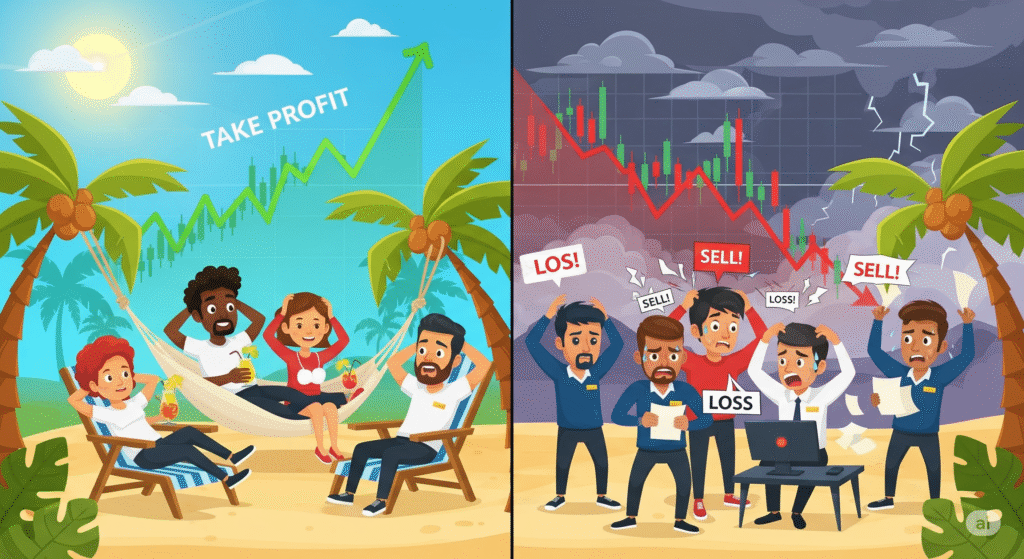

4. Account: Take Profit Vs. Account: Not Taking Profit

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰

Okay, “the trend is your friend” is a classic trading adage that reinforces the principle we just discussed: always trade with the prevailing direction of the market. When you look at a chart with this philosophy in mind, the very first thing you’re trying to establish is: “Is there a clear, discernible ‘friend’ (trend) on this chart that I can follow?”

It’s not just about identifying a trend, but a clear one, because your “friend” needs to be reliable. If the “friend” is wishy-washy, jumping all over the place, it’s not a reliable companion for a trade. Here’s how to think about what you’re looking for immediately:

Account Take Profit Vs. Account No Take Profit

Alright, let’s talk about the tragicomedy that unfolds when you’re trying to double your €10,000 to €20,000 with perfectly sound 1:2 or 1:3 risk-reward setups, but then decide that “take profit” is just a suggestion, not a rule. It’s like baking a perfect cake, letting it cool, and then deciding to leave it on the porch because “it might get even tastier!”

The Dream: You’ve got your €10,000, your reliable stop loss (because you’re not that crazy), and a strategy that consistently gets you to those lovely 1:2 or 1:3 profit zones. You envision your account growing like a well-fed sourdough starter.

The Reality (When You Forget to Take the Cake Out of the Oven):

This is where your “paper profits” become as elusive as a unicorn riding a skateboard.

Scenario 1: The “Paper Profit Mirage” (The 1:2 That Became 1:0… or Worse!)

You enter a trade with a clear 1:2 risk-reward. You risk €100 for a target of €200.

The Euphoria: The market, bless its heart, actually hits your €200 target! Your screen glows green. Your brain screams, “I’m a genius! This is effortless! But… wait. It looks so strong! It could easily go to 1:4! Why settle for €200 when I could get €400?” (This is Greed whispering sweet, dangerous nothings in your ear.)

The “Just a Bit More” Trap: You decide to “let it run.” The market, sensing your overconfidence, pauses. Then it starts to pull back. A little bit. Then a bit more. Your €200 profit becomes €150. Then €100. You start sweating. “It’s just a retrace! It’s coming back for me!”

