The Power of Risk/Reward

What is Price Action?!

Risk/Reward Ratio: Your Trading Superpower (And Your Financial Dating Coach)

Let’s be honest, trading without understanding Risk/Reward () is like showing up to a poker game hoping to win a Bentley while only being willing to bet a bag of chips. It’s amateur hour.

The Risk/Reward Ratio is the single most important concept that separates disciplined, money-making professionals from frantic, praying hopefuls. It is your ultimate trading superpower, and frankly, the only math you need to know.

The Math of Not Being an Idiot

In simple, exciting terms: answers the question, “For every dollar I’m willing to lose on this trade, how many dollars do I stand to gain?”

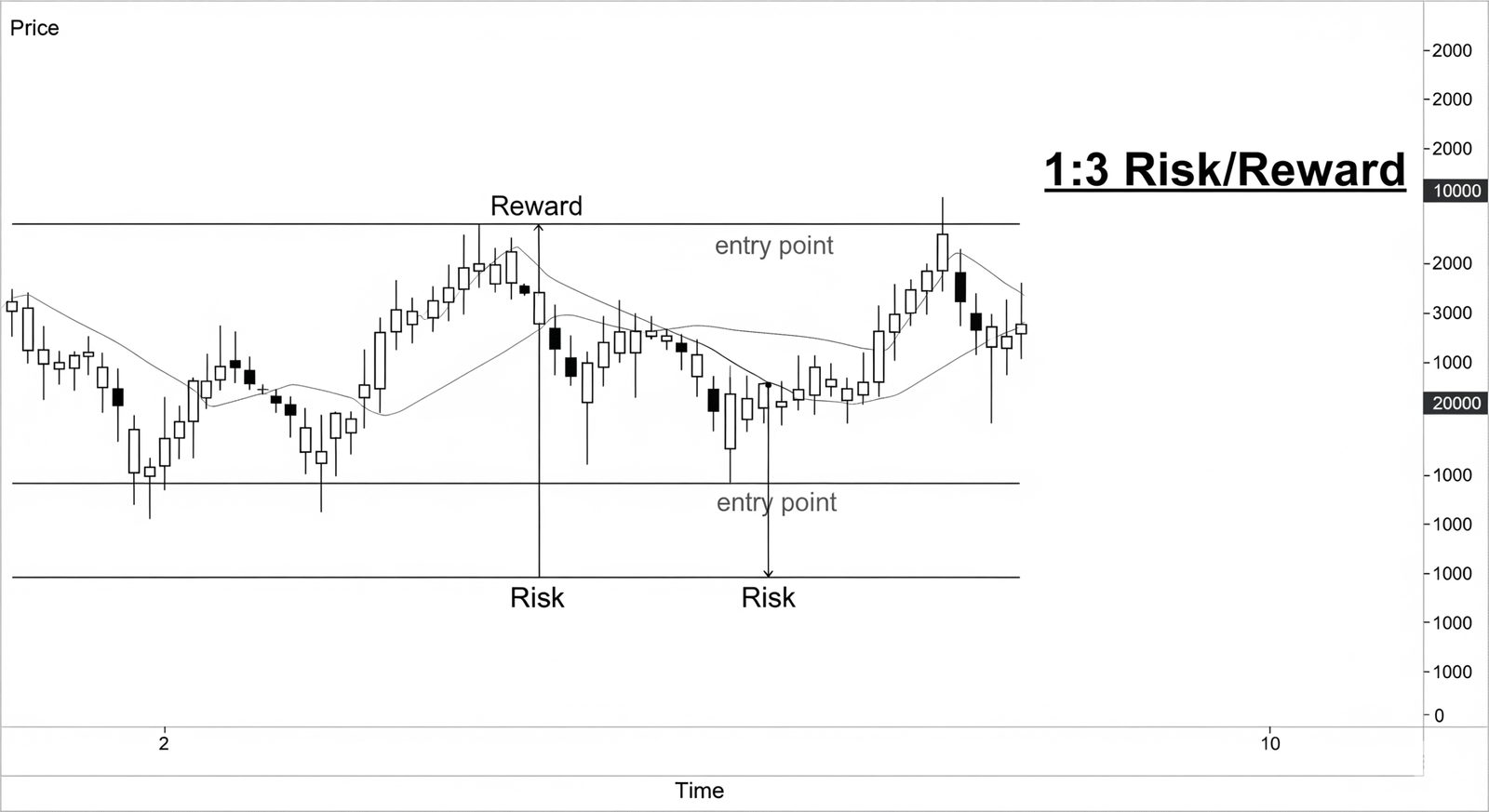

The “Risk” (

): This is the distance between your entry price and your Stop-Loss order. It’s the maximum amount of money you are disciplined enough to lose.

