The Power of Filtering The Markets

What is Price Action?!

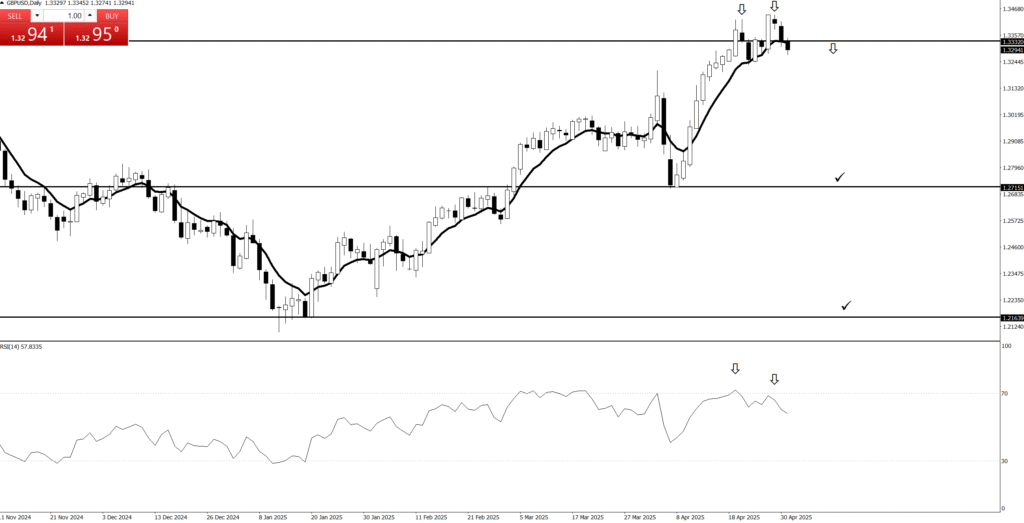

Filtering Markets: Ruthlessly Rejecting the Chaos for Cash!