The Dread: Your €200 paper profit is now €50. Then €20. Then €5. Your heart is pounding. You’re mentally yelling at the chart, “Go back! Go back! I loved you!”

The Facepalm Moment: The price continues its cruel descent. It hits your original entry point. You are now at breakeven. All that work, all that stress, for absolutely zero realized profit. In some cruel twists, it might even hit your original stop loss, turning a solid winner into a loser. Your €10,000 account stays stubbornly at €10,000, and you just wasted a perfectly good trade setup.

The Punchline: You had a golden ticket to a €200 profit party, but you held onto it, hoping for a VIP invitation to a €400 party, and ended up with a ticket to the “Oh, dear, you’re still here?” pity party. You needed five more €200 winners to hit your €20,000 goal, but you just threw one away.

Scenario 2: The “Capital Hostage Situation” (That 1:3 That’s Now Just Breathing)

You’ve got a fantastic 1:3 setup. You risk €100 for a glorious €300 profit. It rips! It’s up €400! “This is it!” you exclaim, “The market is finally rewarding my brilliance! I’m letting this ride to €1,000!”

The Consolidating Slumber: The market, perhaps tired of performing for you, decides to take a nap. After hitting €400, it goes sideways. For days. Weeks. Your €400 unrealized profit sits there, sometimes €380, sometimes €410, never quite getting to that €1,000 you dreamed of.

The Opportunity Cost Headache: While your €10,000 is still technically “up” by €400 (on paper, of course), that capital is now effectively on a very long, boring, unpaid vacation. Other amazing setups appear on your screen – obvious 1:2s, clear 1:3s – but you can’t take them because your money is still tied up, waiting for that one trade to hit a fantastical number. You’re watching money being made elsewhere, unable to participate.

The Gradual Erosion of Patience (and Profit): Eventually, the market’s nap turns into a slow, downward drift. Your €400 profit becomes €300, then €200, then €100. You realize you should have closed at €400. Or €300. Or €200. You finally close it for a measly €50 gain, feeling utterly deflated.

The Punchline: You had a perfectly good €300 profit in your hands, but you held out for €1,000. Now, instead of bagging three €300 winners (which would get you closer to €20,000 much faster), you got one tiny win and a massive dose of frustration. Your capital was held hostage by your own greed, forcing it to miss out on other productive endeavors.

In essence, not taking profit is like trying to reach €20,000 by continually inflating balloons, but never tying them off. They float beautifully for a while, but eventually, they just deflate, leaving you with nothing but hot air and the crushing regret of what could have been. The “paper profit” is a seductive siren, luring your cash to a watery grave of unrealized gains.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

Alright, let’s explore the tragicomedy that unfolds when you’re trying to double your €10,000 to €20,000 with perfectly sound 1:2 or 1:3 risk-reward setups, but then decide that “take profit” is just a suggestion, not a rule. It’s like baking a perfect cake, letting it cool, and then deciding to leave it on the porch because “it might get even tastier!” only for a pigeon to fly by and eat it.

The Dream: You’ve got your crisp €10,000. Your plan is solid: find those sweet 1:2 or 1:3 profit opportunities. Your stop loss is in place (because you’re not that reckless). You envision your account growing like a well-fed sourdough starter.

The Reality (When You Forget to Take the Cake Out of the Oven):

This is where your “paper profits” become as elusive as a unicorn riding a skateboard.

Scenario 1: The “Paper Profit Mirage” (The 1:2 That Became 1:0… or Worse!)

You enter a trade with a clear 1:2 risk-reward. You risk €100 for a target of €200.

The Euphoria: The market, bless its heart, actually hits your €200 target! Your screen glows green. Your brain screams, “I’m a genius! This is effortless! But… wait. It looks so strong! It could easily go to 1:4! Why settle for €200 when I could get €400?” (This is Greed whispering sweet, dangerous nothings in your ear, like a tiny devil dressed as a financial advisor.)

