The Power of The Check-List

The Trading Checklist: Your Financial Flight Plan! (No Cowboys Allowed!)

Let’s be honest. When a market signal lights up, your brain turns into a screaming toddler demanding immediate action. That thrilling rush of FOMO (Fear of Missing Out) is the fastest way to hit the financial iceberg. The ultimate defense against your own impulsive idiocy is the Trading Checklist—your non-negotiable, rigorously boring, but spectacularly effective flight plan for every single transaction.

The professional trader knows that discipline is the only thing separating them from the amateur gambler.

The Advantages of Being Rigorously Boring

The Emotional Firewall (The FOMO Blocker): When your chart shows a potential entry, the checklist forces a mandatory pause.1 You can’t just dive in. You must verify: Is the trend your friend (Rule #1)? Is the wick confirmed (Rule #4)? Is your

at least

(Rule #6)? The checklist is the mechanical brake that prevents emotional, half-baked entries. 2It turns an impulsive guess into a deliberate, verified action.

Consistency is King (The Money Machine): Trading success isn’t about being right once; it’s about being right consistently.3 The checklist ensures that every single trade you take, win or lose, has the exact same, statistically tested ingredients. It ensures you never forget the crucial step (like setting the Stop-Loss!) and replaces random luck with mechanical repetition. This is the simple, boring path to statistically reliable returns.

Measurable Improvement (The Debugger): A losing trade is only a loss if you learn nothing. If you lost, your checklist tells you why. Did you execute all steps perfectly, meaning the system needs review? Or did you skip Step 3 (Key Level Confirmation) because you were feeling lucky? The checklist turns failure into objective, measurable data, allowing you to debug your performance and refine your strategy with surgical precision.4

Clarity Under Pressure: In moments of market volatility or confusion, the checklist is your unwavering anchor. It tells you exactly what to do and when to do it. You stop flying blind and start executing a plan that was designed when your mind was clear and rational.

Stop flying your account by the seat of your pants! Embrace the boring power of the checklist. It’s the professional tool that guarantees disciplined execution and the sweet, sweet consistency that leads to true, lasting wealth.5

