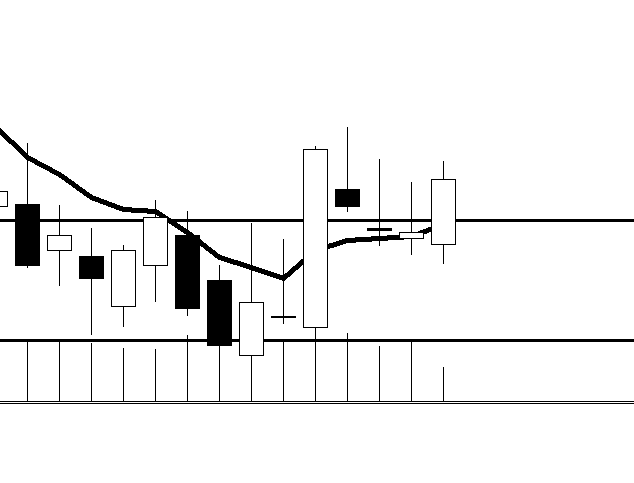

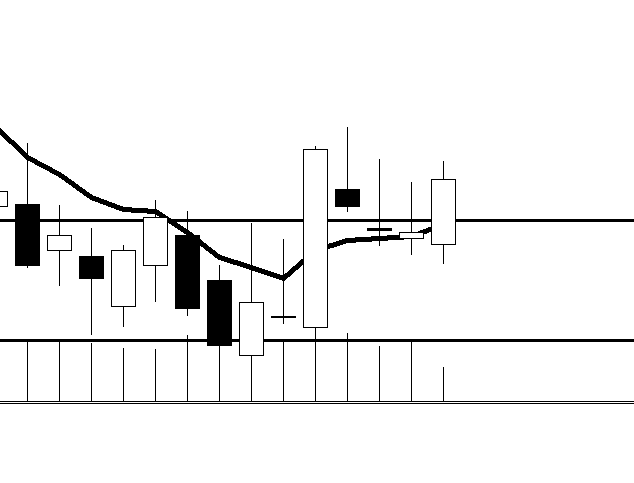

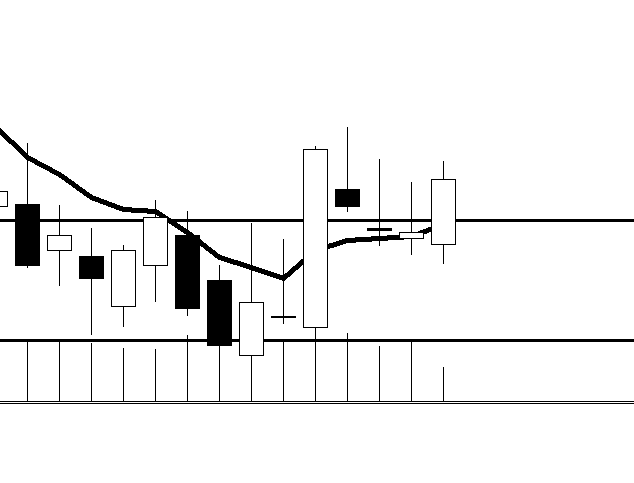

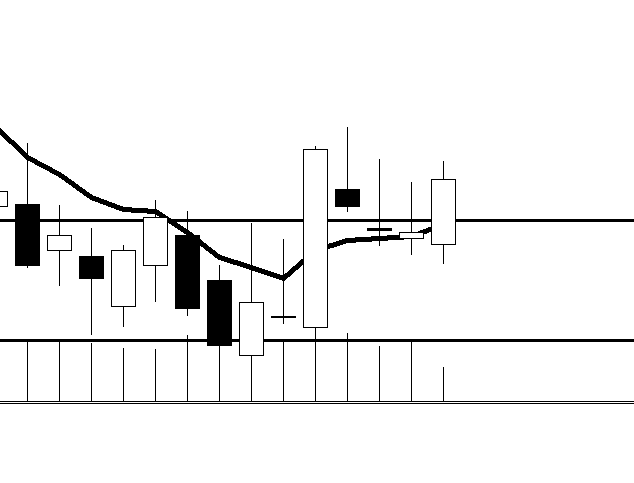

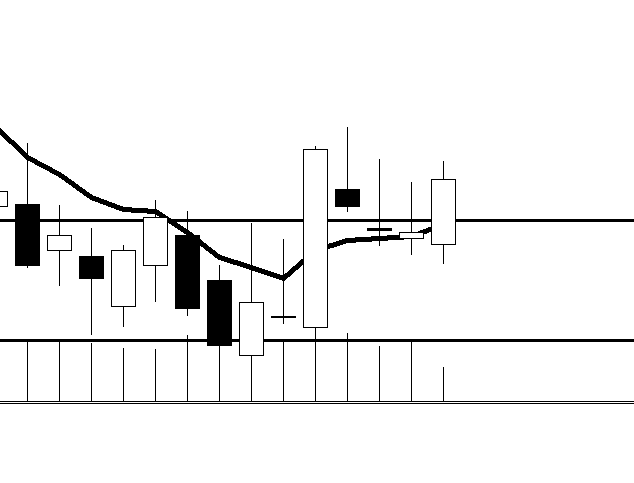

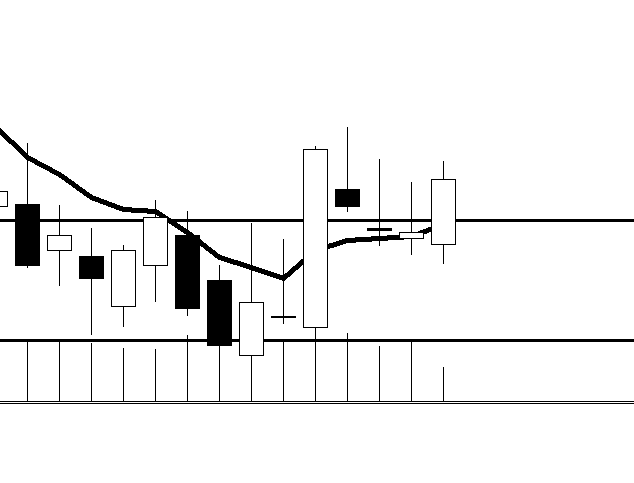

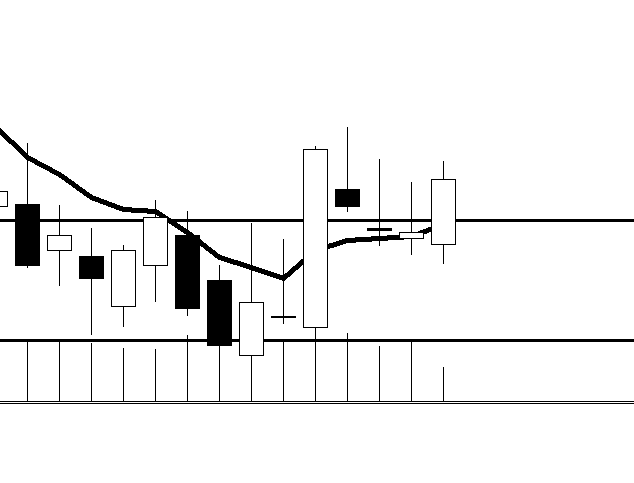

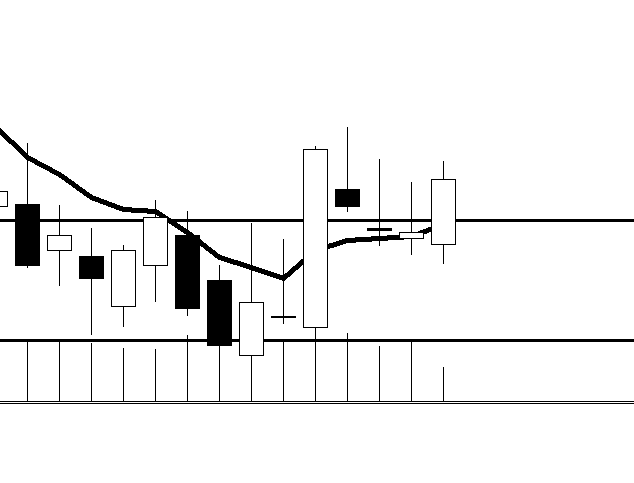

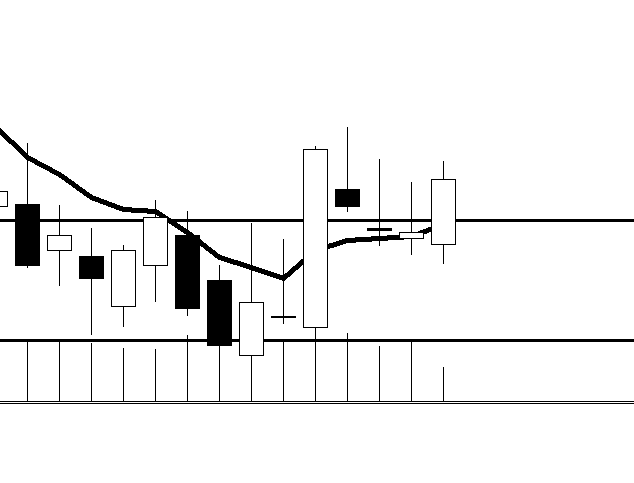

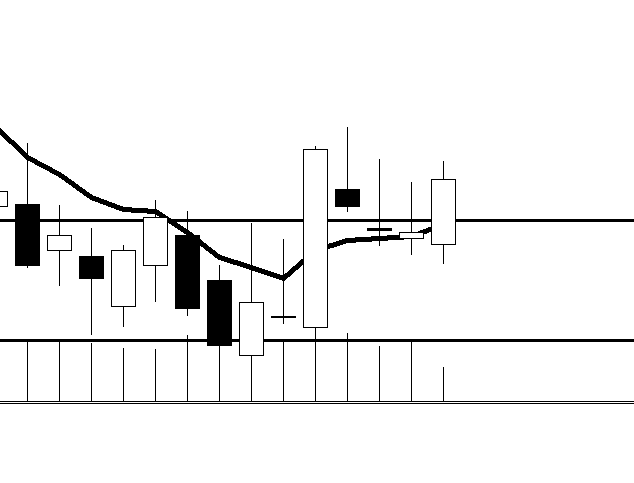

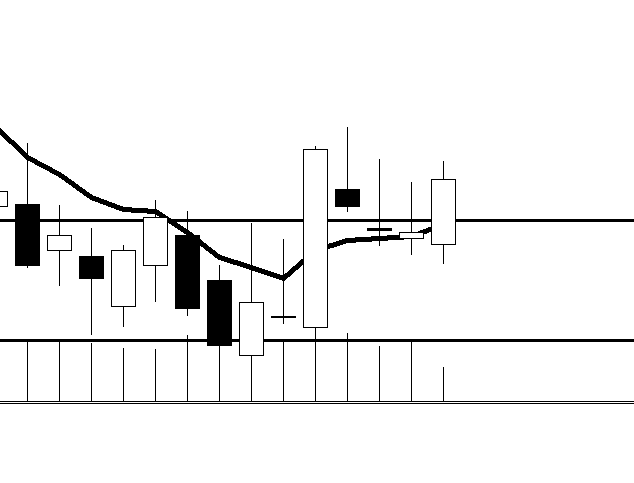

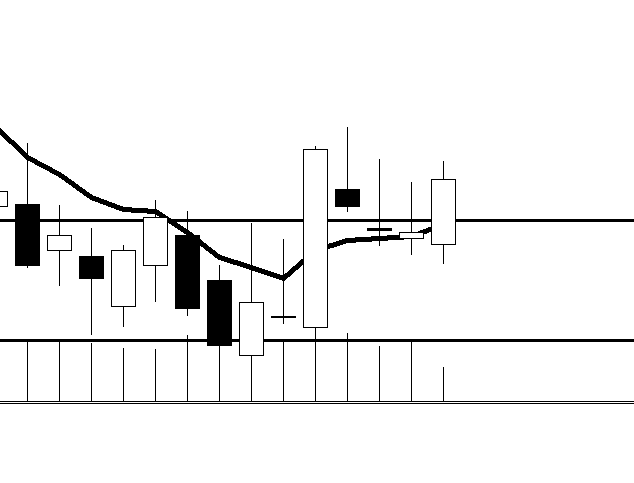

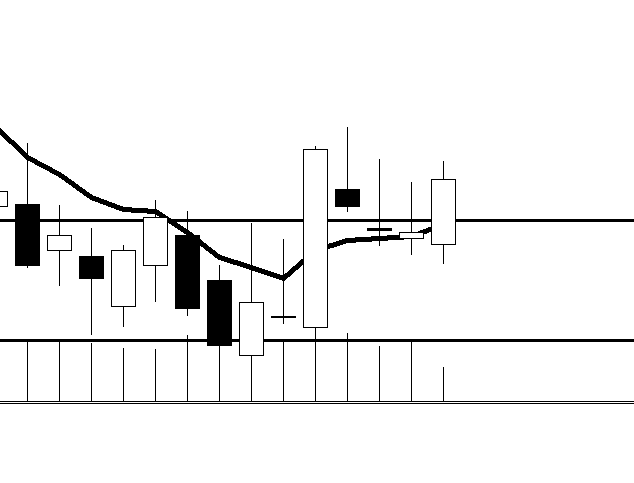

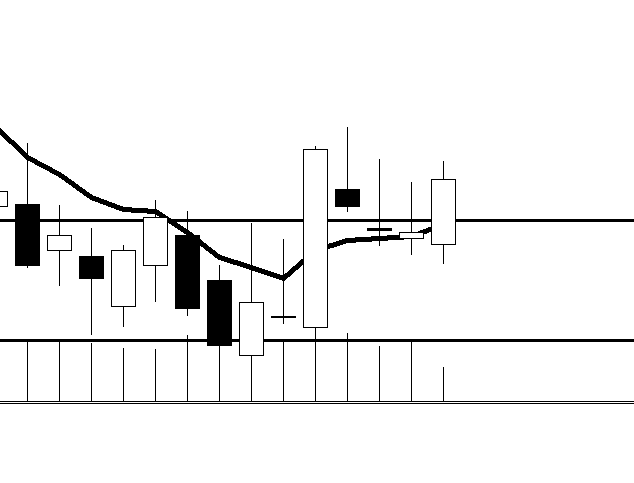

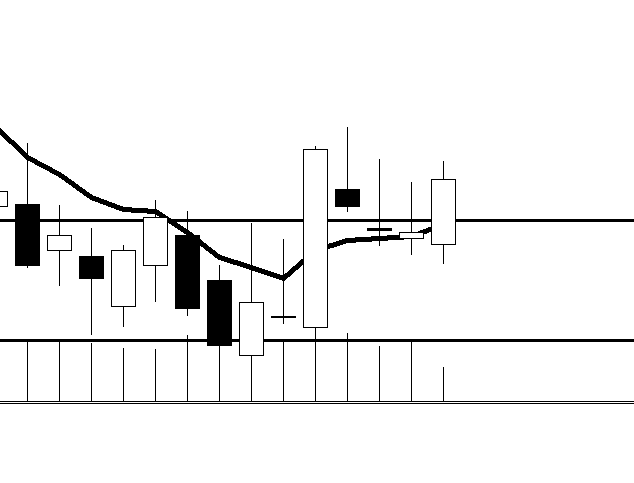

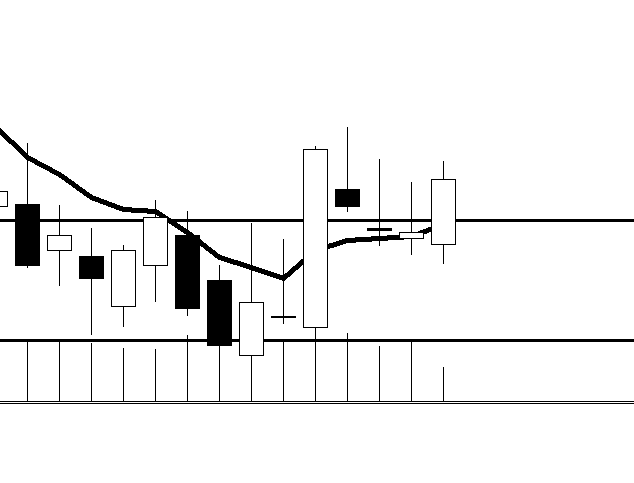

Inside Bar

Hikkake

False Break

Bearish Pin Bar

We Wait

💰Funny Tone Slogans:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

💰Funny Tone Slogans:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Funny Tone Slogans:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Majors

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Minors

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Majors

Inside Bar

Hikkake

False Break

Bearish Pin Bar

Bullsih Pin Bar

EMA

Gap

RSI

Event Area

Blind Entry

Key Level

US. Index

False Break

Failed P.A

50% Retrace

Volume

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Add Your Heading Text Here

Inside Bar

Hikkake

False Break

Bearish Pin Bar

After Entering a Trade

🧘 “We Enter a Trade, Then Wait”

This reflects patience, discipline, and trust in the setup. Once you’ve followed your plan and entered with proper risk management — your job is done. Now it’s time to let the market do the work.