The “Just a Bit More” Trap: You decide to “let it run.” The market, sensing your overconfidence, pauses. Then it starts to pull back. A little bit. Then a bit more. Your €200 profit becomes €150. Then €100. You start sweating. “It’s just a retrace! It’s coming back for me! I know it!” You’re now negotiating with a cold, unfeeling algorithm.

The Dread: Your €200 paper profit is now €50. Then €20. Then €5. Your heart is pounding. You’re mentally yelling at the chart, “Go back! Go back! I loved you! You were supposed to be the one!”

The Facepalm Moment: The price continues its cruel descent. It hits your original entry point. You are now at breakeven. All that analysis, all that stress, for absolutely zero realized profit. In some cruel twists, it might even hit your original stop loss, turning a solid winner into a loser, just for a laugh. Your €10,000 account stays stubbornly at €10,000, and you just wasted a perfectly good trade setup.

The Punchline: You had a golden ticket to a €200 profit party, but you held onto it, hoping for a VIP invitation to a €400 party, and ended up with a ticket to the “Oh, dear, you’re still here?” pity party. You needed five more €200 winners to hit your €20,000 goal, but you just threw one away. You’ve essentially just donated your time and emotional energy to the market for free.

Scenario 2: The “Capital Hostage Situation” (That 1:3 That’s Now Just Breathing)

You’ve got a fantastic 1:3 setup. You risk €100 for a glorious €300 profit. It rips! It’s up €400! “This is it!” you exclaim, “The market is finally rewarding my brilliance! I’m letting this ride to €1,000! I’ll buy a small island!”

The Consolidating Slumber: The market, perhaps tired of performing for you, decides to take a nap. After hitting €400 (and tempting you with visions of grandeur), it goes sideways. For days. Weeks. Your €400 unrealized profit sits there, sometimes €380, sometimes €410, never quite getting to that €1,000 you dreamed of.

The Opportunity Cost Headache: While your €10,000 is still technically “up” by €400 (on paper, of course), that capital is now effectively on a very long, boring, unpaid vacation. Other amazing setups appear on your screen – obvious 1:2s, clear 1:3s – but you can’t take them because your money is still tied up, waiting for that one trade to hit a fantastical number. You’re watching money being made elsewhere, unable to participate, like being at a buffet but only allowed to eat one incredibly slow-moving, slightly stale cracker.

The Gradual Erosion of Patience (and Profit): Eventually, the market’s nap turns into a slow, downward drift. Your €400 profit becomes €300, then €200, then €100. You realize you should have closed at €400. Or €300. Or €200. You finally close it for a measly €50 gain, feeling utterly deflated, like receiving a participation trophy after training for the Olympics.

The Punchline: You had a perfectly good €300 profit in your hands, but you held out for €1,000. Now, instead of bagging three €300 winners (which would get you closer to €20,000 much faster), you got one tiny win and a massive dose of frustration. Your capital was held hostage by your own greed, forcing it to miss out on other productive endeavors. Your dreams of doubling are now delayed indefinitely by your own magnificent over-optimism.

In essence, while the idea of an unlimited profit sounds like a dream, in reality, not taking profit is often a hilarious (for observers) exercise in turning potential triumphs into spectacular displays of self-sabotage, proving that sometimes, even when you’re right, you can still be financially very, very wrong.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

Alright, let’s talk about the joyous, triumphant, and slightly smug path to turning your humble €10,000 into a princely €20,000, all thanks to the magical, often unappreciated, act of actually taking profit! This is where you outsmart the market (and your own inner greed monster) with a simple, pre-set “thank you, next!”

Imagine your Take Profit order as your trusty financial butler. He’s polite, he’s punctual, and he knows exactly when to whisk you away from the casino table with your winnings, even if you’re yelling, “Just one more spin! I feel lucky!”

The Grand Plan:

Starting Capital: €10,000 (your financial humble beginnings)

Target Capital: €20,000 (your financial glow-up goal)

Your Secret Weapons: A robust stop loss (your bodyguard, as discussed), and now, your super-efficient Take Profit order (your cash-collecting butler).

Your Strategy: Always aiming for 1:2 or 1:3 risk-reward, risking just 1% of your capital per trade.

