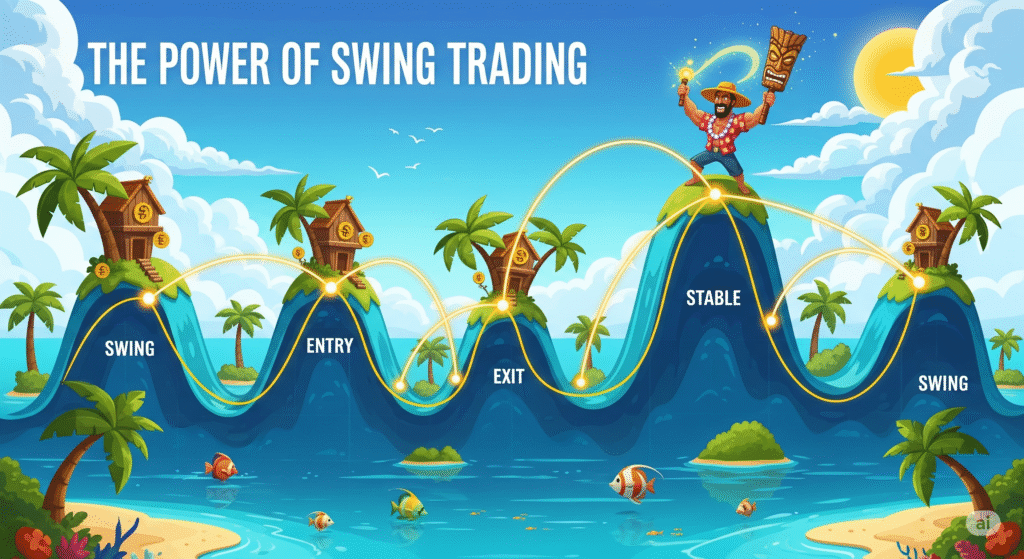

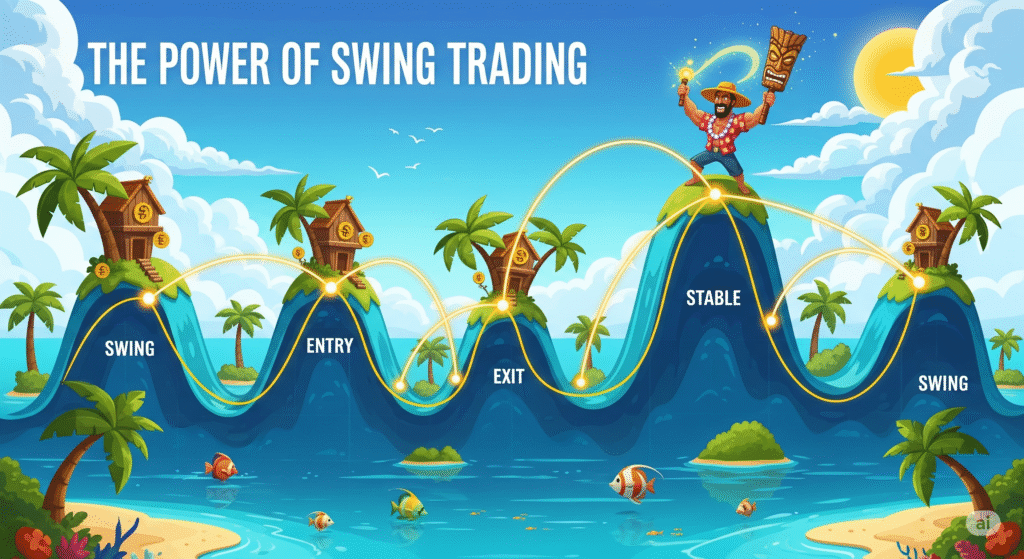

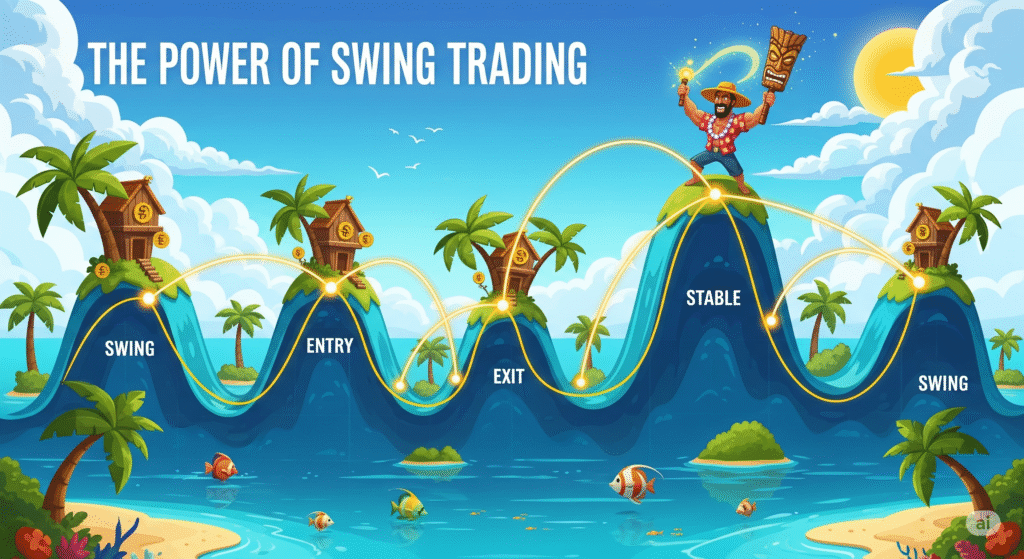

The Power of SwingTrading

Our Exclusive Focus: Swing Trading

Why do we swing trade here? Oh, that’s easy. Because we value our sleep, our sanity, and the ability to occasionally leave our desks without the market staging an intervention.

The Day Trading Delusion (and Why We Skip It)

Some folks, bless their caffeine-fueled hearts, choose the path of day trading. They live a life of milliseconds and heart palpitations, glued to screens like a barnacle on a hull, convinced that if they blink, they’ll miss out on… well, something. Probably just another micro-fluctuation that will send their blood pressure soaring.

Here, we prefer to think of day trading as a high-stakes staring contest with a computer screen. And frankly, our eyes get tired. Plus, we’ve realized that trying to wrestle pennies from the market’s iron grip every five minutes is less like trading and more like an extreme sport designed to induce early-onset grey hair.

The “Long-Term Investor” Lament (and Why We Sidestep It)

Then you have the long-term investors. Wonderful people, truly. They buy a stock and then… wait. And wait. And then they wait some more. Sometimes they wait for years, patiently watching their portfolio fluctuate like a yo-yo on a very, very long string. They’re basically the market’s zen masters, embodying patience to an almost alarming degree.

We respect their serenity, but let’s be real: we’re not quite ready to commit to a stock for longer than some people date. We like to see our money move. Not in a frantic, day-trading “chicken with its head cut off” kind of way, but more of a “let’s ride this wave for a bit and then jump off with some profit before it crashes on the shore” kind of way.

Swing Trading: The Goldilocks Zone of Awesomeness

That’s where swing trading waltzes in, looking all sophisticated and just-right. It’s the glorious middle ground, the financial equivalent of having your cake and eating it too (without getting indigestion from frantic short-term moves or developing wrinkles from infinite waiting).

Here’s why we swing:

We like our beauty sleep: No need to set alarms for pre-market jitters or post-market analysis paralysis. We set our trades, go to bed, and let the market do its thing.

We appreciate a good life: Ever tried to enjoy a weekend when you’re terrified of a Monday morning gap? We haven’t, because our trades are designed to ride bigger moves, meaning less stress and more actual living.

We’re not greedy, just efficient: We aim for those sweet, juicy price swings – not every single tick, and not the glacial pace of a multi-year hold. Just enough to make a decent profit and move on to the next opportunity.