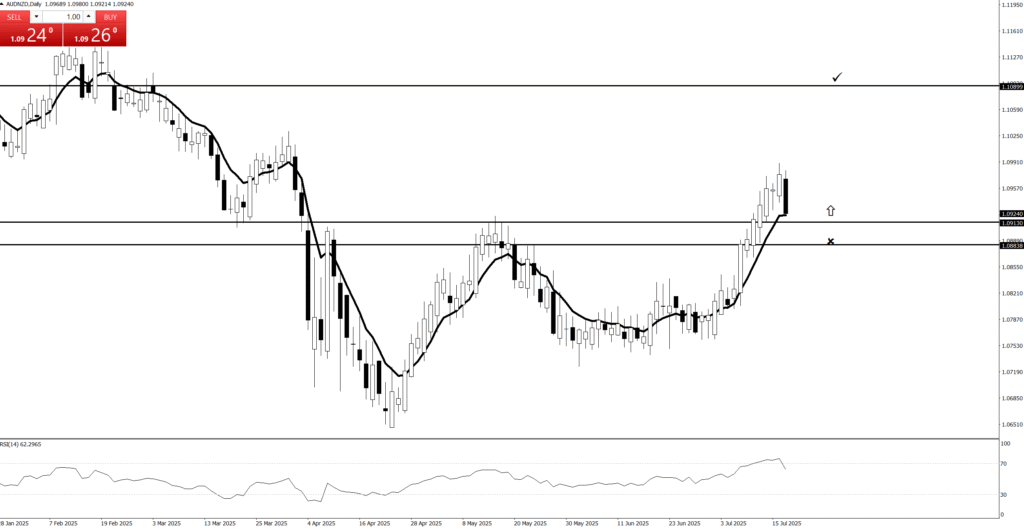

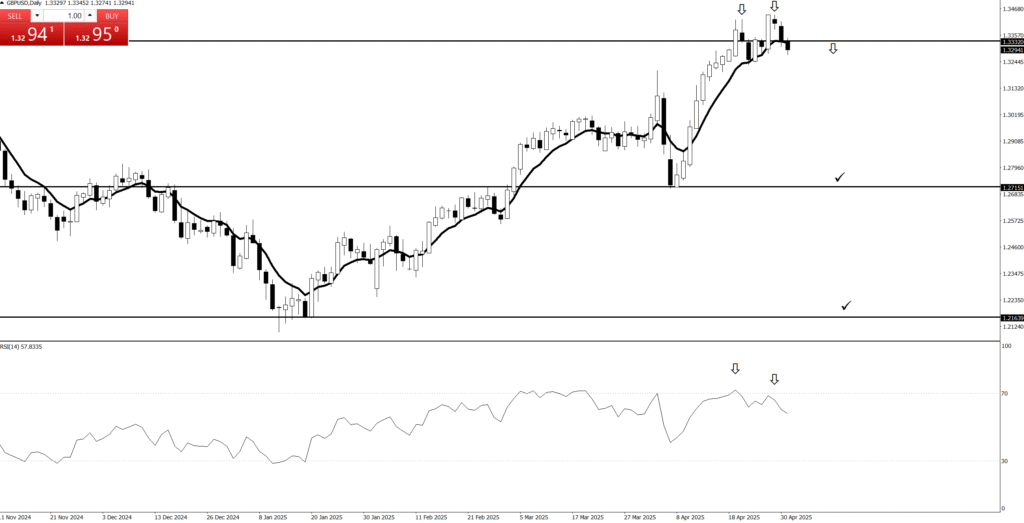

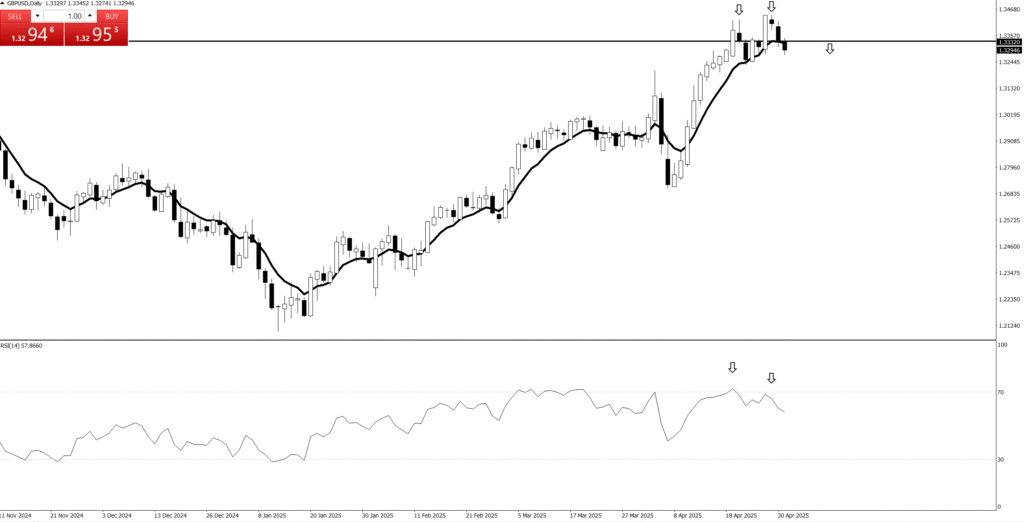

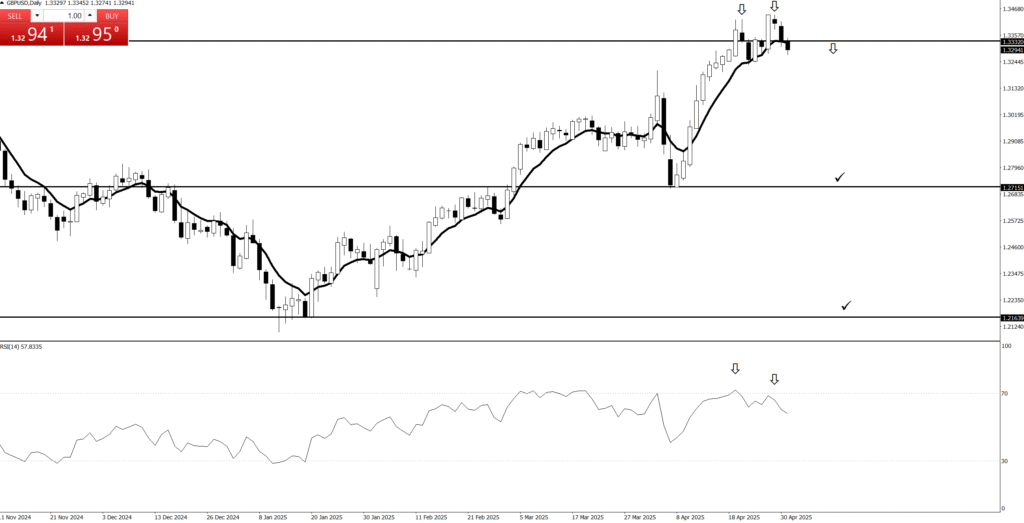

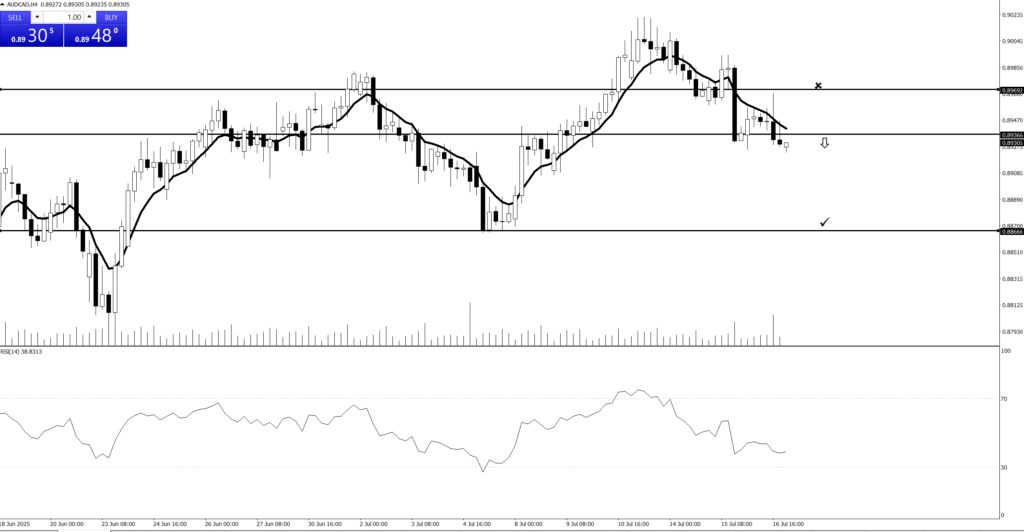

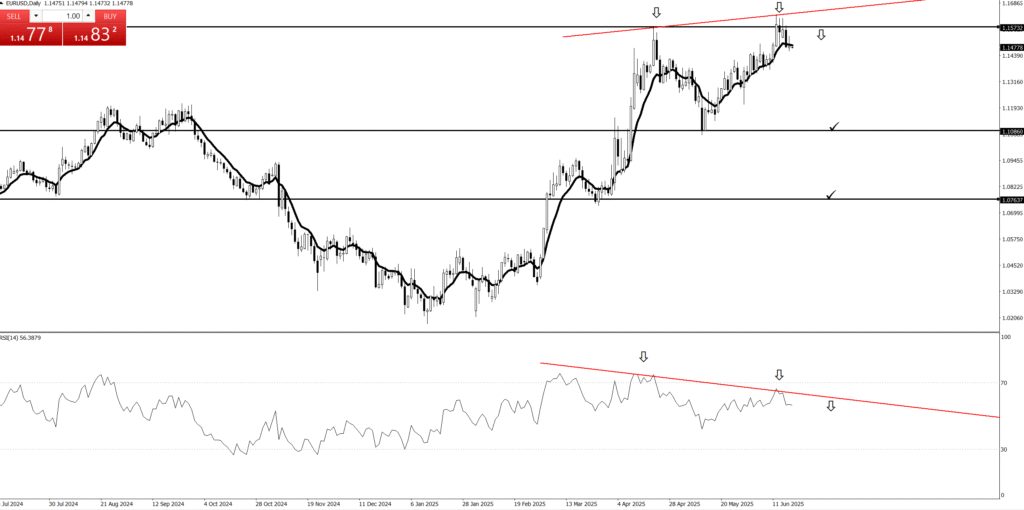

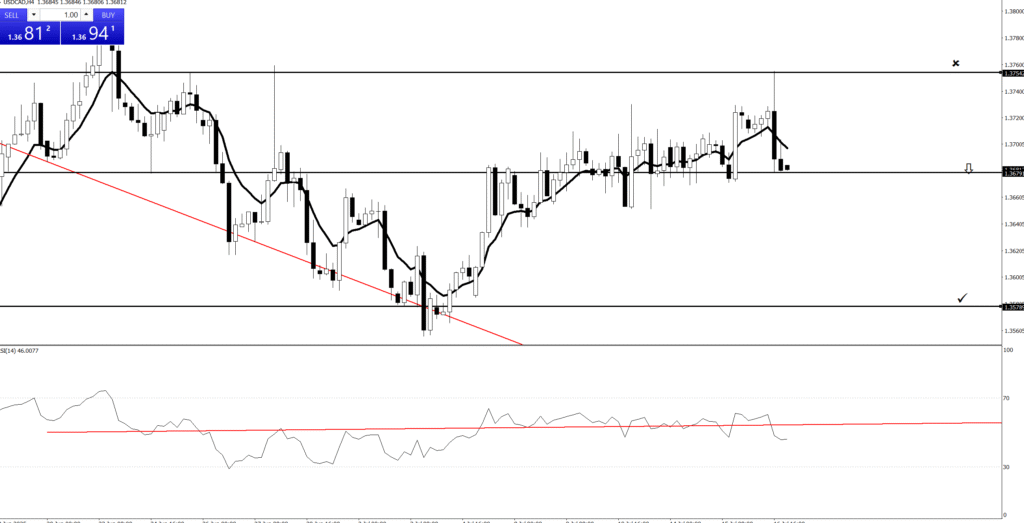

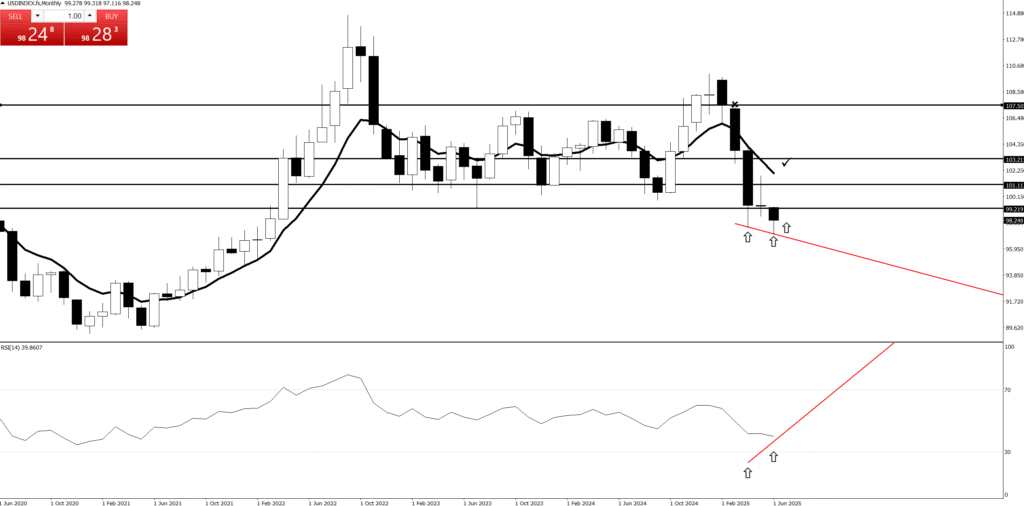

If your trading screen looks like a messy, cluttered thrift shop, you’re doing it wrong! The biggest time-saver and profit-booster for professional traders is Filtering the Markets—the ruthless, systematic process of saying “No” to the ugly, the choppy, and the confusing.

Your job isn’t to trade everything; it’s to trade the best setups. And the only way to find the A-grade opportunities is to instantly discard the 90% of junk that’s destined to waste your time and destroy your capital.

