6. Risk/Reward

You’ve heard it whispered in the hallowed halls of finance, scrawled on bathroom stalls in trading firms, and probably even mumbled by your grandma if she’s secretly a forex guru: “The trend is your friend.”

And let me tell you, it’s not just a catchy little rhyme your mentor uses to sound smart. It’s the absolute, unadulterated truth. Because trying to trade against the trend is like trying to convince a toddler that broccoli is delicious: you’re going to lose, you’re going to get messy, and you’re going to end up crying into your pint of ice cream.

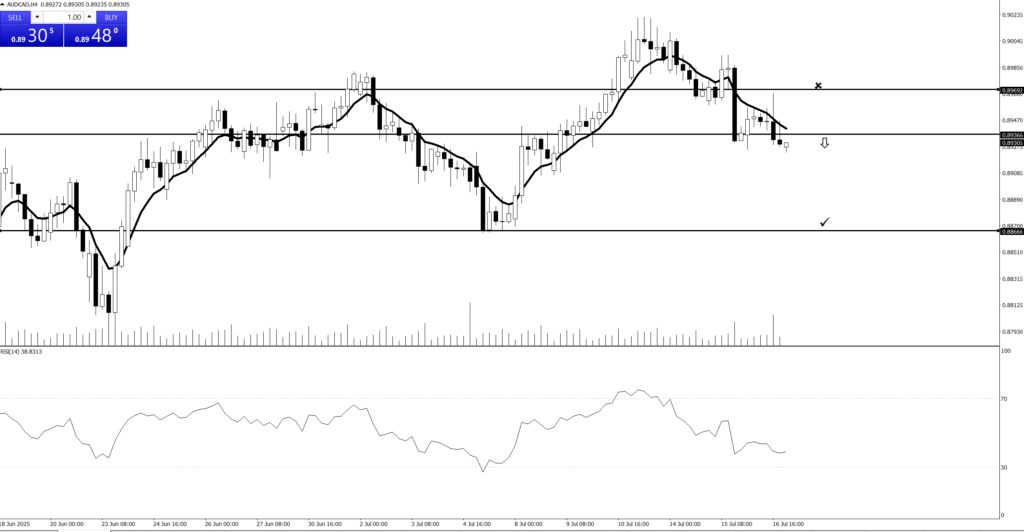

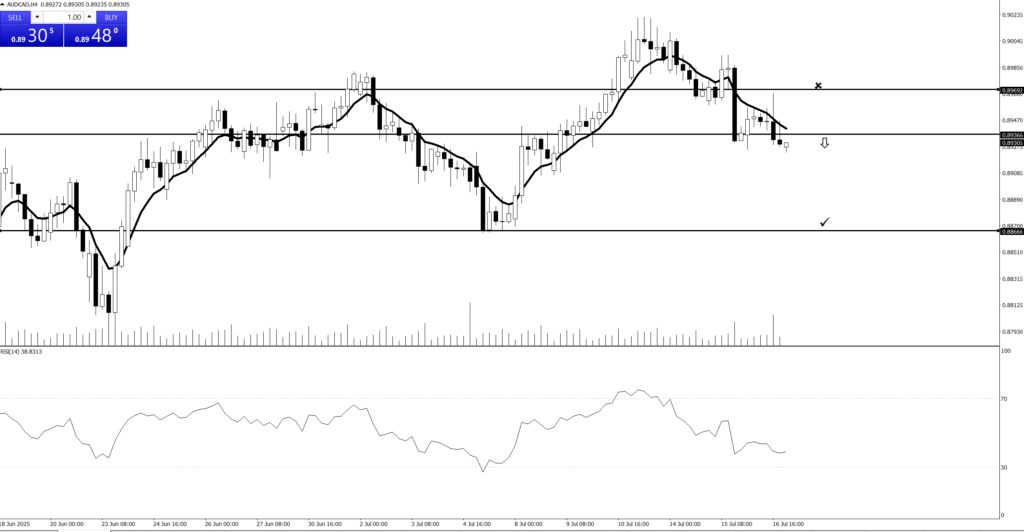

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

The Golden Rule: Have a Plan Before You Enter!