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of PriceAction

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

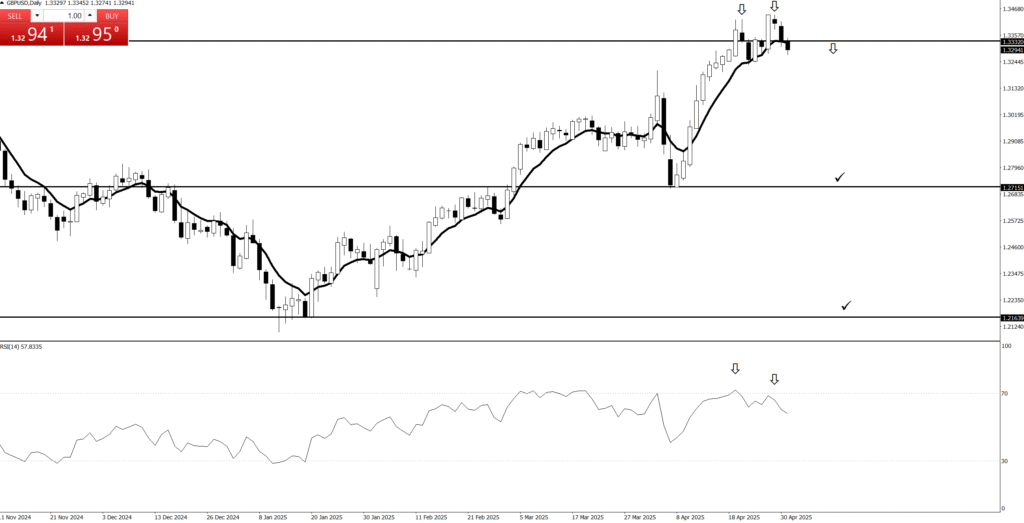

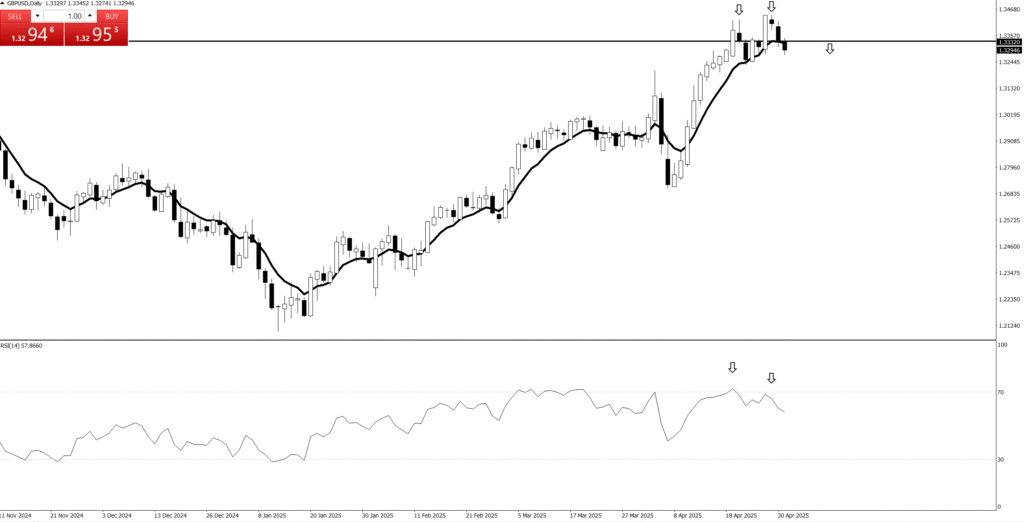

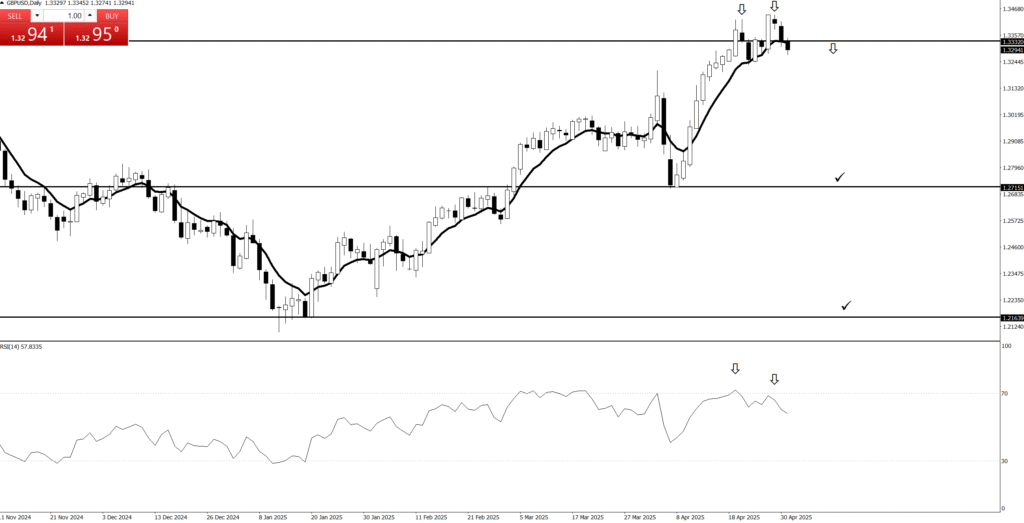

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of PriceAction

💰What in the Kraken’s Name is Price Action?

Imagine you’re on a bustling market street, and everyone’s shouting their prices for pineapples. You don’t need a fancy economist with a spreadsheet to tell you if pineapples are getting more popular or less. You just watch what people are doing: are they eagerly snatching them up at higher prices, or are the vendors struggling to give them away?

Price action is exactly that, but for stocks and other assets! It’s simply reading the story the market is telling you directly through the price itself. No need for complicated, lagging indicators that are always a step behind, like a tired parrot squawking old news. You’re looking at the raw, unfiltered moves on your chart – the ultimate truth of supply and demand, fear and greed.

💰Why is it the Golden Compass of Trading?

