Charts

Price Action Charts

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

Price action trading charts involve the analysis of raw price movement displayed directly on a chart, typically using candlesticks or bars. This method prioritizes the visual interpretation of how buyers and sellers are interacting, without the immediate reliance on secondary indicators.

By observing patterns in price highs, lows, opens, and closes, traders aim to understand market psychology, identify key support and resistance levels, and discern potential trends or reversals. It’s a direct approach to market analysis, where the price itself is considered the most comprehensive and reliable source of information for making trading decisions.

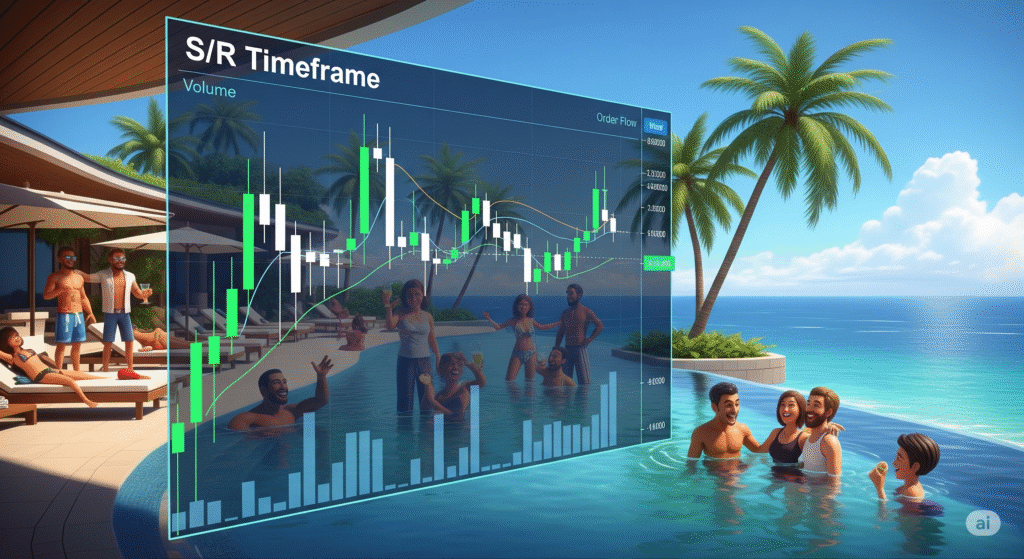

Forex

Ever stare at a bunch of flickering numbers and think, “There has to be a better way to understand this chaos?” Well, my friend, say hello to Trading Charts!

These aren’t just fancy graphs; they’re the market’s own reality show, condensed into a visual story. Each bar or candlestick is a tiny drama playing out, showing you exactly where the price opened, closed, and briefly went crazy, all over a specific period.

Think of it as your personal decoder ring for the financial world. Instead of trying to guess what’s happening, you’re literally seeing the market’s past behavior laid out before you. Are prices skyrocketing like a cat on a trampoline? Or are they plummeting like a lead balloon? Your chart tells all!

So, grab your popcorn. By learning to read these visual diaries, you’ll start spotting patterns, understanding the market’s moods, and maybe even predicting its next dramatic plot twist. It’s less guesswork, more “aha!” moments.

Add Your Heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Metal

Ever stare at a bunch of flickering numbers and think, “There has to be a better way to understand this chaos?” Well, my friend, say hello to Trading Charts!

These aren’t just fancy graphs; they’re the market’s own reality show, condensed into a visual story. Each bar or candlestick is a tiny drama playing out, showing you exactly where the price opened, closed, and briefly went crazy, all over a specific period.

Think of it as your personal decoder ring for the financial world. Instead of trying to guess what’s happening, you’re literally seeing the market’s past behavior laid out before you. Are prices skyrocketing like a cat on a trampoline? Or are they plummeting like a lead balloon? Your chart tells all!