No matter which method you choose, the most crucial aspect of taking profit is to define your take-profit point before you enter the trade. This prevents emotional decisions and ensures you’re trading with discipline. It’s part of your “best setup” plan!

6. Risk/Reward (rr)

Alright, gather ’round, aspiring market adventurers, and let’s talk about the holy grail of trading sanity, the secret sauce to not blowing up your account like an ill-fated fireworks display on the Fourth of July in Barcelona: the Risk/Reward Ratio!

Imagine you’re at a ridiculously fancy buffet (it’s Friday, July 4th, 2025, after all, and we’re feeling celebratory in sunny Barcelona!). You see two trays:

Tray A: Contains a single, slightly bruised olive. If you eat it, you get one point. But, oh no! If you don’t like it, you lose one point.

Tray B: Holds a glistening, perfectly cooked lobster tail. If you eat it, you get three glorious points! But, if it turns out to be secretly made of rubber (hey, it’s a fancy buffet, but still!), you lose one point.

Which one do you go for? If you’ve got half a brain and an appetite for success, you’re eyeing that lobster tail! Why? Because the potential deliciousness (reward) far outweighs the risk of a rubbery bite (risk)!

The Risk/Reward Ratio: Your Trading Buffet Guide!

In trading, the Risk/Reward Ratio (often shortened to R:R) is simply a way to measure how much you stand to gain on a trade versus how much you stand to lose if it goes wrong.

It’s expressed like this: 1:X (e.g., 1:2, 1:3, 1:5)

The “1” always represents your Risk (how much money you’re willing to lose, defined by your stop-loss).

The “X” represents your Reward (how much money you expect to gain, defined by your take-profit target).

Think of it as your Trade-Off Meter:

1:1 Ratio (The “Meh” Meal): You risk $100 to potentially make $100. It’s like flipping a coin for dinner. Not very exciting, is it? You’ve got to be right 51% of the time just to break even after commissions. BORING!

1:2 Ratio (The “Smart Snacker”): You risk $100 to potentially make $200. Now we’re talking! This means for every dollar you put on the line, you’re aiming to pull back two. Even if you’re only right 40% of the time, you can still be profitable! This is like ordering a tapas platter where even if one dish is a bit bland, the others make up for it.

1:3 Ratio (The “Feast Finder”): You risk $100 to potentially make $300. Woohoo! Now you’re getting serious! For every buck you put on the line, you’re hoping for three back. You could be wrong 60% of the time and still make money! This is like finding a Michelin-star restaurant that gives you free desserts if you don’t like the main course. Legendary!

1:5, 1:10, and Beyond (The “Whale Hunter”): These are the legendary ratios, where you’re aiming for massive payouts compared to your tiny risk. It’s like finding a whole school of tuna in the Mediterranean when you only cast a tiny net. These trades might not come often, but when they do, they can make your year!

Why is it So Crucial for Your Wallet (and Your Sanity)?

Because, my friend, you don’t have to be right all the time to be profitable! This is the ultimate mind-blower for new traders.

If you always aim for a 1:2 R:R, and you win only 40% of your trades, guess what? You’re still making money! (4 winning trades x $200 = $800; 6 losing trades x $100 = $600 loss. Net profit = $200!)

If you’re stuck aiming for 1:1, you’d need to win 55-60% just to stay afloat due to trading costs. That’s a lot more pressure!

So, next time you’re eyeing a potential trade, don’t just look at the entry point. First, identify your stop-loss (your escape hatch if things go south – the risk). Then, pinpoint your take-profit (your destination for gains – the reward). Calculate that glorious ratio.

If it’s not at least 1:2 or 1:3 (depending on your strategy’s win rate), then politely decline, turn on some chill beach music, and enjoy the Barcelona sunshine. Because the best trades are like the best parties: low risk, high reward, and totally worth the wait!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

💰⚖️ What is Risk/Reward Ratio?

The Risk/Reward Ratio (R:R) compares how much you’re risking on a trade versus how much you aim to gain.