The “Reward”: This is the distance between your entry price and your Take Profit order. It’s the target gain you’ve calculated based on your analysis.

The goal? To never, ever take a trade where the risk is greater than the reward.

The Gold Standard: The ![]() Ratio

Ratio

The professional trader’s mantra is to seek trades with a minimum or, preferably, a

Risk/Reward Ratio.

A

means for every $$$100 you risk (the distance to your stop-loss), you are aiming to profit $$$300 (the distance to your take-profit).

Why is this so powerful? Because it means you don’t even have to be right most of the time to make money!

Think of it: if you only win 40% of your trades (meaning you lose 60%), but every winner makes three times what every loser costs, you are still printing money! You can afford to be wrong more often than you are right and still end the month in profit. That’s pure financial magic!

Your Financial Dating Coach

The is like your dating profile for a potential trade. It forces you to ask: “Is this asset worth the heartbreak (risk) for the potential payout (reward)?” If the ratio is poor (

is

— risking $$$100 to make $$$50), you immediately swipe left. It’s not worth your time or your capital.

The power of is that it turns trading from a gamble into a game of statistical probability. It gives you the confidence to take small losses because you know the big winners—the ones that are three times the size—are coming. Set your

first, and let the money follow!

The Power of Risk/Reward

What is Price Action?!

Risk/Reward Ratio: Your Trading Superpower (And Your Financial Dating Coach)

Let’s be honest, trading without understanding Risk/Reward () is like showing up to a poker game hoping to win a Bentley while only being willing to bet a bag of chips. It’s amateur hour.

The Risk/Reward Ratio is the single most important concept that separates disciplined, money-making professionals from frantic, praying hopefuls. It is your ultimate trading superpower, and frankly, the only math you need to know.

The Math of Not Being an Idiot

In simple, exciting terms: answers the question, “For every dollar I’m willing to lose on this trade, how many dollars do I stand to gain?”

The “Risk” (

): This is the distance between your entry price and your Stop-Loss order. It’s the maximum amount of money you are disciplined enough to lose.

The “Reward”: This is the distance between your entry price and your Take Profit order. It’s the target gain you’ve calculated based on your analysis.

The goal? To never, ever take a trade where the risk is greater than the reward.

The Gold Standard: The ![]() Ratio

Ratio

The professional trader’s mantra is to seek trades with a minimum or, preferably, a

Risk/Reward Ratio.

A

means for every $$$100 you risk (the distance to your stop-loss), you are aiming to profit $$$300 (the distance to your take-profit).

Why is this so powerful? Because it means you don’t even have to be right most of the time to make money!

Think of it: if you only win 40% of your trades (meaning you lose 60%), but every winner makes three times what every loser costs, you are still printing money! You can afford to be wrong more often than you are right and still end the month in profit. That’s pure financial magic!

Your Financial Dating Coach

The is like your dating profile for a potential trade. It forces you to ask: “Is this asset worth the heartbreak (risk) for the potential payout (reward)?” If the ratio is poor (

is

— risking $$$100 to make $$$50), you immediately swipe left. It’s not worth your time or your capital.

The power of is that it turns trading from a gamble into a game of statistical probability. It gives you the confidence to take small losses because you know the big winners—the ones that are three times the size—are coming. Set your

first, and let the money follow!

The Power of PriceAction

What is Price Action?!

Your Financial GPS: The Power of the Risk/Reward Ratio

Forget complex algorithms and market noise. If you want to trade like a professional and stop relying on luck, you need to understand one exciting concept: the Risk/Reward Ratio (R/R).