So, grab your popcorn. By learning to read these visual diaries, you’ll start spotting patterns, understanding the market’s moods, and maybe even predicting its next dramatic plot twist. It’s less guesswork, more “aha!” moments.

Add Your Heading

Crypto

Ever stare at a bunch of flickering numbers and think, “There has to be a better way to understand this chaos?” Well, my friend, say hello to Trading Charts!

These aren’t just fancy graphs; they’re the market’s own reality show, condensed into a visual story. Each bar or candlestick is a tiny drama playing out, showing you exactly where the price opened, closed, and briefly went crazy, all over a specific period.

Think of it as your personal decoder ring for the financial world. Instead of trying to guess what’s happening, you’re literally seeing the market’s past behavior laid out before you. Are prices skyrocketing like a cat on a trampoline? Or are they plummeting like a lead balloon? Your chart tells all!

So, grab your popcorn. By learning to read these visual diaries, you’ll start spotting patterns, understanding the market’s moods, and maybe even predicting its next dramatic plot twist. It’s less guesswork, more “aha!” moments.

Add Your Heading

Stocks

Ever stare at a bunch of flickering numbers and think, “There has to be a better way to understand this chaos?” Well, my friend, say hello to Trading Charts!

These aren’t just fancy graphs; they’re the market’s own reality show, condensed into a visual story. Each bar or candlestick is a tiny drama playing out, showing you exactly where the price opened, closed, and briefly went crazy, all over a specific period.

Think of it as your personal decoder ring for the financial world. Instead of trying to guess what’s happening, you’re literally seeing the market’s past behavior laid out before you. Are prices skyrocketing like a cat on a trampoline? Or are they plummeting like a lead balloon? Your chart tells all!

So, grab your popcorn. By learning to read these visual diaries, you’ll start spotting patterns, understanding the market’s moods, and maybe even predicting its next dramatic plot twist. It’s less guesswork, more “aha!” moments.

Add Your Heading

Sgd/Jpy

Inside Bar

Crypto Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Forex Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Stock Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Metal Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Sgd/Jpy

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Inside Bar

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Inside Bar

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Swing Trading

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Forex

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Stocks

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Forex

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Stocks

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Crypto

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Metal

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

💰

Price action is the foundation of technical trading. It refers to the movement of price over time, without relying on indicators. Here’s why it’s powerful:

🔥 The Power of Price Action:

Simplicity

Price action strips away distractions. Traders read candles, structure, and key levels directly from the chart.Real-Time Clarity

It reflects real-time decisions of buyers and sellers, showing where the market is reacting.Universal Application

Works on all timeframes and markets—forex, stocks, crypto.Identifies Key Setups

Patterns like:Pin bars

Engulfing candles

Inside bars

Break and retest

provide high-probability entries.

Institutional Footprints

Price action helps you “see” what smart money is doing—entries at key levels, liquidity grabs, false breaks, etc.No Lag

Unlike indicators, it’s immediate—based on what’s happening now, not 10 bars ago.

