The Power of Key Levels

“Hikkake Pattern Reading”

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

“Hikkake Pattern Videos”

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

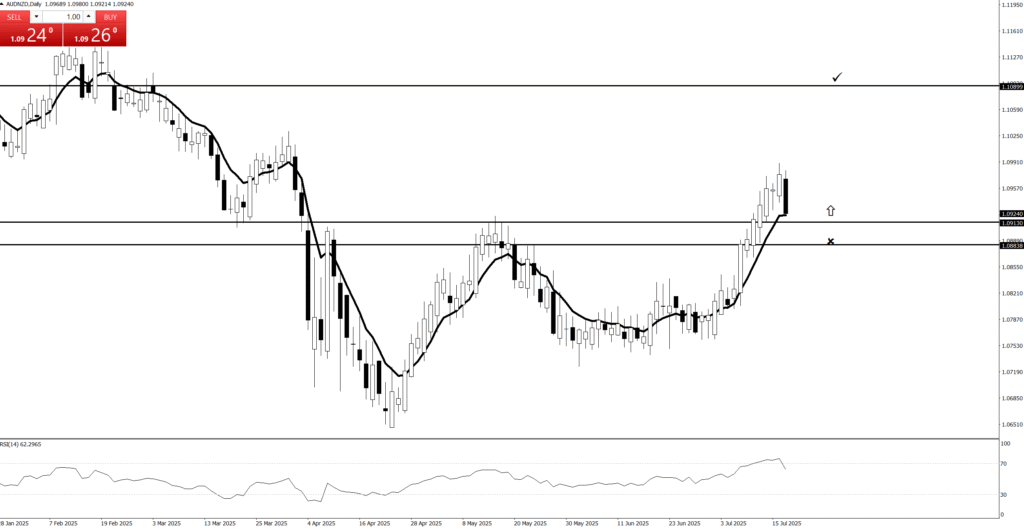

Hikkake Pattern chart examples

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

💰“We don’t draw levels every five minutes — we’re not babysitting the chart!”

“Support and resistance? We let the grown-up candles decide.”

“Lower timeframes lie — daily and weekly tell the truth!”

“Draw your levels like a pro… not like a squirrel on caffeine!”

“We like our support and resistance like we like our coffee: strong and long-lasting.”

“Daily and weekly levels — because guessing on the 1-minute chart is for gamblers.”

Hikkake pattern videos live trading videos

In the bustling circus of financial markets, the inside bar is the chart’s polite introvert: its entire range nestled neatly within the previous candle. This tidy formation whispers of consolidation or indecision, like a market taking a quick, discreet breath. Don’t be fooled by its calm demeanor; traders know this quiet moment often precedes a dramatic reveal. It’s proof even the shyest patterns can be powerful, hinting at a potential breakout without spilling all the beans just yet. Think of it as the market’s subtle “plot twist” before the next big scene, leaving everyone on the edge of their trading seats.

The Inside Bar: A Professional Pause with a Humorous Punch

In the bustling circus of financial markets, the inside bar is the chart’s polite introvert: its entire range nestled neatly within the previous candle. This tidy formation whispers of consolidation or indecision, like a market taking a quick, discreet breath. Don’t be fooled by its calm demeanor; traders know this quiet moment often precedes a dramatic reveal. It’s proof even the shyest patterns can be powerful, hinting at a potential breakout without spilling all the beans just yet.

“False Break”

Okay, here’s a short intro to key levels, keeping it concise and focused on their core meaning in trading:

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

“Pinbars”

Okay, here’s a short intro to key levels, keeping it concise and focused on their core meaning in trading:

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

“Pinbars”

Okay, here’s a short intro to key levels, keeping it concise and focused on their core meaning in trading:

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

“Pinbars”

Okay, here’s a short intro to key levels, keeping it concise and focused on their core meaning in trading:

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

“Pinbars”

Okay, here’s a short intro to key levels, keeping it concise and focused on their core meaning in trading:

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

“Pinbars”

Okay, here’s a short intro to key levels, keeping it concise and focused on their core meaning in trading:

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

“Pinbars”

Okay, here’s a short intro to key levels, keeping it concise and focused on their core meaning in trading:

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

“Pinbars”

Okay, here’s a short intro to key levels, keeping it concise and focused on their core meaning in trading:

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

Our services solve any business problem

Website Optimization