Our charts look less like a toddler’s scribble: With a longer timeframe, the noise calms down, and the actual trends emerge. It’s like turning down the volume on a chaotic party and suddenly hearing the good music.

So, while others are either pulling their hair out or practicing extreme patience, we’re over here, calmly catching waves, enjoying our lives, and occasionally high-fiving each other when a trade goes our way. Because that’s how we roll in the wonderful, sensible, and surprisingly fun world of swing trading.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

The Power of SwingTrading

Swing Trading: The Market’s Sweet Spot

Let’s face it, the world of trading often feels like a crowded casino. You have the Day Traders—a hyper-caffeinated crowd playing with the intensity of a high-stakes poker game, convinced they can catch every twitch of the market. Then you have the Long-Term Investors—the folks who bought stock in 1998 and are currently napping, waiting for 2045.

But what if there was a better way? A way to catch meaningful market movements without turning your life into a 24/7 screen-staring contest?

Enter Swing Trading: the sophisticated middle ground, the financial equivalent of a power nap that actually pays you.

The Power of the “Swing”

Swing trading is based on a beautiful, simple premise: markets don’t move in straight lines. They swing.

A swing trade typically holds a position for anywhere from a couple of days to a few weeks.1 The goal isn’t to catch the micro-fluctuations (that’s the day trader’s migraine), nor is it to wait decades (that’s the investor’s patience test). The goal is to identify a technical catalyst—a pattern, a breakout, or an indicator—that suggests a stock is about to make a definitive, juicy move in one direction.

You’re not trying to guess where the stock will be in five years. You’re simply betting that the stock, having just bottomed out, is now determined to hustle its way to the next temporary peak.

Why It’s Excitingly Simple

Freedom (Seriously): Since you’re targeting bigger moves, you don’t need to be glued to your screen.2 You analyze the charts after the market closes, set your entry and exit points (including that all-important stop-loss), and then—get this—you go live your life.3 It’s professional trading that respects your dinner plans.

Bigger Bites, Less Stress: Swing trading targets a larger percentage gain per trade. While a day trader might be thrilled with $0.20, a swing trader is aiming for the full, delicious $$$2 to $$$10 move. This focus on magnitude over frequency reduces the emotional pressure of constant, rapid-fire decision-making.4

Clarity Over Noise: You are listening for the market’s clear announcements (like a proven uptrend or a support bounce), not its fleeting whispers (minor news headlines). This reliance on repeatable chart patterns makes the decision-making process much more systematic and, frankly, less anxiety-inducing.

In short, swing trading allows you to be an active, profit-seeking player in the market without sacrificing your sanity.5 It’s the smart way to exploit the market’s natural rhythm. Happy hunting!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

The Power of SwingTrading

Swing Trading: The Power Nap of the Market

Let’s be honest, trying to be a day trader is like signing up for an ultra-marathon where you’re constantly chugging espresso and staring at a screen until your eyes cross. It’s an exhausting, full-time gig that requires the reflexes of a caffeinated squirrel and the emotional stability of a Zen master.

But what if you could still catch a good market move without sleeping under your desk? Enter swing trading: the chilled-out, yet surprisingly effective, sibling of day trading.

It’s Like Catching a Wave, Not a Ripple

Think of a stock’s price movement. Day traders try to catch every tiny ripple in the water. Swing traders, on the other hand, wait for a big, juicy wave to form. A “swing” trade usually lasts anywhere from a couple of days to a few weeks.1 The goal? To profit from the “swing” in price that happens as a stock moves from a temporary bottom to a temporary top (or vice versa).2

It’s the financial equivalent of saying, “I see what you’re doing, Mr. Stock. I’ll wait until you look really convinced of your direction before I hop on board.”

The “Why It Works” in Simple Terms

-

More Time, Less Stress: You’re not glued to your monitor. You don’t panic-sell because a stock blinked funny. You can analyze the charts after your day job, set your trades, and actually go enjoy dinner. This is the life-work balance of the trading world.

-

Bigger Profits Per Trade: Since you’re holding for a longer period, you’re aiming for a larger percentage gain—the full “swing”—not just a few pennies. These bigger chunks add up.