Price Action Charts

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

Crypto Chart

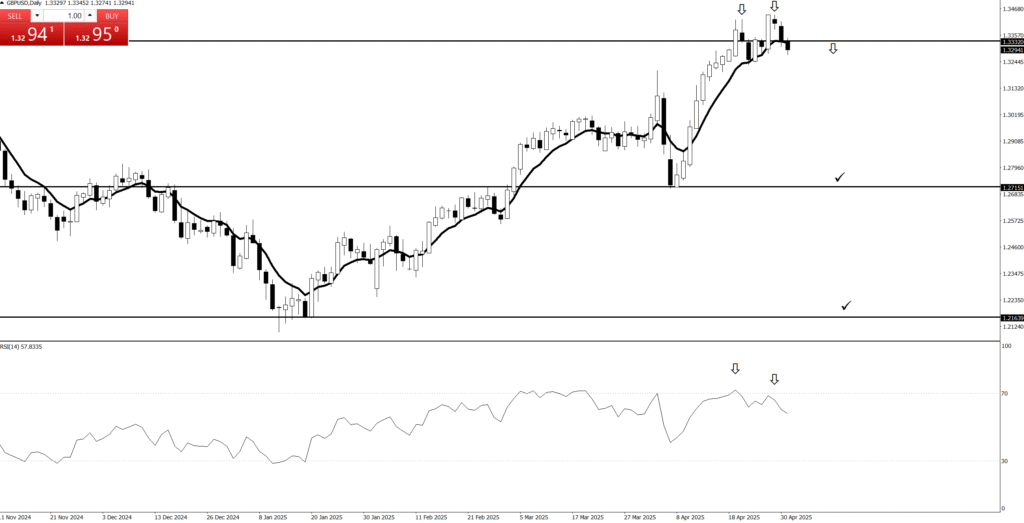

Forex Chart

Stock Chart

Metal Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Take Profit Charts

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

Price action trading charts involve the analysis of raw price movement displayed directly on a chart, typically using candlesticks or bars. This method prioritizes the visual interpretation of how buyers and sellers are interacting, without the immediate reliance on secondary indicators.

By observing patterns in price highs, lows, opens, and closes, traders aim to understand market psychology, identify key support and resistance levels, and discern potential trends or reversals. It’s a direct approach to market analysis, where the price itself is considered the most comprehensive and reliable source of information for making trading decisions.

Trading Charts: Your Market Decoder Ring (and Reality Show!)

Ever stare at a bunch of flickering numbers and think, “There has to be a better way to understand this chaos?” Well, my friend, say hello to Trading Charts!

These aren’t just fancy graphs; they’re the market’s own reality show, condensed into a visual story. Each bar or candlestick is a tiny drama playing out, showing you exactly where the price opened, closed, and briefly went crazy, all over a specific period.

Think of it as your personal decoder ring for the financial world. Instead of trying to guess what’s happening, you’re literally seeing the market’s past behavior laid out before you. Are prices skyrocketing like a cat on a trampoline? Or are they plummeting like a lead balloon? Your chart tells all!

So, grab your popcorn. By learning to read these visual diaries, you’ll start spotting patterns, understanding the market’s moods, and maybe even predicting its next dramatic plot twist. It’s less guesswork, more “aha!” moments.

Price Action

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

Charts

Price Action Charts

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“Price action strips away the noise—what you see is what the market is doing.”

“Charts tell the truth: no indicators, no lag, just raw market behavior.”

“Price action reveals the story behind every candle.”

“Simplicity wins—price action keeps trading clean and clear.”

“With price action, you learn to read the market, not chase signals.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Price Action Charts

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

Price action trading charts involve the analysis of raw price movement displayed directly on a chart, typically using candlesticks or bars. This method prioritizes the visual interpretation of how buyers and sellers are interacting, without the immediate reliance on secondary indicators.

By observing patterns in price highs, lows, opens, and closes, traders aim to understand market psychology, identify key support and resistance levels, and discern potential trends or reversals. It’s a direct approach to market analysis, where the price itself is considered the most comprehensive and reliable source of information for making trading decisions.

Forex

Ever stare at a bunch of flickering numbers and think, “There has to be a better way to understand this chaos?” Well, my friend, say hello to Trading Charts!

These aren’t just fancy graphs; they’re the market’s own reality show, condensed into a visual story. Each bar or candlestick is a tiny drama playing out, showing you exactly where the price opened, closed, and briefly went crazy, all over a specific period.

Think of it as your personal decoder ring for the financial world. Instead of trying to guess what’s happening, you’re literally seeing the market’s past behavior laid out before you. Are prices skyrocketing like a cat on a trampoline? Or are they plummeting like a lead balloon? Your chart tells all!

So, grab your popcorn. By learning to read these visual diaries, you’ll start spotting patterns, understanding the market’s moods, and maybe even predicting its next dramatic plot twist. It’s less guesswork, more “aha!” moments.