After Entering a Trade

You’ve done it! You’ve analyzed, you’ve agonized, and finally, with a triumphant click, you’ve entered your trade. Congratulations! Now, for the thrilling sequel: We Trade and Then We Wait.

This, my friends, is where the real fun begins. Or, depending on the market, where you develop a twitch in your left eye. It’s that magical period where your hard-earned cash is out there, doing… well, whatever it decides to do. You’re no longer in control, you’re merely a spectator, strapped into a rollercoaster that occasionally feels less like Disneyland and more like a rickety fairground ride with a questionable safety record.

So, what exactly happens during this “waiting” phase?

The Staring Contest

First, there’s the intense staring. You’ll find yourself glued to the charts, convinced that if you blink, you’ll miss the exact millisecond your profit target is hit (or, more likely, your stop-loss). You’ll analyze every tick, every flicker of a candlestick, as if it holds the secrets of the universe. Spoiler alert: it mostly holds secrets about human psychology and the occasional algorithm battling another algorithm.

The Internal Monologue

Next comes the epic internal monologue.

“Go up, little number, go up!”

“Oh no, it’s wiggling the wrong way! Is it broken? Did I break it?”

“Just a little further… just a tiny bit more…”

“Did I leave the stove on? Is that why it’s not moving?” (Yes, your brain will go there.)