Scenario 1: The “Consistent Cashier” Method (1:2 Risk-Reward)

Your plan: Risk €100 (1% of €10,000) for a guaranteed €200 profit. Your Take Profit order is set right there, like a perfectly placed little financial trap. Let’s assume you’re hitting about 50% winners.

Trade 1 (Ding!): You spot a beautiful setup. You enter, set your stop loss (your bodyguard), and your Take Profit (your butler) is already waiting patiently. Price moves up, and BING! Your Take Profit is hit! Your butler smoothly collects €200. Your €10,000 transforms into €10,200. “Excellent, sir/madam. Your funds have been secured.”

Trade 2 (Oops!): This one decides to defy you. But before it can cause too much trouble, your stop loss kicks in. You lose €102 (1% of €10,200). Your bodyguard did his job, ushering you safely away from the impending disaster.

Trade 3 (Another Ding!): Back to winning! Your Take Profit snares another €201.96. Your capital climbs to €10,300. You give your butler a silent nod of approval.

The Sweet, Sweet Compounding: As you diligently repeat this process – risking 1%, gaining 2% on winners, losing 1% on losers, and critically, always letting your Take Profit do its job – your account starts doing the financial Macarena. It’s swaying rhythmically upwards. Those little €200 wins might not seem like much on their own, but they accumulate like a very polite, very efficient army of money-making squirrels.

The Punchline: While your “no take profit” friends are tearing their hair out watching their paper gains evaporate (see previous conversations!), you’re calmly sipping your tea. Your account reaches €20,000 not with one grand, terrifying leap, but with a series of predictable, satisfying “Dings!” You’re the boring winner who actually gets to keep their winnings. Who’s laughing now? (It’s you, quietly, all the way to the bank).

Scenario 2: The “Big Game Hunter” Approach (1:3 Risk-Reward)

Here, you’re a bit more selective. You’re risking €100 for a glorious €300 target. Your Take Profit is still your loyal butler, but now he’s waiting a bit further away, net in hand, for the really big fish. You might only hit 40% winners, but those wins are juicy.

Trade 1 (Jackpot!): You set your stop and your eager Take Profit. The market, perhaps sensing your determination, blasts off! CHA-CHING! Your Take Profit is hit, reeling in a whopping €300! Your €10,000 is now €10,300. Your butler probably just did a little jig.

Trade 2 (Miss!): This one wasn’t meant to be. Your stop loss gets hit. You lose €103. “Better luck next time, old chap.”

Trade 3 (Another Miss!): A small €101.97 loss. “Tough crowd today,” you muse, unfazed.

Trade 4 (Whale Sighted!): BAM! Another €302.85 win! Your Take Profit secures the bounty. Capital: €10,398.

The Punchline: You might endure a few more minor losses, but the moments your Take Profit clicks are glorious. You’re not obsessing over whether it “could have gone higher” after it hits €300. Instead, you’re high-fiving your invisible butler and planning your next trade. You know that letting go of the “what ifs” and locking in consistent, larger wins (compared to your losses) is the golden ticket. Soon, your €10,000 has steadily, and predictably, blossomed into €20,000, proving that strategic contentment is far more profitable than greedy regret.

In both scenarios, the Take Profit order is your friend, your ally, and your quiet reminder that “a bird in the hand is worth two in the bush,” especially when those “two” might fly away entirely. You’re not just trading; you’re securing your path to doubling your capital!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

Alright, let’s inject some dark humor into the painful saga of trying to double your €10,000 to €20,000 without the glorious bodyguard known as a stop loss. It’s like planning a meticulously choreographed financial ballet, but forgetting to tell gravity your plans.

The Dream: You’ve got your crisp €10,000. Your plan is solid: find those sweet 1:2 or 1:3 risk-reward setups. Every €1 you theoretically risk will net you €2 or €3. Mathematically, you’re a genius! What could possibly go wrong? You’re basically printing money, just slightly slower than the central bank.

The Reality (When You Ditch the Stop Loss):

Welcome to “Financial Freefall: The No-Net Edition!”

