The Power of False Breaks

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of the Trends”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

The Golden Rule: Have a Plan Before You Enter!

No matter which method you choose, the most crucial aspect of taking profit is to define your take-profit point before you enter the trade. This prevents emotional decisions and ensures you’re trading with discipline. It’s part of your “best setup” plan!

1. “Advantages of this Trading Edge?”

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

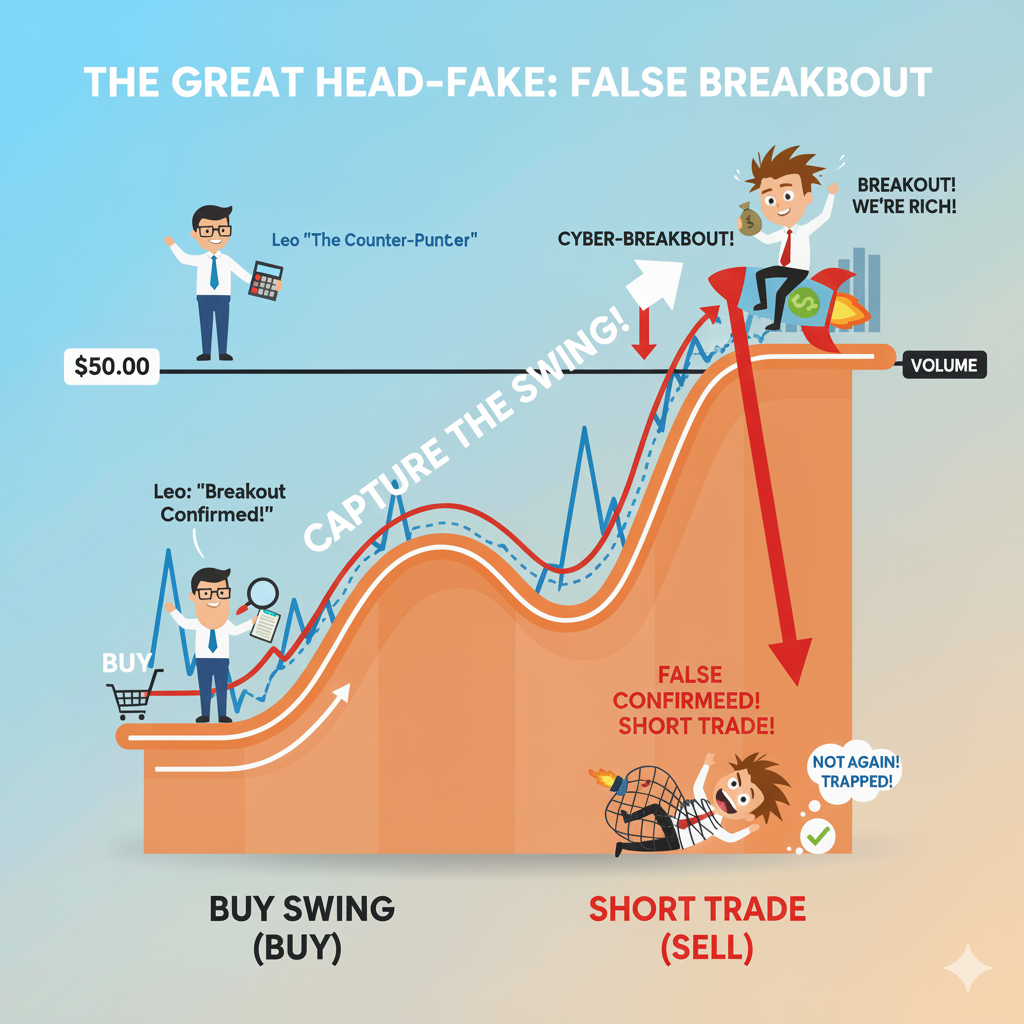

1. “False Breaks”

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

2.“Charts”

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

5. “Videos: False Breaks in Action”

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

5. “The Story of the False Break”

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.

Conclusion/Sammanfattning

False Break: The Best Revenge is Profitable Trading!

Forget the heartache of seeing your breakout trade fail! The False Breakout is the market’s meanest trick, but for professionals, it’s a high-probability goldmine.