Formula:

🧮 Risk/Reward = (Potential Loss) / (Potential Profit)

💰📌 Example:

You enter a trade with:

Entry Price: 1.1000

Stop Loss: 1.0950 → 50 pip risk

Take Profit: 1.1100 → 100 pip reward

Risk/Reward = 50 / 100 = 1:2

You’re risking 1 to make 2.

💰✅ Why It Matters:

🔐 Protects your capital – you don’t need to win all trades to be profitable.

🧠 Brings discipline – forces you to plan every trade.

📈 Key for long-term success – even with 40% win rate, you can be profitable if your R:R is good.

💰🎯 Common R:R Targets:

1:2 (Risk 1 to make 2) – good minimum standard.

1:3 or more – preferred by many swing traders.

1:1 – breakeven level, not ideal unless win rate is high.

💰🧠 Pro Tip:

Always match your Stop Loss and Take Profit to:

Market structure (support/resistance)

Volatility (use ATR)

Strategy logic (e.g., trend following, pullbacks, etc.)

6. Risk/Reward

You’ve heard it whispered in the hallowed halls of finance, scrawled on bathroom stalls in trading firms, and probably even mumbled by your grandma if she’s secretly a forex guru: “The trend is your friend.”

And let me tell you, it’s not just a catchy little rhyme your mentor uses to sound smart. It’s the absolute, unadulterated truth. Because trying to trade against the trend is like trying to convince a toddler that broccoli is delicious: you’re going to lose, you’re going to get messy, and you’re going to end up crying into your pint of ice cream.

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

The Golden Rule: Have a Plan Before You Enter!

No matter which method you choose, the most crucial aspect of taking profit is to define your take-profit point before you enter the trade. This prevents emotional decisions and ensures you’re trading with discipline. It’s part of your “best setup” plan!

6. Risk/Reward (rr)

To double an account from $10,000 to $20,000 with a 5% risk per trade and different risk-reward ratios (1:2 and 1:3), we need to consider the number of winning trades required.

Here’s how to calculate it:

Initial Account Balance: $10,000 Target Account Balance: $20,000 Risk per Trade: 5% of account balance

1. Calculate the Risk Amount per Trade: The dollar amount risked per trade will change as the account balance grows.

2. Number of Doubling Periods (for a rough estimate): To go from $10,000 to $20,000 is one doubling.

3. Analyze with Different Risk-Reward Ratios:

Scenario A: Risk-Reward Ratio 1:2

Meaning: For every $1 risked, you aim to gain $2.

Win Rate for Break-Even: With a 1:2 risk-reward, you need to win at least 33.33% of your trades to break even (1 win for every 2 losses).

Profit per Winning Trade (as a percentage of risk): If you risk 5%, a 1:2 win means you gain 10% of the risked amount.

Approximate Number of Trades: This is where it gets more complex due to compounding. We’re not looking for a specific number of trades to reach a fixed percentage gain, but rather to double the account.

Let’s approach this from the perspective of overall percentage gain needed. To double your account, you need a 100% return on your initial $10,000.

Using the concept of “R-multiples”: If your risk is 1R, and your reward is 2R, then each winning trade nets you 2R. To make $10,000 profit from an initial $10,000, you need to gain $10,000. If 1R = 5% of $10,000 = $500, then 2R = $1,000. So, each winning trade (at 1:2) is approximately $1,000. You would need approximately $10,000 / $1,000 = 10 winning trades if each trade started from the initial balance.

However, since the risk amount changes with the account balance (5% of a growing balance), the profit per trade will also increase. This means you might need fewer winning trades than a simple division suggests.

Scenario B: Risk-Reward Ratio 1:3

Meaning: For every $1 risked, you aim to gain $3.

Win Rate for Break-Even: With a 1:3 risk-reward, you need to win at least 25% of your trades to break even (1 win for every 3 losses).

Profit per Winning Trade (as a percentage of risk): If you risk 5%, a 1:3 win means you gain 15% of the risked amount.

Approximate Number of Trades: If 1R = $500, then 3R = $1,500. You would need approximately $10,000 / $1,500 = 6.67 winning trades if each trade started from the initial balance. Again, with compounding, this number could be slightly lower.