The Power of the Selective Eye

Filtering is your ultimate quality control system. It turns a vast ocean of financial assets into a curated list of high-probability candidates.

Quality Control Over Quantity: Why spend hours deciphering a chart that looks like a drunken scribble? Filtering forces you to only look at markets exhibiting clear, undeniable characteristics: a clean trend, obvious textbook patterns (like Pin Bars or Engulfing Bars), and undisputed Key Levels. This instant quality boost reduces frustration and ensures your entries are based on verifiable strength, not ambiguous hope.

Energy Preservation (Focus is Your Friend): Your attention is a finite resource.1 By filtering out the messy, range-bound, or low-liquidity assets, you concentrate your limited mental energy on the 10% of charts that are actually signaling an imminent high-probability move. This laser-like focus translates directly into better execution, fewer impulsive mistakes, and overall superior trading performance.

The Trend-Friend Filter: The most basic filter is the Trend. If a stock or currency isn’t clearly trending up or down, it’s out! No room for ambiguity. You ruthlessly select only those assets where the path of least resistance—and highest profitability—is already paved. This ensures every trade you consider already has the market’s dominant momentum at its back.

Risk Reduction via Clarity: Messy markets lead to ambiguous risk. Clear, filtered charts provide clean support and resistance zones, which allows you to place your Stop-Loss and Take-Profit orders with precision. Trading clarity is trading safety.

Stop accepting financial mediocrity! Filter your markets like a ruthless bouncer at a VIP club. Only the cleanest, most exciting, highest-probability setups get through your velvet rope. Reject the chaos, and embrace the clean profitability of the selected few!

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of PriceAction

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of PriceAction

💰What in the Kraken’s Name is Price Action?

Imagine you’re on a bustling market street, and everyone’s shouting their prices for pineapples. You don’t need a fancy economist with a spreadsheet to tell you if pineapples are getting more popular or less. You just watch what people are doing: are they eagerly snatching them up at higher prices, or are the vendors struggling to give them away?

Price action is exactly that, but for stocks and other assets! It’s simply reading the story the market is telling you directly through the price itself. No need for complicated, lagging indicators that are always a step behind, like a tired parrot squawking old news. You’re looking at the raw, unfiltered moves on your chart – the ultimate truth of supply and demand, fear and greed.

💰Why is it the Golden Compass of Trading?

Forget trying to navigate with a half-broken sextant! Price action is your North Star, your most reliable guide:

It’s the OG (Original Gangster) Signal: Every indicator you see on a chart is derived from price. Price action is the price. It’s the source code, the main event, the real deal. When you’re looking at price action, you’re getting the news straight from the horse’s mouth, not through a dozen gossipy villagers.

No Lag, Just Action! Imagine trying to surf a wave by looking at where the last wave broke. You’d be wiped out! Many indicators are “lagging,” meaning they tell you what already happened. Price action is live, in the moment, allowing you to catch the wave as it forms. This means quicker decisions, tighter entries, and less time being swept away by unexpected currents.

Simpler Than a Coconut Cocktail: You don’t need a supercomputer or a massive collection of complex tools. A clean chart, your trusty eyeballs, and a basic understanding of candlestick patterns are often all you need. This simplicity reduces overwhelm and helps you make clear, decisive calls without second-guessing.

The Trend is Your Best Mate! Remember that wise old saying, “the trend is your friend”? Price action is the ultimate wingman for spotting that friend! It’s super easy to see if the market is clearly sailing upwards (making higher highs and higher lows), diving downwards (lower lows and lower highs), or just bobbing around in the doldrums. If the trend is clear, you know exactly which direction to point your ship. If it’s messy, price action tells you to stay ashore and enjoy a pineapple smoothie!

💰How to Read the Market’s Secret Diary (The Candlesticks!)

Each little candle on your chart is like a tiny scroll, telling you a mini-story of what happened during that time period (a minute, an hour, a day).

The Body: This is the fat part of the candle. A long green (or white) body means buyers were in control, pushing the price way up. A long red (or black) body means sellers dominated, sending the price tumbling. Think of it as a tug-of-war: who won that round?

The Wicks (or Shadows): These thin lines sticking out from the top and bottom are like antennae, showing you how far the price tried to go but got rejected. A long upper wick means buyers tried to push it high but sellers dragged it back down. A long lower wick means sellers tried to push it low but buyers bravely picked it up. These wicks often whisper secrets about exhaustion or reversals!

By watching how these candles form patterns – like a “Hammer” hitting rock bottom and bouncing back up (a sign of buyers coming to the rescue!), or an “Engulfing” pattern where one big candle swallows the previous one (a dramatic shift in power!) – you start to predict where the currents might take you next.

So, next time you’re charting your course, clear your deck, breathe in that salty air, and let the price action speak to you. It’s the most direct, most powerful, and frankly, the most fun way to understand what’s truly happening in the market and chart your way to potential success!

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

💰Quotes:

“Price action: the art of staring at candles until they confess.”

“Indicators are like rumors; price action is the witness.”

“Trading without price action is like driving blindfolded.”

“Sometimes the best trade is to just let the candle close.”

“If you can’t find the trend, step back and squint—price action is waving at you.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Add Your Heading Text Here

The Power of PriceAction

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

4. Stop Loss

Let’s talk about the unsung hero of our trading strategy, the silent guardian, the watchful protector: the stop-loss.