This monologue is usually accompanied by various nervous habits: nail-biting, desk-tapping, checking your phone for market news every 30 seconds, even if it’s 3 AM.

The Illusion of Control

Then there’s the delightful illusion of control. You might try to send positive vibes to your screen, as if your sheer willpower can nudge the price. Some even resort to bargaining: “Okay, market, if you hit my target, I promise I’ll clean out the garage!” (The market, being an impartial beast, rarely cares about your chores.)

The Sudden Distraction

Finally, just when you’ve reached peak obsession, you’ll inevitably decide to do something else entirely. You’ll make a coffee, check the mail, or engage in a deeply engrossing conversation about the merits of different types of cheese. And that’s usually when it happens – you glance back at the screen, and either:

a) Your target was hit five minutes ago and you missed the glorious moment. b) Your stop-loss was hit five minutes ago and you missed the painful moment. c) Absolutely nothing has changed. Nothing. At. All.

So, the next time you hit that “buy” or “sell” button, remember: the trading is done. Now, settle in, try not to develop any new nervous tics, and embrace the glorious, often ridiculous, art of waiting. May your waits be short and your profits long!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

-

“Enter the trade — then sit on your hands like a monk!”

-

“We don’t click and panic. We click and chill.”

-

“Traders who wait, get paid. Traders who fidget… donate!”

-

“We enter the trade, then do absolutely nothing like pros.”