-

Less Market Noise: Day trading is all about reacting to fleeting news and minor fluctuations, which is basically market gossip. Swing trading focuses on technical analysis (charts, patterns, indicators) and fundamental catalysts (things like earnings reports or product launches). You’re tuning out the background static and listening for the clear announcements.

The Professional Funny Takeaway

Swing trading is perfect for those who want to be active in the market but still value their sanity and vitamin D intake. It allows you to feel like a serious, professional investor without the need for an IV drip of coffee.

It’s the art of capitalizing on the market’s tendency to change its mind slowly. You wait for the market to start moving, confirm it’s going somewhere, and then you politely join the ride.3 In essence, you’re not marrying the stock, you’re just taking it out for a nice weekend trip.

It gives you the power to capture meaningful profits using your brain, not your wrist-snapping reaction time. Happy swinging!

Disclaimer: Don’t forget risk management! The power nap of trading still requires a good alarm clock (stop-loss orders).

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

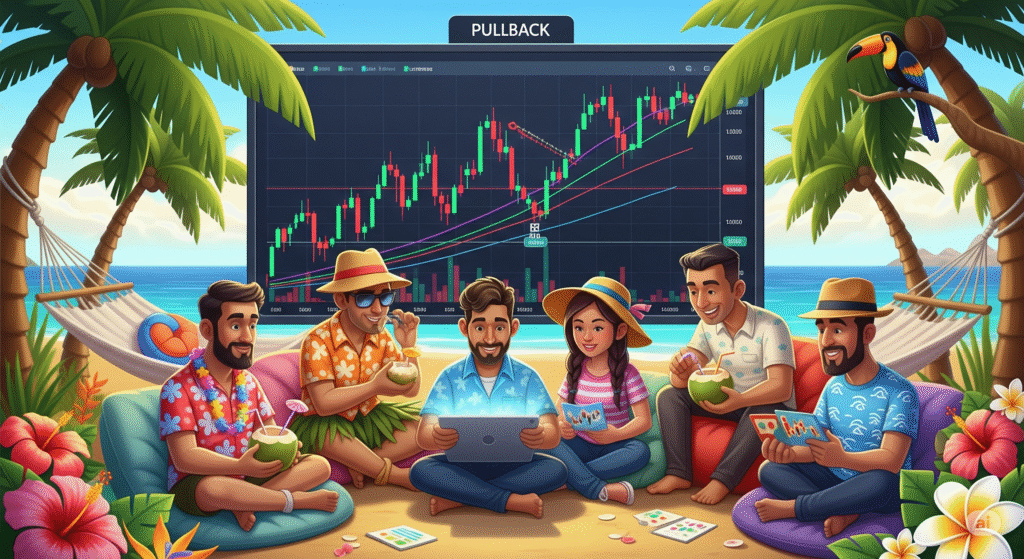

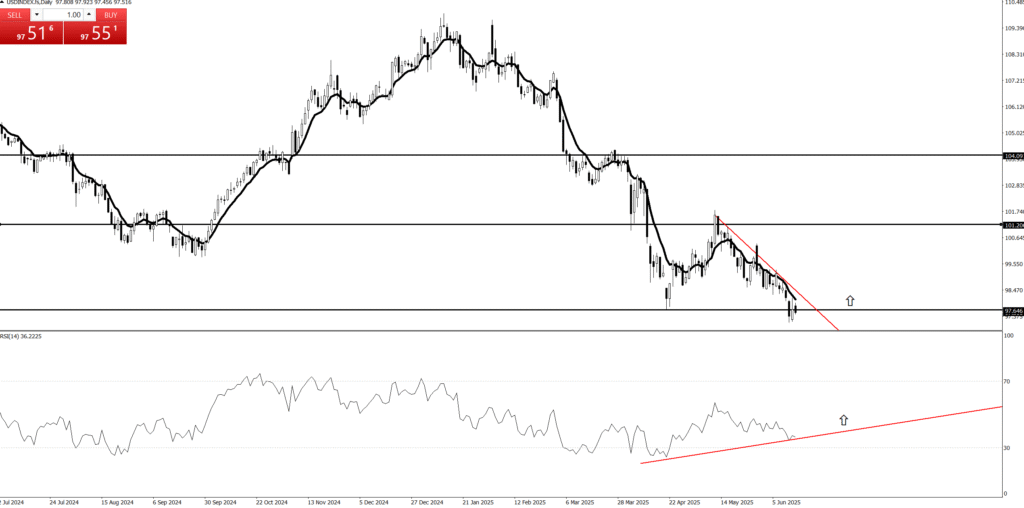

10. The Power of Pullback/Retrace

Alright, my savvy market voyagers! We’ve talked about the trend being your friend, the sneaky False Break, and even the shy but powerful Inside Bar. You’ve learned to spot when the market’s on a roll, heading straight for the profit paradise.

But what happens when your trend-friend, who was just charging ahead like a bull at a festival, suddenly decides to… take a little breather? To tie its shoelace? To check if it left the oven on?

Fear not, for this isn’t a betrayal! This is the incredibly strategic, sometimes frustrating, but ultimately glorious power of the Pullback!

The Pullback: The Market’s “Hold On, Just Gotta Grab My Sunscreen!” Moment!

Imagine this: You’re riding a magnificent, perfectly shaped wave right here off the coast of Barceloneta. You’re cruising, feeling like a surfing legend, heading straight for the shore of epic profits!

Suddenly, the wave decides to momentarily dip back a little. Just a tiny bit. It doesn’t break, it doesn’t disappear, it just sinks down a hair, giving you a quick scare. It’s like your friend, who was leading the charge to the best spot on the beach, suddenly says, “Whoops, almost forgot my towel! Be right back!”

That, my friends, is a Pullback!