Our Love-Hate Relationship with the Stop-Loss

Here at [Your Company/Team Name, or “our trading desk”], we’ve got a profound, albeit slightly complicated, relationship with the stop-loss. Think of it like that super-responsible friend who always makes sure you don’t do anything too stupid on a wild night out. You might grumble when they pull you away from that questionable decision, but you’re eternally grateful the next morning when you’re not missing an eyebrow.

That’s our stop-loss. It’s the designated driver for our trades, preventing us from driving our accounts straight into a ditch at 100 miles an hour while screaming, “It’s just a temporary dip! It’ll come back!” (Spoiler alert: it usually doesn’t, not without taking your entire portfolio with it.)

Why We Embrace the “Slightly Painful Nudge”

Some traders, bless their optimistic hearts, view a stop-loss as a personal insult, a sign of weakness, or perhaps a tiny financial guillotine. They’d rather ride a losing trade down to zero, hoping for a miraculous turnaround, like waiting for a flat tire to reinflate itself through sheer willpower.

Not us. We’ve learned that a small, controlled loss is like a tiny paper cut compared to the gaping financial wound of a blown-up account. When our stop-loss gets hit, it’s not a defeat; it’s the market gently (or sometimes firmly) nudging us with a sticky note that says, “Hey, genius, your idea was wrong. Time to exit and rethink your life choices… or at least your next trade.”

The Unspoken Benefits of Our Stop-Loss Obsession

Sleep: Believe it or not, knowing your downside is capped lets you actually close your eyes at night without visions of red numbers dancing in your head. It’s truly revolutionary.

Sanity: Less emotional attachment to a dying trade means fewer arguments with your spouse about why you’re glued to the screen muttering about “support levels.”

Capital Preservation: This is fancy talk for “not losing all your money.” Our stop-loss is like a tiny, vigilant bodyguard for our trading capital, always ready to step in and say, “Alright, that’s enough fun for today.”

The Freedom to Be Wrong (Often!): Since we accept small losses, we’re not afraid to try new things. We know that if a trade goes sideways, our trusty stop-loss will catch us before we fall into the abyss of regret.

So, yes, we use stop-losses. Not because we’re pessimists, but because we’re realists who prefer controlled exits over catastrophic explosions. And honestly, it leaves us with more money for coffee and other vital trading supplies

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

Price Action: From Chaos to Clarity

💰What in the Kraken’s Name is Price Action?

Imagine you’re on a bustling market street, and everyone’s shouting their prices for pineapples. You don’t need a fancy economist with a spreadsheet to tell you if pineapples are getting more popular or less. You just watch what people are doing: are they eagerly snatching them up at higher prices, or are the vendors struggling to give them away?

Price action is exactly that, but for stocks and other assets! It’s simply reading the story the market is telling you directly through the price itself. No need for complicated, lagging indicators that are always a step behind, like a tired parrot squawking old news. You’re looking at the raw, unfiltered moves on your chart – the ultimate truth of supply and demand, fear and greed.

💰Why is it the Golden Compass of Trading?

Forget trying to navigate with a half-broken sextant! Price action is your North Star, your most reliable guide:

It’s the OG (Original Gangster) Signal: Every indicator you see on a chart is derived from price. Price action is the price. It’s the source code, the main event, the real deal. When you’re looking at price action, you’re getting the news straight from the horse’s mouth, not through a dozen gossipy villagers.

No Lag, Just Action! Imagine trying to surf a wave by looking at where the last wave broke. You’d be wiped out! Many indicators are “lagging,” meaning they tell you what already happened. Price action is live, in the moment, allowing you to catch the wave as it forms. This means quicker decisions, tighter entries, and less time being swept away by unexpected currents.

Simpler Than a Coconut Cocktail: You don’t need a supercomputer or a massive collection of complex tools. A clean chart, your trusty eyeballs, and a basic understanding of candlestick patterns are often all you need. This simplicity reduces overwhelm and helps you make clear, decisive calls without second-guessing.

The Trend is Your Best Mate! Remember that wise old saying, “the trend is your friend”? Price action is the ultimate wingman for spotting that friend! It’s super easy to see if the market is clearly sailing upwards (making higher highs and higher lows), diving downwards (lower lows and lower highs), or just bobbing around in the doldrums. If the trend is clear, you know exactly which direction to point your ship. If it’s messy, price action tells you to stay ashore and enjoy a pineapple smoothie!

💰How to Read the Market’s Secret Diary (The Candlesticks!)

Each little candle on your chart is like a tiny scroll, telling you a mini-story of what happened during that time period (a minute, an hour, a day).

The Body: This is the fat part of the candle. A long green (or white) body means buyers were in control, pushing the price way up. A long red (or black) body means sellers dominated, sending the price tumbling. Think of it as a tug-of-war: who won that round?

The Wicks (or Shadows): These thin lines sticking out from the top and bottom are like antennae, showing you how far the price tried to go but got rejected. A long upper wick means buyers tried to push it high but sellers dragged it back down. A long lower wick means sellers tried to push it low but buyers bravely picked it up. These wicks often whisper secrets about exhaustion or reversals!

By watching how these candles form patterns – like a “Hammer” hitting rock bottom and bouncing back up (a sign of buyers coming to the rescue!), or an “Engulfing” pattern where one big candle swallows the previous one (a dramatic shift in power!) – you start to predict where the currents might take you next.

So, next time you’re charting your course, clear your deck, breathe in that salty air, and let the price action speak to you. It’s the most direct, most powerful, and frankly, the most fun way to understand what’s truly happening in the market and chart your way to potential success!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

The Power of PriceAction

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

The Power of StopLoss

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of PriceAction

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of PriceAction

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of PriceAction

💰What in the Kraken’s Name is Price Action?