Metal

Ever stare at a bunch of flickering numbers and think, “There has to be a better way to understand this chaos?” Well, my friend, say hello to Trading Charts!

These aren’t just fancy graphs; they’re the market’s own reality show, condensed into a visual story. Each bar or candlestick is a tiny drama playing out, showing you exactly where the price opened, closed, and briefly went crazy, all over a specific period.

Think of it as your personal decoder ring for the financial world. Instead of trying to guess what’s happening, you’re literally seeing the market’s past behavior laid out before you. Are prices skyrocketing like a cat on a trampoline? Or are they plummeting like a lead balloon? Your chart tells all!

So, grab your popcorn. By learning to read these visual diaries, you’ll start spotting patterns, understanding the market’s moods, and maybe even predicting its next dramatic plot twist. It’s less guesswork, more “aha!” moments.

Crypto

Ever stare at a bunch of flickering numbers and think, “There has to be a better way to understand this chaos?” Well, my friend, say hello to Trading Charts!

These aren’t just fancy graphs; they’re the market’s own reality show, condensed into a visual story. Each bar or candlestick is a tiny drama playing out, showing you exactly where the price opened, closed, and briefly went crazy, all over a specific period.

Think of it as your personal decoder ring for the financial world. Instead of trying to guess what’s happening, you’re literally seeing the market’s past behavior laid out before you. Are prices skyrocketing like a cat on a trampoline? Or are they plummeting like a lead balloon? Your chart tells all!

So, grab your popcorn. By learning to read these visual diaries, you’ll start spotting patterns, understanding the market’s moods, and maybe even predicting its next dramatic plot twist. It’s less guesswork, more “aha!” moments.

Stocks

Ever stare at a bunch of flickering numbers and think, “There has to be a better way to understand this chaos?” Well, my friend, say hello to Trading Charts!

These aren’t just fancy graphs; they’re the market’s own reality show, condensed into a visual story. Each bar or candlestick is a tiny drama playing out, showing you exactly where the price opened, closed, and briefly went crazy, all over a specific period.

Think of it as your personal decoder ring for the financial world. Instead of trying to guess what’s happening, you’re literally seeing the market’s past behavior laid out before you. Are prices skyrocketing like a cat on a trampoline? Or are they plummeting like a lead balloon? Your chart tells all!

So, grab your popcorn. By learning to read these visual diaries, you’ll start spotting patterns, understanding the market’s moods, and maybe even predicting its next dramatic plot twist. It’s less guesswork, more “aha!” moments.

Crypto Chart

Forex Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Stock Chart

Metal Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Charts

Price Action Charts

“Price action strips away the noise—what you see is what the market is doing.”

“Charts tell the truth: no indicators, no lag, just raw market behavior.”

“Price action reveals the story behind every candle.”

“Simplicity wins—price action keeps trading clean and clear.”

“With price action, you learn to read the market, not chase signals.”

“Price action strips away the noise—what you see is what the market is doing.”

“Charts tell the truth: no indicators, no lag, just raw market behavior.”

“Price action reveals the story behind every candle.”

“Simplicity wins—price action keeps trading clean and clear.”

“With price action, you learn to read the market, not chase signals.”

“Price action strips away the noise—what you see is what the market is doing.”

“Charts tell the truth: no indicators, no lag, just raw market behavior.”

“Price action reveals the story behind every candle.”

“Simplicity wins—price action keeps trading clean and clear.”

“With price action, you learn to read the market, not chase signals.”

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

Price action trading charts involve the analysis of raw price movement displayed directly on a chart, typically using candlesticks or bars. This method prioritizes the visual interpretation of how buyers and sellers are interacting, without the immediate reliance on secondary indicators.

By observing patterns in price highs, lows, opens, and closes, traders aim to understand market psychology, identify key support and resistance levels, and discern potential trends or reversals. It’s a direct approach to market analysis, where the price itself is considered the most comprehensive and reliable source of information for making trading decisions.