Important Considerations and Nuances:

Compounding: As your account grows, 5% of the new balance is a larger dollar amount. This means each subsequent winning trade (if you maintain the 5% risk) will yield a higher dollar profit, accelerating your progress towards the $20,000 goal.

Losses: The above calculations assume only winning trades or a perfect sequence of wins. In reality, you will experience losses.

Win Rate: Your actual win rate is crucial. A higher win rate will get you to your goal faster.

Drawdowns: Even with a profitable system, you will experience drawdowns (periods where your account balance decreases). Managing these is key to reaching your target.

Trade Frequency: How often you trade will affect the time it takes to reach your goal.

Trading Strategy: The effectiveness of your trading strategy in identifying high-probability trades with your desired risk-reward ratio is paramount.

In summary, to double your account from $10,000 to $20,000 with a 5% risk per trade:

With a 1:2 Risk-Reward Ratio: You would likely need around 6 to 10 net winning trades, depending on the sequence of wins and losses and the effect of compounding.

With a 1:3 Risk-Reward Ratio: You would likely need around 4 to 7 net winning trades, again, depending on the sequence and compounding.

These are estimations. The actual number of trades will depend on your specific trading performance, including your win rate and the sequence of your wins and losses. It’s more about the accumulated R-multiples (R=Risk per tradeProfit) needed to reach the target profit, rather than a fixed number of trades in isolation.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

💰⚖️ What is Risk/Reward Ratio?

The Risk/Reward Ratio (R:R) compares how much you’re risking on a trade versus how much you aim to gain.

Formula:

🧮 Risk/Reward = (Potential Loss) / (Potential Profit)

💰📌 Example:

You enter a trade with:

Entry Price: 1.1000

Stop Loss: 1.0950 → 50 pip risk

Take Profit: 1.1100 → 100 pip reward

Risk/Reward = 50 / 100 = 1:2

You’re risking 1 to make 2.

💰✅ Why It Matters:

🔐 Protects your capital – you don’t need to win all trades to be profitable.

🧠 Brings discipline – forces you to plan every trade.

📈 Key for long-term success – even with 40% win rate, you can be profitable if your R:R is good.

💰🎯 Common R:R Targets:

1:2 (Risk 1 to make 2) – good minimum standard.

1:3 or more – preferred by many swing traders.

1:1 – breakeven level, not ideal unless win rate is high.

💰🧠 Pro Tip:

Always match your Stop Loss and Take Profit to:

Market structure (support/resistance)

Volatility (use ATR)

Strategy logic (e.g., trend following, pullbacks, etc.)

6. Risk/Reward

You’ve heard it whispered in the hallowed halls of finance, scrawled on bathroom stalls in trading firms, and probably even mumbled by your grandma if she’s secretly a forex guru: “The trend is your friend.”

And let me tell you, it’s not just a catchy little rhyme your mentor uses to sound smart. It’s the absolute, unadulterated truth. Because trying to trade against the trend is like trying to convince a toddler that broccoli is delicious: you’re going to lose, you’re going to get messy, and you’re going to end up crying into your pint of ice cream.

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

The Golden Rule: Have a Plan Before You Enter!

No matter which method you choose, the most crucial aspect of taking profit is to define your take-profit point before you enter the trade. This prevents emotional decisions and ensures you’re trading with discipline. It’s part of your “best setup” plan!

6. Risk/Reward (rr)

Starting Account Balance: $10,000 Target Account Balance: $20,000 Risk per Trade: 5% of the current account balance

Scenario 1: Risk-Reward Ratio 1:2

In this scenario, for every $1 you risk, you aim to gain $2.

Trade 1:

Account Balance: $10,000

Risk (5%): $500

Potential Reward (1:2): $1,000

Result: Win

New Account Balance: $10,000 + $1,000 = $11,000

Trade 2:

Account Balance: $11,000

Risk (5%): $550

Potential Reward (1:2): $1,100

Result: Win

New Account Balance: $11,000 + $1,100 = $12,100

Trade 3:

Account Balance: $12,100

Risk (5%): $605

Potential Reward (1:2): $1,210

Result: Win

New Account Balance: $12,100 + $1,210 = $13,310

Trade 4:

Account Balance: $13,310

Risk (5%): $665.50

Potential Reward (1:2): $1,331

Result: Win

New Account Balance: $13,310 + $1,331 = $14,641

Trade 5:

Account Balance: $14,641

Risk (5%): $732.05

Potential Reward (1:2): $1,464.10

Result: Win

New Account Balance: $14,641 + $1,464.10 = $16,105.10

Trade 6:

Account Balance: $16,105.10

Risk (5%): $805.26

Potential Reward (1:2): $1,610.52

Result: Win

New Account Balance: $16,105.10 + $1,610.52 = $17,715.62

Trade 7:

Account Balance: $17,715.62

Risk (5%): $885.78

Potential Reward (1:2): $1,771.56

Result: Win

New Account Balance: $17,715.62 + $1,771.56 = $19,487.18

Trade 8:

Account Balance: $19,487.18

Risk (5%): $974.36

Potential Reward (1:2): $1,948.72

Result: Win (You only need a portion of this win to hit $20,000)

New Account Balance: $19,487.18 + $1,948.72 = $21,435.90 (You’ve now exceeded $20,000)

In this idealized example of 8 consecutive wins with a 1:2 risk-reward, you successfully doubled your account. Notice how the dollar amount of profit per trade increased as the account grew, demonstrating the power of compounding.

Scenario 2: Risk-Reward Ratio 1:3

In this scenario, for every $1 you risk, you aim to gain $3.

Trade 1:

Account Balance: $10,000

Risk (5%): $500

Potential Reward (1:3): $1,500

Result: Win

New Account Balance: $10,000 + $1,500 = $11,500

Trade 2:

Account Balance: $11,500

Risk (5%): $575

Potential Reward (1:3): $1,725

Result: Win

New Account Balance: $11,500 + $1,725 = $13,225

Trade 3:

Account Balance: $13,225

Risk (5%): $661.25

Potential Reward (1:3): $1,983.75

Result: Win

New Account Balance: $13,225 + $1,983.75 = $15,208.75

Trade 4:

Account Balance: $15,208.75

Risk (5%): $760.44

Potential Reward (1:3): $2,281.32

Result: Win

New Account Balance: $15,208.75 + $2,281.32 = $17,490.07

Trade 5:

Account Balance: $17,490.07

Risk (5%): $874.50

Potential Reward (1:3): $2,623.51

Result: Win (You only need a portion of this win to hit $20,000)

New Account Balance: $17,490.07 + $2,623.51 = $20,113.58 (You’ve now exceeded $20,000)

In this idealized example of 5 consecutive wins with a 1:3 risk-reward, you successfully doubled your account. As expected, a higher risk-reward ratio requires fewer winning trades to reach the same profit target, assuming a perfect win streak.

Key Takeaways from the Example:

Compounding is Powerful: As your account grows, 5% of that larger balance becomes a bigger dollar amount, meaning your profits per trade also increase, accelerating your path to the goal.

Risk-Reward Matters: A higher risk-reward ratio (like 1:3 vs. 1:2) means each winning trade contributes more significantly to your account growth, thus requiring fewer total winning trades to reach your target.

Idealized Scenario: These examples assume perfect winning streaks. In reality, you will have losing trades. Your actual path will involve a mix of wins and losses, and your win rate will determine how many trades it actually takes to achieve your goal.

Managing Losses: If you have a losing trade, your account balance will decrease, and your next 5% risk will be based on that smaller balance. This means you’ll need to make up for the loss before continuing to grow towards your target.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

Alright, let’s talk about turning that modest ten grand into a twenty grand empire, all while risking a mere 5% per trade. Think of it like a financial tightrope walk, but instead of falling, you just… don’t quite hit your target as fast. And with a 1:2 or 1:3 risk-reward ratio, we’re basically saying, “Hey, I’m aiming for big wins, or I’m barely stubbing my toe!”

The Grand Plan: Doubling Your Dough

You’ve got $10,000. Your mission, should you choose to accept it (and you have, by asking!), is to hit $20,000. This isn’t just about making money; it’s about making money while carefully risking just a tiny slice of your pie each time. We’re talking about a 5% risk per trade. That’s like saying, “I’m confident enough to put a small wager down, but not so confident I’m betting my lucky socks.”