It’s not just a mathematical formula; it’s your financial GPS, your quality control filter, and the secret sauce that allows you to be wrong more often than you are right and still make serious bank.

The Basic Math of Not Being a Sucker

The R/R answers the most crucial question in trading: “For every dollar I put in harm’s way, how many dollars am I realistically trying to capture?”

The Risk (R): This is determined by the placement of your Stop-Loss order. It is the maximum acceptable loss you’ve disciplined yourself to take.

The Reward: This is determined by the placement of your Take Profit order. It’s the calculated target based on technical analysis.

Your goal is to become an R/R Snob. You only want to engage in trades where the potential reward significantly outweighs the potential risk. Anything less than 1:2 is basically a waste of your valuable time.

The Magic of 1:3 (The Pro Trader’s Cheat Code)

The golden ticket in trading is consistently aiming for a 1:3 Risk/Reward Ratio.

What does this mean? For every $$$100 you decide to risk (the distance from your entry to your stop), you must aim for at least $$$300 in profit (the distance from your entry to your take profit).

The excitement here is purely statistical: If you maintain this 1:3 ratio, you only need to win 26% of your trades to break even. If you win just 40% of your trades (meaning you lose a whopping 60%), you are still spectacularly profitable!

You can be terrible at picking stocks, yet still get rich simply because you are amazing at managing your statistical edge!

The Professional Power

The power of the R/R is that it forces discipline. It makes you set your Stop-Loss and Take Profit before you enter the trade. No R/R? No trade. It’s a simple, non-negotiable rule that ensures every opportunity you pursue is financially sound. Stop gambling, start calculating, and watch your trading become statistically bulletproof!

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of PriceAction

6. Risk/Reward (rr)

Alright, gather ’round, aspiring market adventurers, and let’s talk about the holy grail of trading sanity, the secret sauce to not blowing up your account like an ill-fated fireworks display on the Fourth of July in Barcelona: the Risk/Reward Ratio!

Imagine you’re at a ridiculously fancy buffet (it’s Friday, July 4th, 2025, after all, and we’re feeling celebratory in sunny Barcelona!). You see two trays:

Tray A: Contains a single, slightly bruised olive. If you eat it, you get one point. But, oh no! If you don’t like it, you lose one point.

Tray B: Holds a glistening, perfectly cooked lobster tail. If you eat it, you get three glorious points! But, if it turns out to be secretly made of rubber (hey, it’s a fancy buffet, but still!), you lose one point.

Which one do you go for? If you’ve got half a brain and an appetite for success, you’re eyeing that lobster tail! Why? Because the potential deliciousness (reward) far outweighs the risk of a rubbery bite (risk)!

The Risk/Reward Ratio: Your Trading Buffet Guide!

In trading, the Risk/Reward Ratio (often shortened to R:R) is simply a way to measure how much you stand to gain on a trade versus how much you stand to lose if it goes wrong.

It’s expressed like this: 1:X (e.g., 1:2, 1:3, 1:5)

The “1” always represents your Risk (how much money you’re willing to lose, defined by your stop-loss).

The “X” represents your Reward (how much money you expect to gain, defined by your take-profit target).

Think of it as your Trade-Off Meter:

1:1 Ratio (The “Meh” Meal): You risk $100 to potentially make $100. It’s like flipping a coin for dinner. Not very exciting, is it? You’ve got to be right 51% of the time just to break even after commissions. BORING!

1:2 Ratio (The “Smart Snacker”): You risk $100 to potentially make $200. Now we’re talking! This means for every dollar you put on the line, you’re aiming to pull back two. Even if you’re only right 40% of the time, you can still be profitable! This is like ordering a tapas platter where even if one dish is a bit bland, the others make up for it.

1:3 Ratio (The “Feast Finder”): You risk $100 to potentially make $300. Woohoo! Now you’re getting serious! For every buck you put on the line, you’re hoping for three back. You could be wrong 60% of the time and still make money! This is like finding a Michelin-star restaurant that gives you free desserts if you don’t like the main course. Legendary!