-

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

Majors

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Minors

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Eur/Usd

Forex

Inside Bar

Hikkake

False B

B. PinBar

Bear Pin

EMA

Gap

RSI

Event Area

Blind Entry

Key Level

US. Index

False B

Failed P.A

50% R

Volume

We Wait

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

After Entering a Trade

You’ve done it! You’ve analyzed, you’ve agonized, and finally, with a triumphant click, you’ve entered your trade. Congratulations! Now, for the thrilling sequel: We Trade and Then We Wait.

This, my friends, is where the real fun begins. Or, depending on the market, where you develop a twitch in your left eye. It’s that magical period where your hard-earned cash is out there, doing… well, whatever it decides to do. You’re no longer in control, you’re merely a spectator, strapped into a rollercoaster that occasionally feels less like Disneyland and more like a rickety fairground ride with a questionable safety record.

So, what exactly happens during this “waiting” phase?

The Staring Contest

First, there’s the intense staring. You’ll find yourself glued to the charts, convinced that if you blink, you’ll miss the exact millisecond your profit target is hit (or, more likely, your stop-loss). You’ll analyze every tick, every flicker of a candlestick, as if it holds the secrets of the universe. Spoiler alert: it mostly holds secrets about human psychology and the occasional algorithm battling another algorithm.

