False Breaks

Alright, my audacious chart navigators! We’ve talked about the shy Inside Bar, and its slightly more mischievous cousin, the Hikkake. Now, imagine if those two decided to team up and play the ultimate market prank, a trick so sneaky, so utterly deceptive, it makes other traders stomp their feet and yell, “¡No es posible!”

Get ready for the master illusionist, the grand deceiver, the incredibly powerful, and often hilarious, False Break!

The False Break: The Market’s “Psyche! You Fell for It!” Moment!

Picture this: You’re standing outside the Sagrada Familia (it’s Monday, July 7th, 2025, and you’re feeling cultured!). The gate is firmly shut. This gate represents a key resistance level – a price point the market just can’t seem to get past. Traders have tried to push through it before, but the price just bounces off.

Suddenly, a group of really enthusiastic tourists (the “Bulls”) push! The gate creaks! It wobbles! It even appears to open just a crack! A few excited onlookers (the “Early Breakout Buyers”) gasp and surge forward, thinking they’re getting in before anyone else. They run right for that tiny gap!

But then, WHAM! The gate slams shut! It was never truly open! It just gave a little deceptive wiggle. Those “Early Breakout Buyers” are now smushed against the gate, looking utterly bewildered, their dreams of immediate entry shattered. They’re TRAPPED!

That, my friends, is a False Break!

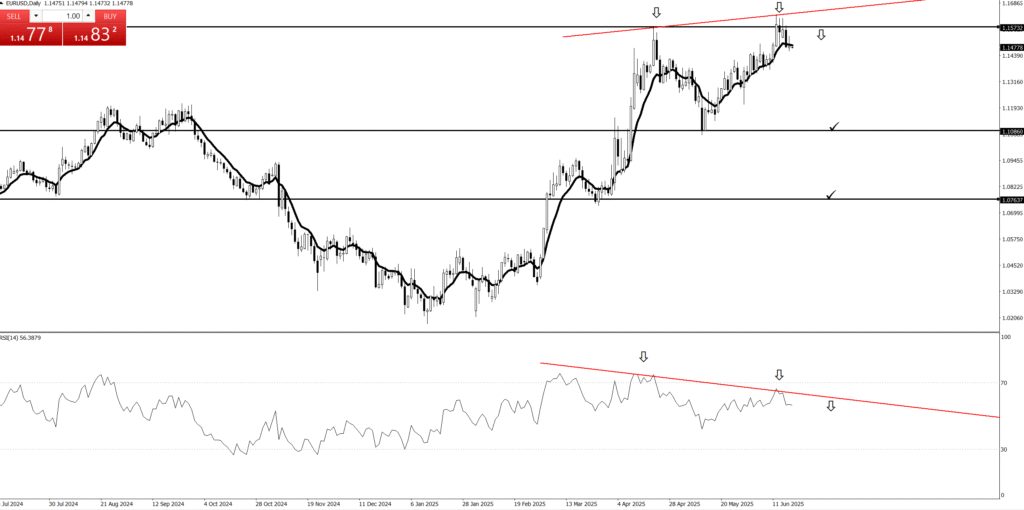

It’s when price makes a dramatic attempt to push beyond a recognized level of support or resistance. It looks convincing! It might even stay outside for a bar or two.

But then it completely fails to hold that new territory. It curls its tail between its legs and slips right back inside the previous range, like a mischievous cat who briefly darted out the door but then thought better of it.

Why This Market Prank Is Your Golden Opportunity!

This isn’t just the market being rude; it’s providing a phenomenal signal, powered by the misery of others!

The “Trapped Tourist” Phenomenon: When price breaks out, a whole bunch of eager beavers jump in, thinking they’re catching the next big wave. When it turns out to be a false break, they’re instantly stuck in a losing position. What do trapped traders do? They panic and try to get out! If they bought the failed breakout, they sell to exit. If they sold the failed breakdown, they buy to exit.

Fueling the Opposite Move: This frantic exit activity by the trapped traders creates a powerful surge of orders in the opposite direction of the failed break! Their selling fuels your short entry; their buying fuels your long entry. It’s like the gate slamming shut pushes everyone backwards with incredible force!