Crypto Chart

Forex Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Stock Chart

Metal Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Price Action Charts

“Price action strips away the noise—what you see is what the market is doing.”

-

“Charts tell the truth: no indicators, no lag, just raw market behavior.”

-

“Price action reveals the story behind every candle.”

-

“Simplicity wins—price action keeps trading clean and clear.”

-

“With price action, you learn to read the market, not chase signals.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

Price action trading charts involve the analysis of raw price movement displayed directly on a chart, typically using candlesticks or bars. This method prioritizes the visual interpretation of how buyers and sellers are interacting, without the immediate reliance on secondary indicators.

By observing patterns in price highs, lows, opens, and closes, traders aim to understand market psychology, identify key support and resistance levels, and discern potential trends or reversals. It’s a direct approach to market analysis, where the price itself is considered the most comprehensive and reliable source of information for making trading decisions.

Crypto Chart

Forex Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Stock Chart

Metal Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Price Action Charts

“Price action strips away the noise—what you see is what the market is doing.”

-

“Charts tell the truth: no indicators, no lag, just raw market behavior.”

-

“Price action reveals the story behind every candle.”

-

“Simplicity wins—price action keeps trading clean and clear.”

-

“With price action, you learn to read the market, not chase signals.”

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

Price action trading charts involve the analysis of raw price movement displayed directly on a chart, typically using candlesticks or bars. This method prioritizes the visual interpretation of how buyers and sellers are interacting, without the immediate reliance on secondary indicators.

By observing patterns in price highs, lows, opens, and closes, traders aim to understand market psychology, identify key support and resistance levels, and discern potential trends or reversals. It’s a direct approach to market analysis, where the price itself is considered the most comprehensive and reliable source of information for making trading decisions.

Trading Charts: Your Market Decoder Ring (and Reality Show!)

Ever stare at a bunch of flickering numbers and think, “There has to be a better way to understand this chaos?” Well, my friend, say hello to Trading Charts!

These aren’t just fancy graphs; they’re the market’s own reality show, condensed into a visual story. Each bar or candlestick is a tiny drama playing out, showing you exactly where the price opened, closed, and briefly went crazy, all over a specific period.

Think of it as your personal decoder ring for the financial world. Instead of trying to guess what’s happening, you’re literally seeing the market’s past behavior laid out before you. Are prices skyrocketing like a cat on a trampoline? Or are they plummeting like a lead balloon? Your chart tells all!

So, grab your popcorn. By learning to read these visual diaries, you’ll start spotting patterns, understanding the market’s moods, and maybe even predicting its next dramatic plot twist. It’s less guesswork, more “aha!” moments.

Price action trading charts emphasize the study of a financial instrument’s price movements over time as the primary source of trading signals. This analytical method focuses on the patterns, structure, and behavior of candlesticks or bars, along with their relationship to key price levels.

The core idea is to understand what the market is communicating directly through its price, without the potential lag or complexity introduced by technical indicators. Traders interpret the battle between buyers and sellers, identify momentum, and anticipate potential shifts by closely observing how price unfolds and reacts within different timeframes, offering a streamlined approach to market analysis.

Trading Charts: Your Crystal Ball (That Only Shows the Past)

Ever wish you had a crystal ball to predict where the market’s going next? Well, you’re in luck! Meet Trading Charts – they’re exactly like a crystal ball, except they only show you what already happened!

But don’t scoff! By carefully examining these squiggly lines and colorful bars, you’re actually reading the market’s historical footprint. Each little flicker, each rise and fall, is a clue. You’re basically a financial detective, piecing together the market’s past crimes (and triumphs) to figure out its likely next move.

So, while they won’t tell you tomorrow’s lottery numbers, charts give you the visual evidence you need to understand the market’s moods, patterns, and probable next steps. They turn the chaotic noise of prices into a readable story. Get ready to put on your detective hat and see what secrets the market’s been keeping!