The Internal Monologue

Next comes the epic internal monologue.

“Go up, little number, go up!”

“Oh no, it’s wiggling the wrong way! Is it broken? Did I break it?”

“Just a little further… just a tiny bit more…”

“Did I leave the stove on? Is that why it’s not moving?” (Yes, your brain will go there.)

This monologue is usually accompanied by various nervous habits: nail-biting, desk-tapping, checking your phone for market news every 30 seconds, even if it’s 3 AM.

The Illusion of Control

Then there’s the delightful illusion of control. You might try to send positive vibes to your screen, as if your sheer willpower can nudge the price. Some even resort to bargaining: “Okay, market, if you hit my target, I promise I’ll clean out the garage!” (The market, being an impartial beast, rarely cares about your chores.)

The Sudden Distraction

Finally, just when you’ve reached peak obsession, you’ll inevitably decide to do something else entirely. You’ll make a coffee, check the mail, or engage in a deeply engrossing conversation about the merits of different types of cheese. And that’s usually when it happens – you glance back at the screen, and either:

a) Your target was hit five minutes ago and you missed the glorious moment. b) Your stop-loss was hit five minutes ago and you missed the painful moment. c) Absolutely nothing has changed. Nothing. At. All.

So, the next time you hit that “buy” or “sell” button, remember: the trading is done. Now, settle in, try not to develop any new nervous tics, and embrace the glorious, often ridiculous, art of waiting. May your waits be short and your profits long!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

-

“Enter the trade — then sit on your hands like a monk!”

-

“We don’t click and panic. We click and chill.”

-

“Traders who wait, get paid. Traders who fidget… donate!”

-

“We enter the trade, then do absolutely nothing like pros.”

-

“Let the market work. You’re not its boss.”

After Entering a Trade

You’ve done it! You’ve analyzed, you’ve agonized, and finally, with a triumphant click, you’ve entered your trade. Congratulations! Now, for the thrilling sequel: We Trade and Then We Wait.

This, my friends, is where the real fun begins. Or, depending on the market, where you develop a twitch in your left eye. It’s that magical period where your hard-earned cash is out there, doing… well, whatever it decides to do. You’re no longer in control, you’re merely a spectator, strapped into a rollercoaster that occasionally feels less like Disneyland and more like a rickety fairground ride with a questionable safety record.

So, what exactly happens during this “waiting” phase?

The Staring Contest

First, there’s the intense staring. You’ll find yourself glued to the charts, convinced that if you blink, you’ll miss the exact millisecond your profit target is hit (or, more likely, your stop-loss). You’ll analyze every tick, every flicker of a candlestick, as if it holds the secrets of the universe. Spoiler alert: it mostly holds secrets about human psychology and the occasional algorithm battling another algorithm.

The Internal Monologue

Next comes the epic internal monologue.

“Go up, little number, go up!”

“Oh no, it’s wiggling the wrong way! Is it broken? Did I break it?”

“Just a little further… just a tiny bit more…”

“Did I leave the stove on? Is that why it’s not moving?” (Yes, your brain will go there.)

This monologue is usually accompanied by various nervous habits: nail-biting, desk-tapping, checking your phone for market news every 30 seconds, even if it’s 3 AM.

The Illusion of Control

Then there’s the delightful illusion of control. You might try to send positive vibes to your screen, as if your sheer willpower can nudge the price. Some even resort to bargaining: “Okay, market, if you hit my target, I promise I’ll clean out the garage!” (The market, being an impartial beast, rarely cares about your chores.)

The Sudden Distraction

Finally, just when you’ve reached peak obsession, you’ll inevitably decide to do something else entirely. You’ll make a coffee, check the mail, or engage in a deeply engrossing conversation about the merits of different types of cheese. And that’s usually when it happens – you glance back at the screen, and either:

a) Your target was hit five minutes ago and you missed the glorious moment. b) Your stop-loss was hit five minutes ago and you missed the painful moment. c) Absolutely nothing has changed. Nothing. At. All.

So, the next time you hit that “buy” or “sell” button, remember: the trading is done. Now, settle in, try not to develop any new nervous tics, and embrace the glorious, often ridiculous, art of waiting. May your waits be short and your profits long!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

-

“Enter the trade — then sit on your hands like a monk!”

-

“We don’t click and panic. We click and chill.”

-

“Traders who wait, get paid. Traders who fidget… donate!”

-

“We enter the trade, then do absolutely nothing like pros.”

-

“Let the market work. You’re not its boss.”

After Entering a Trade

You’ve done it! You’ve analyzed, you’ve agonized, and finally, with a triumphant click, you’ve entered your trade. Congratulations! Now, for the thrilling sequel: We Trade and Then We Wait.

This, my friends, is where the real fun begins. Or, depending on the market, where you develop a twitch in your left eye. It’s that magical period where your hard-earned cash is out there, doing… well, whatever it decides to do. You’re no longer in control, you’re merely a spectator, strapped into a rollercoaster that occasionally feels less like Disneyland and more like a rickety fairground ride with a questionable safety record.

So, what exactly happens during this “waiting” phase?