Imagine you’re on a bustling market street, and everyone’s shouting their prices for pineapples. You don’t need a fancy economist with a spreadsheet to tell you if pineapples are getting more popular or less. You just watch what people are doing: are they eagerly snatching them up at higher prices, or are the vendors struggling to give them away?

Price action is exactly that, but for stocks and other assets! It’s simply reading the story the market is telling you directly through the price itself. No need for complicated, lagging indicators that are always a step behind, like a tired parrot squawking old news. You’re looking at the raw, unfiltered moves on your chart – the ultimate truth of supply and demand, fear and greed.

💰Why is it the Golden Compass of Trading?

Forget trying to navigate with a half-broken sextant! Price action is your North Star, your most reliable guide:

It’s the OG (Original Gangster) Signal: Every indicator you see on a chart is derived from price. Price action is the price. It’s the source code, the main event, the real deal. When you’re looking at price action, you’re getting the news straight from the horse’s mouth, not through a dozen gossipy villagers.

No Lag, Just Action! Imagine trying to surf a wave by looking at where the last wave broke. You’d be wiped out! Many indicators are “lagging,” meaning they tell you what already happened. Price action is live, in the moment, allowing you to catch the wave as it forms. This means quicker decisions, tighter entries, and less time being swept away by unexpected currents.

Simpler Than a Coconut Cocktail: You don’t need a supercomputer or a massive collection of complex tools. A clean chart, your trusty eyeballs, and a basic understanding of candlestick patterns are often all you need. This simplicity reduces overwhelm and helps you make clear, decisive calls without second-guessing.

The Trend is Your Best Mate! Remember that wise old saying, “the trend is your friend”? Price action is the ultimate wingman for spotting that friend! It’s super easy to see if the market is clearly sailing upwards (making higher highs and higher lows), diving downwards (lower lows and lower highs), or just bobbing around in the doldrums. If the trend is clear, you know exactly which direction to point your ship. If it’s messy, price action tells you to stay ashore and enjoy a pineapple smoothie!

💰How to Read the Market’s Secret Diary (The Candlesticks!)

Each little candle on your chart is like a tiny scroll, telling you a mini-story of what happened during that time period (a minute, an hour, a day).

The Body: This is the fat part of the candle. A long green (or white) body means buyers were in control, pushing the price way up. A long red (or black) body means sellers dominated, sending the price tumbling. Think of it as a tug-of-war: who won that round?

The Wicks (or Shadows): These thin lines sticking out from the top and bottom are like antennae, showing you how far the price tried to go but got rejected. A long upper wick means buyers tried to push it high but sellers dragged it back down. A long lower wick means sellers tried to push it low but buyers bravely picked it up. These wicks often whisper secrets about exhaustion or reversals!

By watching how these candles form patterns – like a “Hammer” hitting rock bottom and bouncing back up (a sign of buyers coming to the rescue!), or an “Engulfing” pattern where one big candle swallows the previous one (a dramatic shift in power!) – you start to predict where the currents might take you next.

So, next time you’re charting your course, clear your deck, breathe in that salty air, and let the price action speak to you. It’s the most direct, most powerful, and frankly, the most fun way to understand what’s truly happening in the market and chart your way to potential success!

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

💰Quotes:

“Price action: the art of staring at candles until they confess.”

“Indicators are like rumors; price action is the witness.”

“Trading without price action is like driving blindfolded.”

“Sometimes the best trade is to just let the candle close.”

“If you can’t find the trend, step back and squint—price action is waving at you.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Add Your Heading Text Here

The Power of PriceAction

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

4. Stop Loss

Let’s talk about the unsung hero of our trading strategy, the silent guardian, the watchful protector: the stop-loss.

Our Love-Hate Relationship with the Stop-Loss

Here at [Your Company/Team Name, or “our trading desk”], we’ve got a profound, albeit slightly complicated, relationship with the stop-loss. Think of it like that super-responsible friend who always makes sure you don’t do anything too stupid on a wild night out. You might grumble when they pull you away from that questionable decision, but you’re eternally grateful the next morning when you’re not missing an eyebrow.

That’s our stop-loss. It’s the designated driver for our trades, preventing us from driving our accounts straight into a ditch at 100 miles an hour while screaming, “It’s just a temporary dip! It’ll come back!” (Spoiler alert: it usually doesn’t, not without taking your entire portfolio with it.)

Why We Embrace the “Slightly Painful Nudge”

Some traders, bless their optimistic hearts, view a stop-loss as a personal insult, a sign of weakness, or perhaps a tiny financial guillotine. They’d rather ride a losing trade down to zero, hoping for a miraculous turnaround, like waiting for a flat tire to reinflate itself through sheer willpower.

Not us. We’ve learned that a small, controlled loss is like a tiny paper cut compared to the gaping financial wound of a blown-up account. When our stop-loss gets hit, it’s not a defeat; it’s the market gently (or sometimes firmly) nudging us with a sticky note that says, “Hey, genius, your idea was wrong. Time to exit and rethink your life choices… or at least your next trade.”

The Unspoken Benefits of Our Stop-Loss Obsession

Sleep: Believe it or not, knowing your downside is capped lets you actually close your eyes at night without visions of red numbers dancing in your head. It’s truly revolutionary.

Sanity: Less emotional attachment to a dying trade means fewer arguments with your spouse about why you’re glued to the screen muttering about “support levels.”