1:5, 1:10, and Beyond (The “Whale Hunter”): These are the legendary ratios, where you’re aiming for massive payouts compared to your tiny risk. It’s like finding a whole school of tuna in the Mediterranean when you only cast a tiny net. These trades might not come often, but when they do, they can make your year!

Why is it So Crucial for Your Wallet (and Your Sanity)?

Because, my friend, you don’t have to be right all the time to be profitable! This is the ultimate mind-blower for new traders.

If you always aim for a 1:2 R:R, and you win only 40% of your trades, guess what? You’re still making money! (4 winning trades x $200 = $800; 6 losing trades x $100 = $600 loss. Net profit = $200!)

If you’re stuck aiming for 1:1, you’d need to win 55-60% just to stay afloat due to trading costs. That’s a lot more pressure!

So, next time you’re eyeing a potential trade, don’t just look at the entry point. First, identify your stop-loss (your escape hatch if things go south – the risk). Then, pinpoint your take-profit (your destination for gains – the reward). Calculate that glorious ratio.

If it’s not at least 1:2 or 1:3 (depending on your strategy’s win rate), then politely decline, turn on some chill beach music, and enjoy the Barcelona sunshine. Because the best trades are like the best parties: low risk, high reward, and totally worth the wait!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

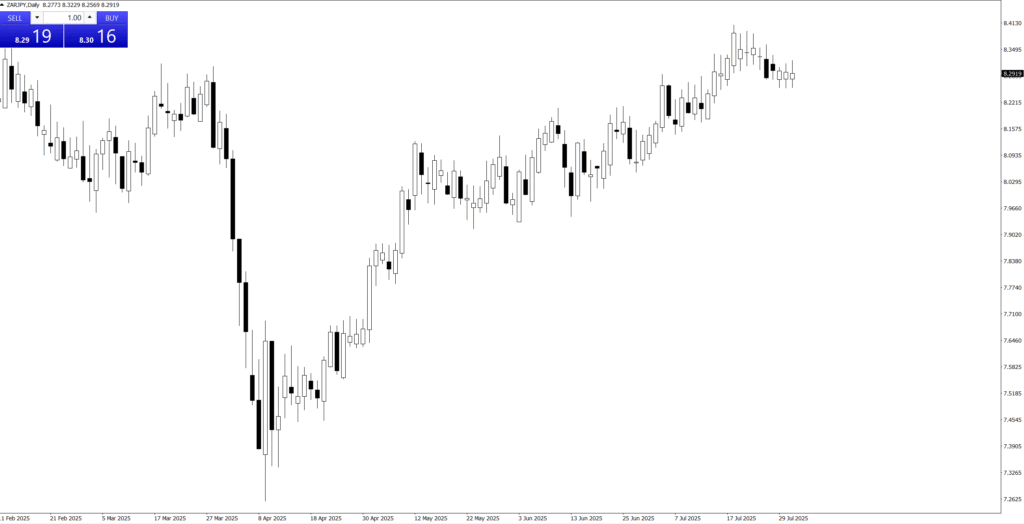

3. The Power of The Trend

You’ve heard it whispered in the hallowed halls of finance, scrawled on bathroom stalls in trading firms, and probably even mumbled by your grandma if she’s secretly a forex guru: “The trend is your friend.”

And let me tell you, it’s not just a catchy little rhyme your mentor uses to sound smart. It’s the absolute, unadulterated truth. Because trying to trade against the trend is like trying to convince a toddler that broccoli is delicious: you’re going to lose, you’re going to get messy, and you’re going to end up crying into your pint of ice cream.

Why the Trend is Your Bestie (and the Counter-Trend is a Frenemy with Benefits)

Imagine you’re at a crowded party. The trend? That’s the cool, popular person everyone wants to hang out with. They’re effortlessly moving in one direction, and everyone’s following. Do you:

Join the popular kid and have a good time (and maybe even get some free snacks)? (That’s trend trading.)

Try to push against the flow of people, constantly bumping into elbows and getting dirty looks, all while trying to reach that one obscure corner of the room that might have a single, stale chip? (That’s counter-trend trading.)

Exactly. One sounds like a party; the other sounds like a bad day at the mall on Black Friday.