Crypto Chart

Forex Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Stock Chart

Metal Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Chart of the Day

Swing Trading

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

💰

Price action is the foundation of technical trading. It refers to the movement of price over time, without relying on indicators. Here’s why it’s powerful:

🔥 The Power of Price Action:

Simplicity

Price action strips away distractions. Traders read candles, structure, and key levels directly from the chart.Real-Time Clarity

It reflects real-time decisions of buyers and sellers, showing where the market is reacting.Universal Application

Works on all timeframes and markets—forex, stocks, crypto.Identifies Key Setups

Patterns like:Pin bars

Engulfing candles

Inside bars

Break and retest

provide high-probability entries.

Institutional Footprints

Price action helps you “see” what smart money is doing—entries at key levels, liquidity grabs, false breaks, etc.No Lag

Unlike indicators, it’s immediate—based on what’s happening now, not 10 bars ago.

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Price Action Charts

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

Price action trading charts involve the analysis of raw price movement displayed directly on a chart, typically using candlesticks or bars. This method prioritizes the visual interpretation of how buyers and sellers are interacting, without the immediate reliance on secondary indicators.

By observing patterns in price highs, lows, opens, and closes, traders aim to understand market psychology, identify key support and resistance levels, and discern potential trends or reversals. It’s a direct approach to market analysis, where the price itself is considered the most comprehensive and reliable source of information for making trading decisions.

Trading Charts: Your Market Decoder Ring (and Reality Show!)

Ever stare at a bunch of flickering numbers and think, “There has to be a better way to understand this chaos?” Well, my friend, say hello to Trading Charts!

These aren’t just fancy graphs; they’re the market’s own reality show, condensed into a visual story. Each bar or candlestick is a tiny drama playing out, showing you exactly where the price opened, closed, and briefly went crazy, all over a specific period.

Think of it as your personal decoder ring for the financial world. Instead of trying to guess what’s happening, you’re literally seeing the market’s past behavior laid out before you. Are prices skyrocketing like a cat on a trampoline? Or are they plummeting like a lead balloon? Your chart tells all!

So, grab your popcorn. By learning to read these visual diaries, you’ll start spotting patterns, understanding the market’s moods, and maybe even predicting its next dramatic plot twist. It’s less guesswork, more “aha!” moments.

Price Action Charts

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

Crypto Chart

Forex Chart

Stock Chart

Metal Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Forex

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

💰

Price action is the foundation of technical trading. It refers to the movement of price over time, without relying on indicators. Here’s why it’s powerful:

🔥 The Power of Price Action:

Simplicity

Price action strips away distractions. Traders read candles, structure, and key levels directly from the chart.Real-Time Clarity

It reflects real-time decisions of buyers and sellers, showing where the market is reacting.Universal Application

Works on all timeframes and markets—forex, stocks, crypto.Identifies Key Setups

Patterns like:Pin bars

Engulfing candles

Inside bars

Break and retest

provide high-probability entries.

Institutional Footprints

Price action helps you “see” what smart money is doing—entries at key levels, liquidity grabs, false breaks, etc.No Lag

Unlike indicators, it’s immediate—based on what’s happening now, not 10 bars ago.

Stocks

💰

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

💰

Price action is the foundation of technical trading. It refers to the movement of price over time, without relying on indicators. Here’s why it’s powerful:

🔥 The Power of Price Action:

Simplicity

Price action strips away distractions. Traders read candles, structure, and key levels directly from the chart.Real-Time Clarity

It reflects real-time decisions of buyers and sellers, showing where the market is reacting.Universal Application

Works on all timeframes and markets—forex, stocks, crypto.Identifies Key Setups

Patterns like:Pin bars

Engulfing candles

Inside bars

Break and retest

provide high-probability entries.

Institutional Footprints

Price action helps you “see” what smart money is doing—entries at key levels, liquidity grabs, false breaks, etc.No Lag

Unlike indicators, it’s immediate—based on what’s happening now, not 10 bars ago.