Forget trying to navigate with a half-broken sextant! Price action is your North Star, your most reliable guide:

It’s the OG (Original Gangster) Signal: Every indicator you see on a chart is derived from price. Price action is the price. It’s the source code, the main event, the real deal. When you’re looking at price action, you’re getting the news straight from the horse’s mouth, not through a dozen gossipy villagers.

No Lag, Just Action! Imagine trying to surf a wave by looking at where the last wave broke. You’d be wiped out! Many indicators are “lagging,” meaning they tell you what already happened. Price action is live, in the moment, allowing you to catch the wave as it forms. This means quicker decisions, tighter entries, and less time being swept away by unexpected currents.

Simpler Than a Coconut Cocktail: You don’t need a supercomputer or a massive collection of complex tools. A clean chart, your trusty eyeballs, and a basic understanding of candlestick patterns are often all you need. This simplicity reduces overwhelm and helps you make clear, decisive calls without second-guessing.

The Trend is Your Best Mate! Remember that wise old saying, “the trend is your friend”? Price action is the ultimate wingman for spotting that friend! It’s super easy to see if the market is clearly sailing upwards (making higher highs and higher lows), diving downwards (lower lows and lower highs), or just bobbing around in the doldrums. If the trend is clear, you know exactly which direction to point your ship. If it’s messy, price action tells you to stay ashore and enjoy a pineapple smoothie!

💰How to Read the Market’s Secret Diary (The Candlesticks!)

Each little candle on your chart is like a tiny scroll, telling you a mini-story of what happened during that time period (a minute, an hour, a day).

The Body: This is the fat part of the candle. A long green (or white) body means buyers were in control, pushing the price way up. A long red (or black) body means sellers dominated, sending the price tumbling. Think of it as a tug-of-war: who won that round?

The Wicks (or Shadows): These thin lines sticking out from the top and bottom are like antennae, showing you how far the price tried to go but got rejected. A long upper wick means buyers tried to push it high but sellers dragged it back down. A long lower wick means sellers tried to push it low but buyers bravely picked it up. These wicks often whisper secrets about exhaustion or reversals!

By watching how these candles form patterns – like a “Hammer” hitting rock bottom and bouncing back up (a sign of buyers coming to the rescue!), or an “Engulfing” pattern where one big candle swallows the previous one (a dramatic shift in power!) – you start to predict where the currents might take you next.

So, next time you’re charting your course, clear your deck, breathe in that salty air, and let the price action speak to you. It’s the most direct, most powerful, and frankly, the most fun way to understand what’s truly happening in the market and chart your way to potential success!

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

💰Quotes:

“Price action: the art of staring at candles until they confess.”

“Indicators are like rumors; price action is the witness.”

“Trading without price action is like driving blindfolded.”

“Sometimes the best trade is to just let the candle close.”

“If you can’t find the trend, step back and squint—price action is waving at you.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Add Your Heading Text Here

The Power of PriceAction

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of The Check-List

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

4. Stop Loss

Let’s talk about the unsung hero of our trading strategy, the silent guardian, the watchful protector: the stop-loss.

Our Love-Hate Relationship with the Stop-Loss

Here at [Your Company/Team Name, or “our trading desk”], we’ve got a profound, albeit slightly complicated, relationship with the stop-loss. Think of it like that super-responsible friend who always makes sure you don’t do anything too stupid on a wild night out. You might grumble when they pull you away from that questionable decision, but you’re eternally grateful the next morning when you’re not missing an eyebrow.

That’s our stop-loss. It’s the designated driver for our trades, preventing us from driving our accounts straight into a ditch at 100 miles an hour while screaming, “It’s just a temporary dip! It’ll come back!” (Spoiler alert: it usually doesn’t, not without taking your entire portfolio with it.)

Why We Embrace the “Slightly Painful Nudge”

Some traders, bless their optimistic hearts, view a stop-loss as a personal insult, a sign of weakness, or perhaps a tiny financial guillotine. They’d rather ride a losing trade down to zero, hoping for a miraculous turnaround, like waiting for a flat tire to reinflate itself through sheer willpower.