Let’s break down how many winning acts it’ll take with our two different “payday” ratios:

Act 1: The “Twofer” – 1:2 Risk-Reward Ratio

Imagine you’re playing a game where if you win, you get double your bet back. Sounds pretty sweet, right? Here, for every dollar you’re willing to lose, you’re hoping to bag two.

With a 5% risk, that means if your account is $10,000, you’re risking $500. A winning trade at 1:2 would net you a cool $1,000. “Easy peasy!” you might think. But here’s where compounding gets a bit like that friend who constantly reminds you how much you’ve grown:

Trade 1 (Win!): Start at $10,000. Risk $500, win $1,000. Account is now $11,000. “Look at me, I’m practically a hedge fund!”

Trade 2 (Another Win!): Now you’re risking 5% of $11,000, which is $550. Win $1,100. Account is $12,100. “The money tree is blossoming!”

…and so on. Each win makes your next risk (and potential reward) a little bit bigger.

If you hit nothing but winners (a trader’s fantasy, often starring unicorns and pots of gold), you’d probably need around 7 to 8 straight winning trades to get from $10,000 to over $20,000. Think of it as hitting the bullseye repeatedly, blindfolded, while riding a unicycle. Highly aspirational!

Act 2: The “Three-Legged Race” – 1:3 Risk-Reward Ratio

Now, for the really ambitious folks! This ratio says, “I’m going for the gold, or at least triple my risk!” For every dollar you’re willing to wave goodbye to, you’re aiming for three back. This is where your inner high-roller comes out, but responsibly.

Again, with that 5% risk: if you’re at $10,000, you’re still risking $500. But a winning trade at 1:3? That’s a juicy $1,500!

Trade 1 (Boom!): Start at $10,000. Risk $500, win $1,500. Account is now $11,500. “Are these dollar bills or butterflies? Because my stomach is fluttering!”

Trade 2 (Ka-Ching!): Account is $11,500. Risk $575, win $1,725. Account is $13,225. “My portfolio is getting a six-pack!”

…you get the idea. The dollar amounts of your wins are much juicier here.

In this super-duper-ideal scenario of pure winning streaks, you’re looking at roughly 4 to 6 consecutive winning trades to push past the $20,000 mark. That’s like playing darts and hitting the triple 20, over and over. Possible? Sure. Easy? Not so much.

The Not-So-Funny Fine Print (But Important!)

Remember, these examples are like a Hollywood movie script – everything goes perfectly. In the real world, you’ll have losing trades. You’ll hit those 5% risk limits and watch a chunk of your account disappear. That’s totally normal! It just means your journey to $20,000 will be more like a scenic detour with a few unexpected potholes, rather than a straight shot down the highway.

The key is consistency, discipline, and having a trading strategy that actually produces more winners than losers (or at least, bigger winners than losers). Good luck, and may your trades be ever in your favor! Or at least, mostly in your favor.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

💰⚖️ What is Risk/Reward Ratio?

The Risk/Reward Ratio (R:R) compares how much you’re risking on a trade versus how much you aim to gain.

Formula:

🧮 Risk/Reward = (Potential Loss) / (Potential Profit)

💰📌 Example:

You enter a trade with:

Entry Price: 1.1000

Stop Loss: 1.0950 → 50 pip risk

Take Profit: 1.1100 → 100 pip reward

Risk/Reward = 50 / 100 = 1:2

You’re risking 1 to make 2.

💰✅ Why It Matters:

🔐 Protects your capital – you don’t need to win all trades to be profitable.

🧠 Brings discipline – forces you to plan every trade.

📈 Key for long-term success – even with 40% win rate, you can be profitable if your R:R is good.

💰🎯 Common R:R Targets:

1:2 (Risk 1 to make 2) – good minimum standard.

1:3 or more – preferred by many swing traders.

1:1 – breakeven level, not ideal unless win rate is high.

💰🧠 Pro Tip:

Always match your Stop Loss and Take Profit to:

Market structure (support/resistance)

Volatility (use ATR)

Strategy logic (e.g., trend following, pullbacks, etc.)

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.