The excitement? You’re trading the moment of maximum financial chaos! When price fakes a move (a “Bear Trap” at support or a “Bull Trap” at resistance) and immediately snaps back, it’s the loudest signal you can get. It screams: “All the impatient traders just got liquidated!”

The power is simple:

Confirmation: The sharp reversal proves the support/resistance level is still rock-solid.

Fuel: The forced stop-losses of the trapped crowd provide explosive momentum for your trade in the opposite direction.

You get a low-risk entry, a tight stop-loss (right at the tip of the fakeout wick), and a statistical edge. Stop being the victim; start profiting from the market’s betrayal. Wait for the trap, trade the snap, and let the trapped traders finance your victory lap!

💰The Power of False Break Slogans:

“False Breaks: When the market fakes you out to take your money—until you turn the tables.”

“Catch the false break and trade the real move.”

“False Breaks separate the pros from the amateurs.”

“The power of false breaks: Turning market tricks into trading wins.”

“False breaks: The market’s way of saying ‘Gotcha!’—and your chance to say ‘Gotcha back.’”

“Don’t fear the break—fear missing the false one.”

“False Breaks: Where patience rewards the prepared.”

“When price fakes, the smart trader acts.”

“The false break: A trap for the impatient, a signal for the wise.”

“Master false breaks, master the market’s mind games.”

💰The Power of Inside Bars:

“Inside Bars: Silence before the storm.”

“Small bars, big moves—inside bars lead the way.”

“Inside Bars: Where patience meets opportunity.”

“The market whispers with inside bars—listen closely.”

“Inside Bars show the calm before the breakout.”

“Power lies in the pause—trade the inside bar.”

“Inside Bars: The secret signals of professional traders.”

“Inside Bars: Compact setups, explosive potential.”

“The inside bar: A quiet setup for loud profits.”

“Inside Bars turn market hesitation into trading advantage.”

💰False Break Slogans:

“False breaks: When the market fakes out to fool the crowd.”

“Don’t chase the break—wait for the false one.”

“False breaks catch the impatient and reward the patient.”

“Spot the false break and trade the real move.”

“False breaks: The market’s sneaky little traps.”

“When price breaks, sometimes it’s just playing tricks.”

“False breaks separate the traders from the gamblers.”

“The best trades often start with a false break.”

“False breaks: The market’s way of saying ‘Not this time.’”

“False breaks: Where smart traders wait, others lose.”

💰Funny False Break Slogans:

“False breaks: The market’s version of ‘Just kidding!’”

“When the market says ‘Go!’ but really means ‘Nope!’”

“False breaks: Like a bad Tinder date—promising but ends with a fakeout.”

“Chasing false breaks? That’s how you lose friends and money.”

“False breaks: Because the market loves a good prank.”

“False breaks—proof the market has a sense of humor.”

“The market’s fakeout move: Gotcha, again!”

“False breaks: Like the ‘Are we there yet?’ of trading.”

“False breaks keep your heart rate up—and your account down.”

“If false breaks were a movie genre, they’d be a thriller with a twist ending.”

💰🔥 🚫 The Power of a False Break (Fakeout)

A False Break happens when price looks like it’s breaking a key level (support, resistance, trendline), but then quickly reverses back inside the previous range. It tricks traders into entering in the wrong direction, causing a sharp reversal.

💰🔑 Why False Breaks Are Powerful:

Traps breakout traders who jump in too early.

Shows where smart money operates — big players create fake moves to trigger stops and accumulate.

Signals strong reversals — after the false break, price often moves quickly in the opposite direction.

Great for risk/reward — tight stops near the false break, with good profit potential.

💰🎯 How to Trade a False Break:

Spot the key level.

Wait for price to break beyond the level.

Confirm price reverses back inside the range.

Enter against the false break with a stop just beyond the breakout extreme.

Use other tools (volume, candles, momentum) to confirm.

💰In essence, your very first action is a rapid visual assessment: “Where is the market clearly trying to go?” If it’s not clearly trying to go anywhere, then your strategy (following the trend) dictates that you don’t have a trade.