Exhibit A: The “It’s Just a Scratch!” Syndrome (Your 1:2 R:R Becomes 1:Who-Knows-What)

You identify a stellar long setup. You decide your “mental stop” is a neat €100 below your entry (because, you know, 1% of €10,000, keeps things tidy). Your target is a glorious €200 profit.

The Flinch: Price drops €100. You chuckle, “Haha, very funny, market! Trying to shake me out, eh? Not today, satan!” You pat your screen reassuringly.

The Grumble: Price drops to €200 down. Your chuckle turns into a cough. “Right, just a deeper retest. This is healthy price action. It’ll bounce from here. My intuition is telling me to hold!”

The Sweat: Price drops to €500 down. Your palms are clammy. Your €10,000 account is now €9,500. “Okay, this is getting a bit rude. But I don’t want to lock in a loss. I know my analysis was good!” You start whispering encouraging words to your computer screen.

The Panic-Induced Paralysis: The market, sensing your fear (it’s notoriously good at that), decides to really lean into the joke. It drops €1,000. You’re now down 10% on one trade! The theoretical 1:2 risk-reward ratio is now 1:-10, and it’s still going. You’re too terrified to close, too hopeful for a miraculous rebound.

The Grand Finale: That single, unmanaged trade, which was supposed to risk a mere €100, finally closes (or you get a margin call) at a brutal €3,000 loss. Your €10,000 is now €7,000.

The Punchline: You didn’t just fail to make €20,000; you’re now facing a 42.8% gain just to get back to €10,000, let alone €20,000. Your 1:2 R:R ratio just got mugged in a dark alley by the “unlimited risk” monster.

Exhibit B: The “Averaging Down to Oblivion” Maneuver (Your 1:3 R:R Becomes 1:The-Abyss)

You spot a beautiful setup for a €100 risk to €300 reward. You enter. Price immediately drops.

The “Brilliant” Idea: “Aha! It’s cheaper now! I’ll just buy more here. My average entry will drop, and when it goes back up, I’ll make even more!” (This is often the gateway drug to financial ruin). You add another position, doubling your exposure.

The Market’s Double-Tap: The price drops further, giggling maniacally. Your first position is now down €200, your second is down €100. You’re effectively risking €300, and your intended €300 reward now seems like a distant mirage.

The Deep Dive: The price continues its descent. Now you have €500 in unrealized losses. Then €1,000. Then €2,000. You’re now a proud owner of a magnificent financial black hole, sucking in your capital. Most of your €10,000 is now tied up in one perpetually losing trade, desperately waiting for a bounce.

The Account Stagnation (and Then Contraction): Your dreams of doubling are replaced by the grim reality of just trying to get back to breakeven. You can’t take new trades because all your capital is held hostage. You’re the captain of a sinking ship, still shouting about your glorious 1:3 risk-reward ratio while bailing water with a teaspoon.

Exhibit C: The Overnight “Surprise Party” (The Black Swan Gauntlet)

You close your trading day confident, your position showing a small profit, heading towards your 1:2 or 1:3 target. “I don’t need a stop loss, I’ll just manage it tomorrow!” you declare to your pet hamster.

The News Bomb: Overnight, an unexpected geopolitical crisis erupts, or a major company you’re short on announces it found a cure for everything (or the one you’re long on declares bankruptcy via interpretive dance).

The “Gap of Doom”: The market opens the next day, not where you closed, but 10% (or 20%, or more!) against your position. Your €10,000 account, if you had a 1-lot position, might instantly be down €1,000 or €2,000 before you can even blink.

Waking Up to a Nightmare: Your glorious 1:2 or 1:3 risk-reward ratio becomes a cruel joke, as your actual loss is now 1:too-many-f***ing-R. All your hard-earned (or intended) gains are wiped out in a single, unmanaged moment of market savagery.