The Siren Song of the Reversal (and Why You Should Plug Your Ears)

We’ve all felt it. That little voice in your head, whispering sweet nothings like, “But it has to turn around! It’s gone too far!” That, my friends, is the siren song of the reversal, luring innocent traders onto the jagged rocks of their stop-loss orders.

Here’s the deal: Trends are like those annoying relatives who just keep talking. They might pause for breath, they might even take a sip of water, but they’re generally going to keep going in the same direction until they’ve exhausted themselves or someone physically pulls them away. Trying to pick the exact moment they’ll shut up is a fool’s errand.

So, How Do You Befriend the Trend?

It’s simple, really:

Don’t fight it: If the market’s going up, don’t short it just because you feel it’s “too high.” If it’s plummeting, don’t try to catch a falling knife unless you enjoy emergency room visits.

Ride the wave: Identify the direction the market wants to go, and then hop on for the ride. It’s like catching a bus – much easier than trying to push it uphill yourself.

Know when to get off: Even your best friend eventually leaves the party. Trends reverse. Learn to spot the signs of exhaustion, take your profits, and look for the next popular person to hang out with.

In conclusion, attempting to outsmart the trend is a recipe for tears, frustration, and probably a very unhealthy relationship with your trading platform. So, instead of being the rebellious teenager of the markets, be the smart, agreeable one. Embrace the trend. It’s your friend, your guide, and potentially, your path to less stress and more actual money.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

The Power of SwingTrading

Our Exclusive Focus: Swing Trading

Why do we swing trade here? Oh, that’s easy. Because we value our sleep, our sanity, and the ability to occasionally leave our desks without the market staging an intervention.

The Day Trading Delusion (and Why We Skip It)

Some folks, bless their caffeine-fueled hearts, choose the path of day trading. They live a life of milliseconds and heart palpitations, glued to screens like a barnacle on a hull, convinced that if they blink, they’ll miss out on… well, something. Probably just another micro-fluctuation that will send their blood pressure soaring.

Here, we prefer to think of day trading as a high-stakes staring contest with a computer screen. And frankly, our eyes get tired. Plus, we’ve realized that trying to wrestle pennies from the market’s iron grip every five minutes is less like trading and more like an extreme sport designed to induce early-onset grey hair.

The “Long-Term Investor” Lament (and Why We Sidestep It)

Then you have the long-term investors. Wonderful people, truly. They buy a stock and then… wait. And wait. And then they wait some more. Sometimes they wait for years, patiently watching their portfolio fluctuate like a yo-yo on a very, very long string. They’re basically the market’s zen masters, embodying patience to an almost alarming degree.

We respect their serenity, but let’s be real: we’re not quite ready to commit to a stock for longer than some people date. We like to see our money move. Not in a frantic, day-trading “chicken with its head cut off” kind of way, but more of a “let’s ride this wave for a bit and then jump off with some profit before it crashes on the shore” kind of way.

Swing Trading: The Goldilocks Zone of Awesomeness

That’s where swing trading waltzes in, looking all sophisticated and just-right. It’s the glorious middle ground, the financial equivalent of having your cake and eating it too (without getting indigestion from frantic short-term moves or developing wrinkles from infinite waiting).

Here’s why we swing:

We like our beauty sleep: No need to set alarms for pre-market jitters or post-market analysis paralysis. We set our trades, go to bed, and let the market do its thing.

We appreciate a good life: Ever tried to enjoy a weekend when you’re terrified of a Monday morning gap? We haven’t, because our trades are designed to ride bigger moves, meaning less stress and more actual living.

We’re not greedy, just efficient: We aim for those sweet, juicy price swings – not every single tick, and not the glacial pace of a multi-year hold. Just enough to make a decent profit and move on to the next opportunity.

Our charts look less like a toddler’s scribble: With a longer timeframe, the noise calms down, and the actual trends emerge. It’s like turning down the volume on a chaotic party and suddenly hearing the good music.

So, while others are either pulling their hair out or practicing extreme patience, we’re over here, calmly catching waves, enjoying our lives, and occasionally high-fiving each other when a trade goes our way. Because that’s how we roll in the wonderful, sensible, and surprisingly fun world of swing trading.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”