Capital Preservation: This is fancy talk for “not losing all your money.” Our stop-loss is like a tiny, vigilant bodyguard for our trading capital, always ready to step in and say, “Alright, that’s enough fun for today.”

The Freedom to Be Wrong (Often!): Since we accept small losses, we’re not afraid to try new things. We know that if a trade goes sideways, our trusty stop-loss will catch us before we fall into the abyss of regret.

So, yes, we use stop-losses. Not because we’re pessimists, but because we’re realists who prefer controlled exits over catastrophic explosions. And honestly, it leaves us with more money for coffee and other vital trading supplies

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

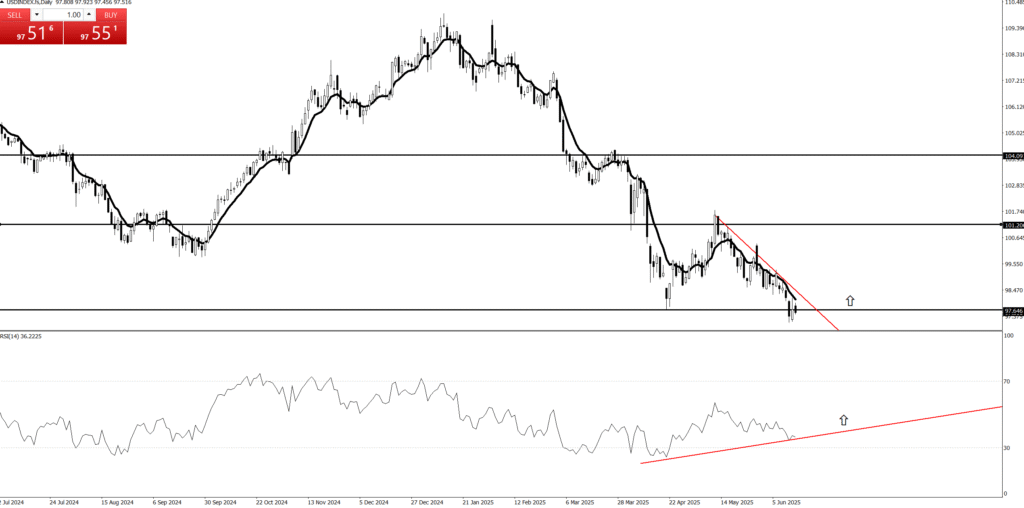

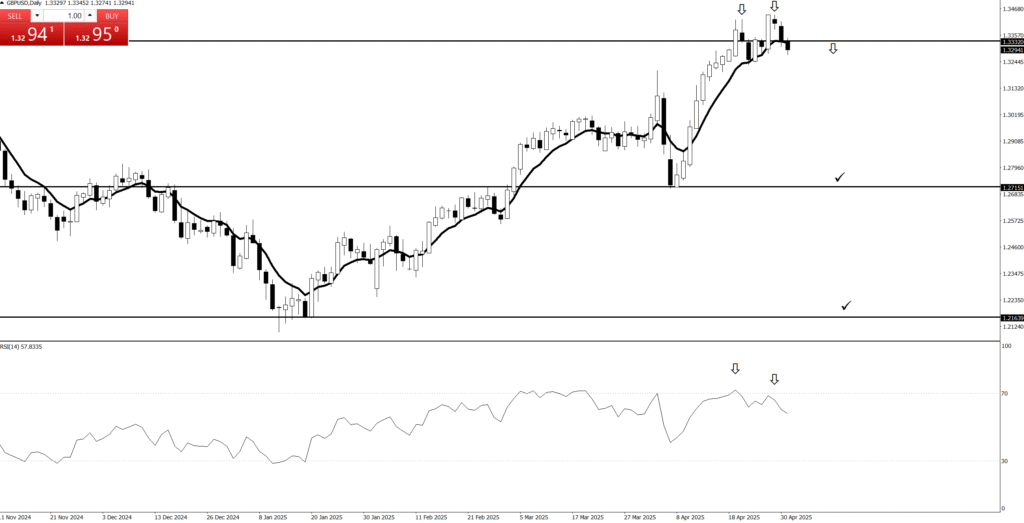

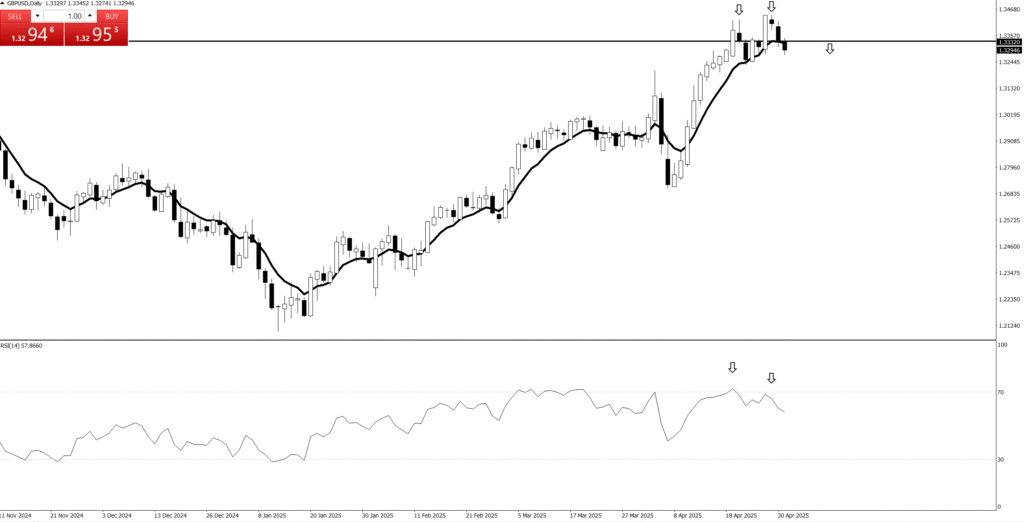

20. Filtering The Markets

Alright, future trading gurus and chart whisperers! So, you’ve decided you don’t just want to trade, you want to trade the best setups. This is like being a talent scout for market opportunities – you’re looking for the next big star, not just any old extra.

