19. The Overall Market Condition

Alright, brave chart-gazer, buckle up! Reading the overall market condition on a chart is like trying to figure out if your teenager is having a good day – there are signs, but you’re never entirely sure until it’s over, and sometimes the mood swings are just… impressive.

Here’s your humorous guide to deciphering the market’s vibe:

Check the “Popular Kids” (Major Market Indices):

Forget your individual stocks for a sec. First, glance at the S&P 500 (the prom king), the Dow (the grumpy grandpa), and the Nasdaq (the tech nerd who just invented a new dance move). Are they all skipping happily uphill (bull market party!), doing the limbo under a bar (bear market limbo!), or just awkwardly shuffling sideways in a tight circle (sideways consolidation – pure indecision)?

Funny Take: If all the popular kids are running in the same direction, you can probably figure out which way the crowd’s going. If they’re all tripping over each other, grab some popcorn!

Size Up the “Party Crowd” (Volume):

Volume is like the noise level at the party. If prices are soaring and the volume is deafening (lots of trading), it means everyone’s really excited and committed to this move.

Funny Take: But if prices are climbing on barely a whisper of volume? That’s like a party where only three people showed up – not very convincing, is it? Conversely, if prices are tanking and the volume is screaming, it means everyone’s stampeding for the exit. Pure panic, or perhaps just a bad DJ.

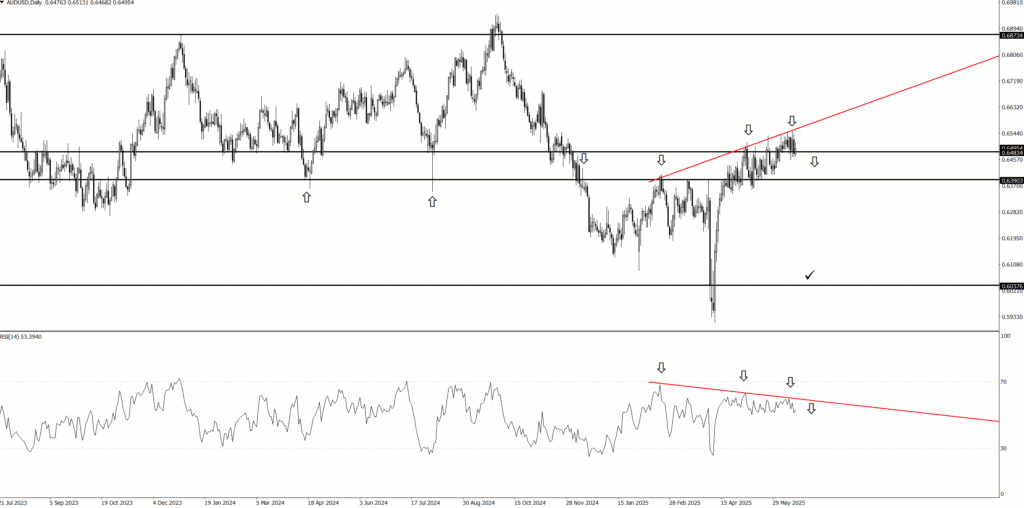

Meet the “Bouncer” & the “Comfy Couch” (Support & Resistance):

These are the invisible lines where the market apparently says, “Thus far, and no further!” Resistance is the bouncer: prices try to get above it, but usually get told, “Nah, not today, chief.” Support is the comfy couch: prices fall to it, and suddenly everyone wants to sit down and relax, stopping the fall.

Funny Take: If prices smash through the bouncer (resistance break!) with high volume, it’s like someone just kicked open the VIP section – the party is really getting started! If they fall through the comfy couch, well, someone just broke the furniture, and things are getting serious (or seriously bad).

Decipher the “Drama Queens” (Candlestick Patterns):

Every single candlestick is telling you a micro-story about a fight between buyers and sellers. Big green candles mean the buyers wore their superhero capes. Big red candles mean the sellers were having a particularly grumpy day.

Funny Take: Look for dramatic patterns! A “Hammer” candle is like the market trying to nail down a bottom. A “Shooting Star” looks pretty but often means the party’s about to end. And an “Engulfing” candle? That’s when one side completely swallows the other – like your crazy aunt devouring the entire plate of appetizers.

Consult the “Fortune Tellers” (Broad Market Indicators):

Moving Averages (MAs): These are like the market’s memory. If prices are consistently above the 200-day MA, the market has a good long-term memory of going up. Below it? It remembers better days.

RSI (Relative Strength Index): This little oscillating line tells you if the market has run too far too fast (overbought, “out of breath”) or fallen too much (oversold, “needs a hug”).

VIX (The “Fear Index”): This one’s easy: if the VIX is spiking, everyone’s panicking like they just saw a spider. If it’s low, everyone’s blissfully unaware, probably singing karaoke off-key.

By putting all these clues together, you’re not just looking at a chart; you’re essentially reading the market’s very dramatic, sometimes hilarious, and occasionally terrifying diary. Good luck, and may your charts always tell you a funny story!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”