The Staring Contest

First, there’s the intense staring. You’ll find yourself glued to the charts, convinced that if you blink, you’ll miss the exact millisecond your profit target is hit (or, more likely, your stop-loss). You’ll analyze every tick, every flicker of a candlestick, as if it holds the secrets of the universe. Spoiler alert: it mostly holds secrets about human psychology and the occasional algorithm battling another algorithm.

The Internal Monologue

Next comes the epic internal monologue.

“Go up, little number, go up!”

“Oh no, it’s wiggling the wrong way! Is it broken? Did I break it?”

“Just a little further… just a tiny bit more…”

“Did I leave the stove on? Is that why it’s not moving?” (Yes, your brain will go there.)

This monologue is usually accompanied by various nervous habits: nail-biting, desk-tapping, checking your phone for market news every 30 seconds, even if it’s 3 AM.

The Illusion of Control

Then there’s the delightful illusion of control. You might try to send positive vibes to your screen, as if your sheer willpower can nudge the price. Some even resort to bargaining: “Okay, market, if you hit my target, I promise I’ll clean out the garage!” (The market, being an impartial beast, rarely cares about your chores.)

The Sudden Distraction

Finally, just when you’ve reached peak obsession, you’ll inevitably decide to do something else entirely. You’ll make a coffee, check the mail, or engage in a deeply engrossing conversation about the merits of different types of cheese. And that’s usually when it happens – you glance back at the screen, and either:

a) Your target was hit five minutes ago and you missed the glorious moment. b) Your stop-loss was hit five minutes ago and you missed the painful moment. c) Absolutely nothing has changed. Nothing. At. All.

So, the next time you hit that “buy” or “sell” button, remember: the trading is done. Now, settle in, try not to develop any new nervous tics, and embrace the glorious, often ridiculous, art of waiting. May your waits be short and your profits long!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

-

“Enter the trade — then sit on your hands like a monk!”

-

“We don’t click and panic. We click and chill.”

-

“Traders who wait, get paid. Traders who fidget… donate!”

-

“We enter the trade, then do absolutely nothing like pros.”

-

“Let the market work. You’re not its boss.”

Add Your Heading Text Here

💰Funny Tone Slogans:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Funny Tone Slogans:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Funny Tone Slogans:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Funny Tone Slogans:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Funny Tone Slogans:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

🔥 Powerful Price Action Slogans:

“Let Price Tell the Story.”

“No Indicators. Just Logic.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

“Master the Chart. Forget the Clutter.”

“Follow the Price. Not the Hype.”

“Clean Charts, Clear Mind.”

“The Truth is in the Candles.”

“Price Action: The Language of the Market.”

💰Swing Trading:

“Catch the Move, Not the Noise.”

“Hold Tight. Swing Right.”

“Patience is the Swing Trader’s Edge.”

“We Trade the Swings, Not the Hype.”

“Big Moves Take Time – So Do Big Profits.”

“Less Stress. Bigger Swings.”

“Wait for the Setup. Ride the Wave.”

“Swing Trading: Where Patience Pays.”

“The Trend is Your Ride. Don’t Jump Off Early.”

“Daily Charts, Weekly Paychecks.”

Ahoy there, fellow chart adventurer! Get ready to hoist the sails and feel the wind in your hair, because we’re about to dive into the most exciting treasure hunt on the financial seas: the Power of Price Action!

💰What in the Kraken’s Name is Price Action?

Imagine you’re on a bustling market street, and everyone’s shouting their prices for pineapples. You don’t need a fancy economist with a spreadsheet to tell you if pineapples are getting more popular or less. You just watch what people are doing: are they eagerly snatching them up at higher prices, or are the vendors struggling to give them away?

Price action is exactly that, but for stocks and other assets! It’s simply reading the story the market is telling you directly through the price itself. No need for complicated, lagging indicators that are always a step behind, like a tired parrot squawking old news. You’re looking at the raw, unfiltered moves on your chart – the ultimate truth of supply and demand, fear and greed.

💰Why is it the Golden Compass of Trading?

Forget trying to navigate with a half-broken sextant! Price action is your North Star, your most reliable guide:

It’s the OG (Original Gangster) Signal: Every indicator you see on a chart is derived from price. Price action is the price. It’s the source code, the main event, the real deal. When you’re looking at price action, you’re getting the news straight from the horse’s mouth, not through a dozen gossipy villagers.

No Lag, Just Action! Imagine trying to surf a wave by looking at where the last wave broke. You’d be wiped out! Many indicators are “lagging,” meaning they tell you what already happened. Price action is live, in the moment, allowing you to catch the wave as it forms. This means quicker decisions, tighter entries, and less time being swept away by unexpected currents.

Simpler Than a Coconut Cocktail: You don’t need a supercomputer or a massive collection of complex tools. A clean chart, your trusty eyeballs, and a basic understanding of candlestick patterns are often all you need. This simplicity reduces overwhelm and helps you make clear, decisive calls without second-guessing.

The Trend is Your Best Mate! Remember that wise old saying, “the trend is your friend”? Price action is the ultimate wingman for spotting that friend! It’s super easy to see if the market is clearly sailing upwards (making higher highs and higher lows), diving downwards (lower lows and lower highs), or just bobbing around in the doldrums. If the trend is clear, you know exactly which direction to point your ship. If it’s messy, price action tells you to stay ashore and enjoy a pineapple smoothie!

💰How to Read the Market’s Secret Diary (The Candlesticks!)