Visually: It’s a temporary, counter-trend movement within a larger, established trend. If the market is in a strong uptrend (making higher highs and higher lows), a pullback is that brief, scary moment when the price dips down a bit, making a lower high or lower low for just a moment, before resuming its upward climb.

It’s the market taking a strategic pause. It’s catching its breath, shaking off the weak hands, and reloading for the next big push.

Why This Brief Dip Is Your Golden Ticket to the Best Seats!

Now, a rookie trader, fueled by FOMO (Fear Of Missing Out) and too many sangrias, sees the initial wave and jumps on it at the very top, just before the pullback. They’re like the tourist who buys the most expensive souvenir at the airport instead of waiting for the artisan market.

But you, my patient, discerning market connoisseur, you understand the secret of the Pullback!

The Discount Opportunity: A pullback is like a flash sale on your favorite trend! The price briefly comes back to a more attractive level, offering you a cheaper entry into an already established movement. Why pay full price when you can get a discount? It’s like finding a 2-for-1 deal on paella!

Shaking Off the Weak Hands: When the price dips, some nervous Nellies (traders who bought at the top) get scared and sell their positions. This brief selling pressure clears out the market, making room for fresh, confident buyers (like you!) to hop on board for the next leg up.

Confirmation of Strength: If a trend pulls back to a significant level (like a previous resistance-turned-support, or a key moving average) and then holds and resumes its original direction, it confirms that the trend is healthy and strong! It’s like your friend grabbing their towel and then sprinting even faster to the beach spot, proving they’re still in the game!

Optimal Risk/Reward: This is where your inner buffet master rejoices! By waiting for a pullback, you can often get an entry point closer to your stop-loss, giving you a much tighter risk and thus a juicier Risk/Reward ratio for the ride up! More lobster, less risk of rubber!

So, the next time your trend-friend briefly pauses, looks over its shoulder, or seems to stumble a bit, don’t panic! It’s not abandonment; it’s an invitation! It’s the market’s subtle way of saying, “Hey, wait up! I’m giving you a chance to hop on at a better price before we really take off!” It’s the moment to adjust your board, confirm your balance, and get ready for the next, even bigger, wave!

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”