Not us. We’ve learned that a small, controlled loss is like a tiny paper cut compared to the gaping financial wound of a blown-up account. When our stop-loss gets hit, it’s not a defeat; it’s the market gently (or sometimes firmly) nudging us with a sticky note that says, “Hey, genius, your idea was wrong. Time to exit and rethink your life choices… or at least your next trade.”

The Unspoken Benefits of Our Stop-Loss Obsession

Sleep: Believe it or not, knowing your downside is capped lets you actually close your eyes at night without visions of red numbers dancing in your head. It’s truly revolutionary.

Sanity: Less emotional attachment to a dying trade means fewer arguments with your spouse about why you’re glued to the screen muttering about “support levels.”

Capital Preservation: This is fancy talk for “not losing all your money.” Our stop-loss is like a tiny, vigilant bodyguard for our trading capital, always ready to step in and say, “Alright, that’s enough fun for today.”

The Freedom to Be Wrong (Often!): Since we accept small losses, we’re not afraid to try new things. We know that if a trade goes sideways, our trusty stop-loss will catch us before we fall into the abyss of regret.

So, yes, we use stop-losses. Not because we’re pessimists, but because we’re realists who prefer controlled exits over catastrophic explosions. And honestly, it leaves us with more money for coffee and other vital trading supplies

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

Price Action: From Chaos to Clarity

💰What in the Kraken’s Name is Price Action?

Imagine you’re on a bustling market street, and everyone’s shouting their prices for pineapples. You don’t need a fancy economist with a spreadsheet to tell you if pineapples are getting more popular or less. You just watch what people are doing: are they eagerly snatching them up at higher prices, or are the vendors struggling to give them away?

Price action is exactly that, but for stocks and other assets! It’s simply reading the story the market is telling you directly through the price itself. No need for complicated, lagging indicators that are always a step behind, like a tired parrot squawking old news. You’re looking at the raw, unfiltered moves on your chart – the ultimate truth of supply and demand, fear and greed.

💰Why is it the Golden Compass of Trading?

Forget trying to navigate with a half-broken sextant! Price action is your North Star, your most reliable guide:

It’s the OG (Original Gangster) Signal: Every indicator you see on a chart is derived from price. Price action is the price. It’s the source code, the main event, the real deal. When you’re looking at price action, you’re getting the news straight from the horse’s mouth, not through a dozen gossipy villagers.

No Lag, Just Action! Imagine trying to surf a wave by looking at where the last wave broke. You’d be wiped out! Many indicators are “lagging,” meaning they tell you what already happened. Price action is live, in the moment, allowing you to catch the wave as it forms. This means quicker decisions, tighter entries, and less time being swept away by unexpected currents.

Simpler Than a Coconut Cocktail: You don’t need a supercomputer or a massive collection of complex tools. A clean chart, your trusty eyeballs, and a basic understanding of candlestick patterns are often all you need. This simplicity reduces overwhelm and helps you make clear, decisive calls without second-guessing.

The Trend is Your Best Mate! Remember that wise old saying, “the trend is your friend”? Price action is the ultimate wingman for spotting that friend! It’s super easy to see if the market is clearly sailing upwards (making higher highs and higher lows), diving downwards (lower lows and lower highs), or just bobbing around in the doldrums. If the trend is clear, you know exactly which direction to point your ship. If it’s messy, price action tells you to stay ashore and enjoy a pineapple smoothie!

💰How to Read the Market’s Secret Diary (The Candlesticks!)

Each little candle on your chart is like a tiny scroll, telling you a mini-story of what happened during that time period (a minute, an hour, a day).

The Body: This is the fat part of the candle. A long green (or white) body means buyers were in control, pushing the price way up. A long red (or black) body means sellers dominated, sending the price tumbling. Think of it as a tug-of-war: who won that round?

The Wicks (or Shadows): These thin lines sticking out from the top and bottom are like antennae, showing you how far the price tried to go but got rejected. A long upper wick means buyers tried to push it high but sellers dragged it back down. A long lower wick means sellers tried to push it low but buyers bravely picked it up. These wicks often whisper secrets about exhaustion or reversals!