Each little candle on your chart is like a tiny scroll, telling you a mini-story of what happened during that time period (a minute, an hour, a day).

-

The Body: This is the fat part of the candle. A long green (or white) body means buyers were in control, pushing the price way up. A long red (or black) body means sellers dominated, sending the price tumbling. Think of it as a tug-of-war: who won that round?

-

The Wicks (or Shadows): These thin lines sticking out from the top and bottom are like antennae, showing you how far the price tried to go but got rejected. A long upper wick means buyers tried to push it high but sellers dragged it back down. A long lower wick means sellers tried to push it low but buyers bravely picked it up. These wicks often whisper secrets about exhaustion or reversals!

By watching how these candles form patterns – like a “Hammer” hitting rock bottom and bouncing back up (a sign of buyers coming to the rescue!), or an “Engulfing” pattern where one big candle swallows the previous one (a dramatic shift in power!) – you start to predict where the currents might take you next.

So, next time you’re charting your course, clear your deck, breathe in that salty air, and let the price action speak to you. It’s the most direct, most powerful, and frankly, the most fun way to understand what’s truly happening in the market and chart your way to potential success!

Price Action

Ahoy there, fellow chart adventurer! Get ready to hoist the sails and feel the wind in your hair, because we’re about to dive into the most exciting treasure hunt on the financial seas: the Power of Price Action!

What in the Kraken’s Name is Price Action?

Imagine you’re on a bustling market street, and everyone’s shouting their prices for pineapples. You don’t need a fancy economist with a spreadsheet to tell you if pineapples are getting more popular or less. You just watch what people are doing: are they eagerly snatching them up at higher prices, or are the vendors struggling to give them away?

Price action is exactly that, but for stocks and other assets! It’s simply reading the story the market is telling you directly through the price itself. No need for complicated, lagging indicators that are always a step behind, like a tired parrot squawking old news. You’re looking at the raw, unfiltered moves on your chart – the ultimate truth of supply and demand, fear and greed.

Why is it the Golden Compass of Trading?

Forget trying to navigate with a half-broken sextant! Price action is your North Star, your most reliable guide:

It’s the OG (Original Gangster) Signal: Every indicator you see on a chart is derived from price. Price action is the price. It’s the source code, the main event, the real deal. When you’re looking at price action, you’re getting the news straight from the horse’s mouth, not through a dozen gossipy villagers.

No Lag, Just Action! Imagine trying to surf a wave by looking at where the last wave broke. You’d be wiped out! Many indicators are “lagging,” meaning they tell you what already happened. Price action is live, in the moment, allowing you to catch the wave as it forms. This means quicker decisions, tighter entries, and less time being swept away by unexpected currents.

Simpler Than a Coconut Cocktail: You don’t need a supercomputer or a massive collection of complex tools. A clean chart, your trusty eyeballs, and a basic understanding of candlestick patterns are often all you need. This simplicity reduces overwhelm and helps you make clear, decisive calls without second-guessing.

The Trend is Your Best Mate! Remember that wise old saying, “the trend is your friend”? Price action is the ultimate wingman for spotting that friend! It’s super easy to see if the market is clearly sailing upwards (making higher highs and higher lows), diving downwards (lower lows and lower highs), or just bobbing around in the doldrums. If the trend is clear, you know exactly which direction to point your ship. If it’s messy, price action tells you to stay ashore and enjoy a pineapple smoothie!

How to Read the Market’s Secret Diary (The Candlesticks!)

Each little candle on your chart is like a tiny scroll, telling you a mini-story of what happened during that time period (a minute, an hour, a day).

The Body: This is the fat part of the candle. A long green (or white) body means buyers were in control, pushing the price way up. A long red (or black) body means sellers dominated, sending the price tumbling. Think of it as a tug-of-war: who won that round?

The Wicks (or Shadows): These thin lines sticking out from the top and bottom are like antennae, showing you how far the price tried to go but got rejected. A long upper wick means buyers tried to push it high but sellers dragged it back down. A long lower wick means sellers tried to push it low but buyers bravely picked it up. These wicks often whisper secrets about exhaustion or reversals!

By watching how these candles form patterns – like a “Hammer” hitting rock bottom and bouncing back up (a sign of buyers coming to the rescue!), or an “Engulfing” pattern where one big candle swallows the previous one (a dramatic shift in power!) – you start to predict where the currents might take you next.

So, next time you’re charting your course, clear your deck, breathe in that salty air, and let the price action speak to you. It’s the most direct, most powerful, and frankly, the most fun way to understand what’s truly happening in the market and chart your way to potential success!

💰Quotes:

“Let Price Tell the Story.”

“No Indicators. Just Logic.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

“Master the Chart. Forget the Clutter.”

“Follow the Price. Not the Hype.”

“Clean Charts, Clear Mind.”

“The Truth is in the Candles.”

“Price Action: The Language of the Market.”

💰What in the Kraken’s Name is Price Action?

Imagine you’re on a bustling market street, and everyone’s shouting their prices for pineapples. You don’t need a fancy economist with a spreadsheet to tell you if pineapples are getting more popular or less. You just watch what people are doing: are they eagerly snatching them up at higher prices, or are the vendors struggling to give them away?