The Moral of the Hilariously Tragic Story:

Without a stop loss, your beautiful risk-reward ratio is like a meticulously drawn treasure map that leads you directly to a pit of quicksand. Your “risk” becomes an arbitrary line in the sand that the market gleefully steps over. You’re not managing risk; you’re just hoping it all works out. And hope, as any seasoned trader will tell you, is a terrible trading strategy when it’s your primary form of risk management.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

Alright, let’s talk about turning your humble €10,000 into a magnificent €20,000, not with a magic wand, but with the delightfully consistent (and slightly boring, in a good way) power of risk-reward ratios! This is less about high-octane gambling and more about being the financial equivalent of that person who always wins the board game by quietly accumulating points, while everyone else is busy flipping the table.

Your starting capital: €10,000. Your glorious destination: €20,000. Your secret weapon (besides your brilliant mind): Risking just 1% of your capital per trade, and actually, you know, using that stop loss!

The “Slow and Steady Wins the Financial Race” Method (1:2 Risk-Reward)

Imagine your €10,000 is a very enthusiastic, but slightly chaotic, garden. Your goal is to grow €20,000 worth of prize-winning tomatoes.

Your Rules: For every €100 (that 1% risk) you might lose on a little tomato plant, you’re only planting it if you genuinely believe it’ll yield you a juicy €200 profit. It’s like only betting on a racehorse that promises to run twice as fast as its nearest rival.

The Gardening Process:

Trade 1 (Win!): You plant your tomato. It flourishes! Your €10,000 smiles as it turns into €10,200. “Look at me, compounding already!”

Trade 2 (Oops, a Pest!): A small garden pest (market noise) hits your next plant. You cut your losses swiftly (thanks, stop loss!), losing €102. Your capital dips to €10,098. No drama, just a tiny prune. “Phew, close call, little plant. Next!”

Trade 3 (Another Winner!): Back in business! Another €201.96 profit. Capital: €10,300.

…and so the cycle continues.

The Punchline: You’re not winning every trade. Maybe you win half, maybe 60%, maybe even 40% on a rough week. But because your winners are always twice the size of your losers, your account slowly, but surely, starts resembling a happy little money tree. It’s like having a financial vacuum cleaner that sucks up €2 for every €1 it occasionally drops. It’s not flashy, there are no fireworks, but suddenly, you look up and your €10,000 has quietly, politely, doubled to €20,000. You feel like a wizard, but all you really did was stick to the plan.

The “Fewer but Bigger Fish” Strategy (1:3 Risk-Reward)

Now, let’s get a bit more ambitious with our fishing net. For every €100 risk, you’re only going for the really big ones – those that promise €300 in profit. This means you might catch fewer fish (lower win rate), but when you do, they’re absolute monsters.

Your Rules: You’re a discerning angler. You’ll risk €100, but only for a shot at reeling in €300.

The Fishing Trip:

Trade 1 (Win!): You cast your line, and BOOM! A fat €300 profit! Your €10,000 is now €10,300. “Take THAT, market!”

Trade 2 (Lost the Bait!): Darn. Lost €103. Capital: €10,197. “Oh well, just a tiny minnow escaped.”

Trade 3 (Line Snapped!): Another €101.97 gone. Capital: €10,095. “This fishing trip is harder than it looks…”

Trade 4 (Bigger Catch!): Patience pays off! Another €302.85 win! Capital: €10,398.

The Punchline: You might have more losing trades in a row (that 40% win rate feeling like you’re mostly losing), but every time you do win, it’s like finding a €300 bill in an old jacket. Those bigger wins easily gobble up your string of small losses. Suddenly, one day, you check your account, and it’s not just back above €10,000, but it’s soaring past €15,000, then… BAM! €20,000! You’ve doubled your money, perhaps with fewer trades than the 1:2 crowd, proving that sometimes, you just need fewer, higher-quality shots on goal.

In both scenarios, the humor lies in the seemingly mundane, yet incredibly powerful, act of consistently cutting your losses short and letting your winners run, allowing compounding to do its quiet, mathematical magic. No drama, no blowing up accounts, just the satisfying click of profits accumulating while the market tries (and fails) to tempt you into self-sabotage.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”