Here’s how you sift through the financial dating pool to find “the one”:

Define Your “Dream Date” (Your Best Setup):

First, get specific. Are you into the strong, silent types (clear uptrends)? The bad boys who always reverse course (reversals)? Or the ones who just bounce around a lot but never commit (range-bound)? You can’t find your soulmate if you don’t know what you’re looking for, right? Decide on your “must-haves”: does it need specific chart patterns (like a double bottom, proving it hit rock bottom and is ready to rebound), or a certain “bling” from indicators (RSI saying “I’m not that overbought yet!”)?

Pick Your Dating Apps (Market Selection):

Don’t try to swipe right on every single stock, forex pair, and crypto coin in the universe. You’ll get carpal tunnel and a headache. Stick to your preferred dating pool: Are you a Wall Street stock-jockey, a forex fiend, or perhaps a crypto connoisseur? Narrow it down to a manageable watchlist, like your top 20 potential matches.

Unleash the “Vetting Committee” (Filtering Tools & Methods):

This is where the magic (and a bit of tech wizardry) happens.

Market Scanners: These are your digital matchmakers. You tell them, “Find me stocks that just broke out of a stubborn resistance level with volume that screams ‘I’m serious!'” and they’ll spit out a list. It’s like having a dating app that only shows you people who just got a promotion and are actually looking for commitment.

Multiple Timeframes: This is checking their social media and their LinkedIn. A great setup on a 15-minute chart might be total noise on a daily. Does their short-term flirtation align with their long-term trend? You want consistency, people!

Relative Strength: Who’s outperforming their peers? This is like finding the person who’s actually thriving while everyone else is still complaining about their ex. They’ve got that “it” factor.

News & Catalysts: Sometimes, a market’s ready for a big move, but it needs a little push. An earnings report or a central bank announcement can be that dramatic “movie moment” that kicks off the action. Think of it as the market’s equivalent of a sudden, romantic gesture.

The “Elimination Round” (The Filtering Process):

The Big Picture First: Don’t get lost in the weeds. Is the entire market in a bull stampede or a bear hibernation? It’s tough to go against the tide, so figure out what kind of “weather” you’re fishing in.

Sector Spotlight: Which industries are shining, and which are trying to hide under a rock? Fish where the fish are biting!

Final Scrutiny: Now, and only now, do you look at individual charts from your filtered list. Does this specific setup tick all your boxes? Is the risk-reward ratio actually attractive, or are you just trying to force a square peg into a round hole?

By following this highly scientific (and totally not random) process, you’ll greatly improve your chances of finding those elusive, high-probability setups. Happy hunting, and may your charts always be in your favor!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

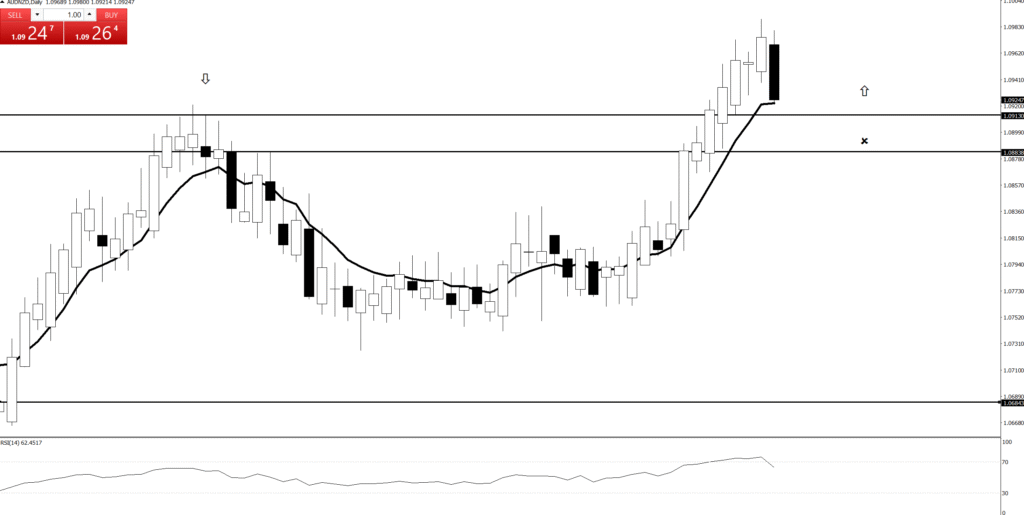

“Filtering The Markets”

Okay, here’s a short intro to key levels, keeping it concise and focused on their core meaning in trading:

In the dynamic world of financial trading, key levels are the unsung heroes of technical analysis. Think of them as crucial lines in the sand on a price chart – specific price points where an asset’s value has historically shown significant reaction. Whether acting as support (a floor preventing further falls) or resistance (a ceiling preventing further rises), these levels are where supply and demand typically battle it out. Understanding them is fundamental, as they offer traders powerful insights into potential price reversals, continuations, and strategic points for entering or exiting trades.