Price action is exactly that, but for stocks and other assets! It’s simply reading the story the market is telling you directly through the price itself. No need for complicated, lagging indicators that are always a step behind, like a tired parrot squawking old news. You’re looking at the raw, unfiltered moves on your chart – the ultimate truth of supply and demand, fear and greed.

💰Why is it the Golden Compass of Trading?

Forget trying to navigate with a half-broken sextant! Price action is your North Star, your most reliable guide:

It’s the OG (Original Gangster) Signal: Every indicator you see on a chart is derived from price. Price action is the price. It’s the source code, the main event, the real deal. When you’re looking at price action, you’re getting the news straight from the horse’s mouth, not through a dozen gossipy villagers.

No Lag, Just Action! Imagine trying to surf a wave by looking at where the last wave broke. You’d be wiped out! Many indicators are “lagging,” meaning they tell you what already happened. Price action is live, in the moment, allowing you to catch the wave as it forms. This means quicker decisions, tighter entries, and less time being swept away by unexpected currents.

Simpler Than a Coconut Cocktail: You don’t need a supercomputer or a massive collection of complex tools. A clean chart, your trusty eyeballs, and a basic understanding of candlestick patterns are often all you need. This simplicity reduces overwhelm and helps you make clear, decisive calls without second-guessing.

The Trend is Your Best Mate! Remember that wise old saying, “the trend is your friend”? Price action is the ultimate wingman for spotting that friend! It’s super easy to see if the market is clearly sailing upwards (making higher highs and higher lows), diving downwards (lower lows and lower highs), or just bobbing around in the doldrums. If the trend is clear, you know exactly which direction to point your ship. If it’s messy, price action tells you to stay ashore and enjoy a pineapple smoothie!

💰How to Read the Market’s Secret Diary (The Candlesticks!)

Each little candle on your chart is like a tiny scroll, telling you a mini-story of what happened during that time period (a minute, an hour, a day).

The Body: This is the fat part of the candle. A long green (or white) body means buyers were in control, pushing the price way up. A long red (or black) body means sellers dominated, sending the price tumbling. Think of it as a tug-of-war: who won that round?

The Wicks (or Shadows): These thin lines sticking out from the top and bottom are like antennae, showing you how far the price tried to go but got rejected. A long upper wick means buyers tried to push it high but sellers dragged it back down. A long lower wick means sellers tried to push it low but buyers bravely picked it up. These wicks often whisper secrets about exhaustion or reversals!

By watching how these candles form patterns – like a “Hammer” hitting rock bottom and bouncing back up (a sign of buyers coming to the rescue!), or an “Engulfing” pattern where one big candle swallows the previous one (a dramatic shift in power!) – you start to predict where the currents might take you next.

So, next time you’re charting your course, clear your deck, breathe in that salty air, and let the price action speak to you. It’s the most direct, most powerful, and frankly, the most fun way to understand what’s truly happening in the market and chart your way to potential success!

Price Action

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

💰

Price action is the foundation of technical trading. It refers to the movement of price over time, without relying on indicators. Here’s why it’s powerful:

🔥 The Power of Price Action:

Simplicity

Price action strips away distractions. Traders read candles, structure, and key levels directly from the chart.Real-Time Clarity

It reflects real-time decisions of buyers and sellers, showing where the market is reacting.Universal Application

Works on all timeframes and markets—forex, stocks, crypto.Identifies Key Setups

Patterns like:Pin bars

Engulfing candles

Inside bars

Break and retest

provide high-probability entries.

Institutional Footprints

Price action helps you “see” what smart money is doing—entries at key levels, liquidity grabs, false breaks, etc.No Lag

Unlike indicators, it’s immediate—based on what’s happening now, not 10 bars ago.

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

A Pin Bar entry in trading refers to a setup based on a candlestick pattern that signals a potential reversal in price. The term “Pin Bar” is short for “Pinocchio Bar”, named for its long “nose” that lies about market direction — suggesting a false move in one direction before reversing.

🔹 Bullish Pin Bar (Buy Setup)

Context: Occurs at support or after a downtrend.

Pin Bar Shape: Long lower tail, small real body near the top.

Entry: Buy on break above the high of the pin bar.

Stop Loss: Below the low of the pin bar.

Take Profit: Near resistance, or use risk-reward (e.g., 2:1).

🔹 Bearish Pin Bar (Sell Setup)

Context: Occurs at resistance or after an uptrend.

Pin Bar Shape: Long upper tail, small real body near the bottom.

Entry: Sell on break below the low of the pin bar.

Stop Loss: Above the high of the pin bar.

Take Profit: Near support or via R:R ratio.

🔧 Tips for Effective Pin Bar Trading

Trade with trend for higher probability.

Use with support/resistance, Fibonacci, or moving averages.

Avoid trading pin bars in choppy or low-volume conditions.

Look for strong rejection candles with good context — not just any long wick.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

1. The Power of Price Action

Ahoy there, fellow chart adventurer! Get ready to hoist the sails and feel the wind in your hair, because we’re about to dive into the most exciting treasure hunt on the financial seas: the Power of Price Action!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Add Your Heading Text Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Trading- Edge

.Live

The Edge Is Your Opportunity.

Beginner

Entry With RSI

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our Trading Place

Calm And Collected

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Calm trading means consistent charts.”

“Same chart, same story — less confusion, more clarity.”

“Timeframe hopping creates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Trading- Edge

.Live

The Edge Is Your Opportunity.

Beginner

Entry With RSI

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.