By watching how these candles form patterns – like a “Hammer” hitting rock bottom and bouncing back up (a sign of buyers coming to the rescue!), or an “Engulfing” pattern where one big candle swallows the previous one (a dramatic shift in power!) – you start to predict where the currents might take you next.

So, next time you’re charting your course, clear your deck, breathe in that salty air, and let the price action speak to you. It’s the most direct, most powerful, and frankly, the most fun way to understand what’s truly happening in the market and chart your way to potential success!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

The Power of StopLoss

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of StopLoss

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

21. CheckList

A trading checklist is a crucial tool for any trader, from beginner to professional. It’s a structured list of tasks and questions you must complete before, during, and after a trade. Its main purpose is to enforce discipline and consistency, which helps to minimize emotional decision-making and reduce costly errors.

A good checklist acts as your personal trading plan, guiding you through every step of the process. This helps you stick to a strategy, manage risk effectively, and avoid impulsive actions driven by fear or greed. By systematically checking off each item, you ensure that you are following your predetermined rules and not just “winging it.”

Here’s a breakdown of what a trading checklist might include:

Pre-Trade Checklist:

Market Analysis: What is the overall market trend? Are there any major news events or economic data releases today that could affect the market?

Trade Setup: Does this trade meet all the criteria of my strategy? Have I identified clear entry and exit points?

Risk Management: What is my maximum risk for this trade? Have I set my stop-loss order? Is my position size appropriate for my account balance?

In-Trade Checklist:

Execution: Have I executed the trade at the planned entry point?

Monitoring: Am I sticking to my original plan, or am I being tempted to make changes based on emotional reactions?

Adjustments: If I need to adjust my stop-loss, am I following my rules for doing so?

Post-Trade Checklist:

Review: Did I follow my plan exactly? What did I do well, and what could I have done better?

Journaling: Have I recorded the trade details, including my thought process, the outcome, and any lessons learned?

Performance: How does this trade affect my overall performance metrics?

By consistently using a trading checklist, you can transform your trading from a chaotic, emotional exercise into a clear, methodical process, ultimately leading to greater clarity and success.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

Trading can feel like you’re strapped to a rocket that’s either soaring to the moon or crashing back to Earth with a spectacular explosion. That’s where a trading checklist comes in—it’s basically your pre-flight safety routine, but for your wallet.

Think of it as your sober, slightly boring best friend who stops you from making terrible decisions at 2 a.m. It’s a list of everything you need to do and check before, during, and after a trade. Its main job is to put a muzzle on your inner trading gremlin—that little monster that screams “buy it now!” or “sell everything!” based on a hunch or, worse, a lucky feeling.

Here’s a sneak peek at what your trading gremlin’s worst enemy looks like:

Before You Hit the Big Red “Trade” Button

Did I find a good-looking setup? Is this trade actually part of my master plan, or am I just chasing a shiny new stock because everyone else is?

Have I checked the calendar? Is some big, scary economic news coming out today that could turn my genius trade into a fiery wreck?

Where’s my parachute? Did I set a stop-loss? You know, that magical point where you gracefully bow out of a trade before it gets awkward and you lose your shirt.

What’s my ammo count? Am I risking a reasonable amount, or am I betting the entire farm on this one trade? Spoiler alert: don’t bet the farm.

While the Trade Is Happening

Is my hand off the mouse? Am I resisting the urge to mess with my perfectly good plan just because the price wiggled a little bit?

Am I feeling a little sweaty? If so, why? Am I panicking, or is my trade just going through a normal, non-panicky phase?

Am I still sane? Is my emotional state still in check, or am I ready to jump out the window because of a red candle?

After the Dust Settles

Did I do what I said I’d do? Did I stick to the plan like super glue, or did my trading gremlin take over and buy me a bunch of useless widgets?

Time for a post-mortem. What went right? What went wrong? Why did I think that was a good idea? Journaling this stuff is like therapy for your trading account.

Am I ready for the next round? After all that, am I good to go again, or do I need to take a breather and stare at a wall for a few minutes?

In short, a trading checklist helps you trade like a cool, calm robot, not a jittery, caffeine-fueled squirrel. It turns the chaotic market into a repeatable, methodical process, so you can trade with a bit more clarity and a lot less chaos.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”