Revealing True Intent: A false break powerfully confirms the strength of the original resistance or support level. The market tried to go one way, was decisively rejected, and that rejection often signals a strong move in the other direction. It’s the market saying, “Nope! Not going that way! I lied! I’m going THIS way now, with a vengeance!”

So, next time you see a price try to burst through a level like a bull in a china shop, only to retreat sheepishly back inside, don’t despair! That’s not a frustrating failure; that’s the market playing a hilarious prank on the impatient, creating a perfect springboard for your next high-probability trade. You just sit back, enjoy your espresso, and wait for those trapped tourists to fuel your ride to profit!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

-

“Enter the trade — then sit on your hands like a monk!”

-

“We don’t click and panic. We click and chill.”

-

“Traders who wait, get paid. Traders who fidget… donate!”

-

“We enter the trade, then do absolutely nothing like pros.”

-

“Let the market work. You’re not its boss.”

9. The Power of False Break

Alright, my audacious chart navigators! We’ve talked about the shy Inside Bar, and its slightly more mischievous cousin, the Hikkake. Now, imagine if those two decided to team up and play the ultimate market prank, a trick so sneaky, so utterly deceptive, it makes other traders stomp their feet and yell, “¡No es posible!”

Get ready for the master illusionist, the grand deceiver, the incredibly powerful, and often hilarious, False Break!

The False Break: The Market’s “Psyche! You Fell for It!” Moment!

Picture this: You’re standing outside the Sagrada Familia (it’s Monday, July 7th, 2025, and you’re feeling cultured!). The gate is firmly shut. This gate represents a key resistance level – a price point the market just can’t seem to get past. Traders have tried to push through it before, but the price just bounces off.

Suddenly, a group of really enthusiastic tourists (the “Bulls”) push! The gate creaks! It wobbles! It even appears to open just a crack! A few excited onlookers (the “Early Breakout Buyers”) gasp and surge forward, thinking they’re getting in before anyone else. They run right for that tiny gap!

But then, WHAM! The gate slams shut! It was never truly open! It just gave a little deceptive wiggle. Those “Early Breakout Buyers” are now smushed against the gate, looking utterly bewildered, their dreams of immediate entry shattered. They’re TRAPPED!

That, my friends, is a False Break!

It’s when price makes a dramatic attempt to push beyond a recognized level of support or resistance. It looks convincing! It might even stay outside for a bar or two.

But then it completely fails to hold that new territory. It curls its tail between its legs and slips right back inside the previous range, like a mischievous cat who briefly darted out the door but then thought better of it.

Why This Market Prank Is Your Golden Opportunity!

This isn’t just the market being rude; it’s providing a phenomenal signal, powered by the misery of others!

The “Trapped Tourist” Phenomenon: When price breaks out, a whole bunch of eager beavers jump in, thinking they’re catching the next big wave. When it turns out to be a false break, they’re instantly stuck in a losing position. What do trapped traders do? They panic and try to get out! If they bought the failed breakout, they sell to exit. If they sold the failed breakdown, they buy to exit.

Fueling the Opposite Move: This frantic exit activity by the trapped traders creates a powerful surge of orders in the opposite direction of the failed break! Their selling fuels your short entry; their buying fuels your long entry. It’s like the gate slamming shut pushes everyone backwards with incredible force!

Revealing True Intent: A false break powerfully confirms the strength of the original resistance or support level. The market tried to go one way, was decisively rejected, and that rejection often signals a strong move in the other direction. It’s the market saying, “Nope! Not going that way! I lied! I’m going THIS way now, with a vengeance!”

So, next time you see a price try to burst through a level like a bull in a china shop, only to retreat sheepishly back inside, don’t despair! That’s not a frustrating failure; that’s the market playing a hilarious prank on the impatient, creating a perfect springboard for your next high-probability trade. You just sit back, enjoy your espresso, and wait for those trapped tourists to fuel your ride to profit!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”