4. Stop Loss Vs. No StopLoss

stoploss pros

Here are the key advantages, or “pros,” of using a stop loss in trading:

Effective Risk Management: A stop loss is your primary tool for defining and limiting the maximum amount of money you are willing to lose on any single trade. It acts as an automatic safety net, preventing small, manageable losses from spiraling into catastrophic ones that could wipe out your trading capital.

Emotional Discipline: It removes the emotional component from cutting losses. By setting your exit point when you are calm and rational (before the trade), you prevent impulsive decisions driven by fear (panic selling) or hope (holding onto a losing position in denial). This promotes adherence to your trading plan.

Capital Preservation: By explicitly limiting your downside on each trade, a stop loss helps preserve your trading capital. This is crucial for longevity in the markets, as you need capital to continue trading and capitalize on future opportunities.

Frees Up Capital: When a stop loss is triggered, your position is closed, and the capital tied up in that losing trade is immediately released. This allows you to redeploy your funds into new, potentially more promising opportunities rather than being stuck in a detrimental position.

Improved Sleep & Reduced Stress: Knowing your maximum potential loss on any given trade can significantly reduce the psychological stress and anxiety associated with market volatility. This allows for clearer thinking and better decision-making.

Encourages Better Trade Selection: The act of placing a stop loss often forces traders to think critically about their entry point and why they are entering the trade, ensuring there’s enough room for profit before the stop is hit. It encourages a favorable risk-to-reward ratio.

no stoploss cons

Here are the significant disadvantages, or “cons,” of not using a stop loss in trading:

Unlimited Downside Risk: This is the most dangerous drawback. Without a predefined exit point for a losing trade, a small loss can quickly snowball into a massive, account-crippling, or even account-wiping loss if the market continues to move against your position.

Severe Emotional Turmoil: Holding onto a rapidly losing position with no safety net is incredibly stressful. This emotional pressure often leads to irrational decision-making, such as “hope trading” (refusing to close a losing trade in the unrealistic hope it will turn around), revenge trading, or making other undisciplined choices.

Capital Imprisonment: Your trading capital remains tied up in a losing trade, sometimes for extended periods. This prevents you from utilizing that capital for new, potentially profitable opportunities that might arise. It’s a significant opportunity cost.

Risk of Margin Calls and Account Blow-Up: If you’re trading with leverage (on margin), a rapidly escalating loss without a stop loss can lead to a margin call from your broker, requiring you to deposit more funds or face forced liquidation of your position, often at the worst possible price. This is a common way trading accounts are entirely wiped out.

Lack of Discipline and Poor Habits: Consistently trading without a stop loss can foster deeply ingrained bad habits. It teaches you to accept unlimited risk and bypass critical risk management practices, making it harder to develop the disciplined mindset necessary for long-term success.

“Death by a Thousand Cuts” or “One Big Hit”: While you might avoid whipsaws from minor fluctuations, you risk either slowly bleeding capital on multiple small unattended losses or, more drastically, taking one massive hit that devastates your account.

4. Stop Loss Vs. No StopLoss

Alright, let’s inject some humor into the very serious business of protecting your precious capital!

Stop Loss: Your Financial Ex-Terminator (It’ll Be Back, Your Money Won’t)

You know how in horror movies, the character who stubbornly refuses to listen to the wise old local always meets a sticky end? Well, in trading, that stubborn character is “your portfolio without a stop loss.” But fear not, for the stop loss is here, and it’s got your back (even if it’s dragging you out of a burning building)!

Here are the glorious “pros” of this financial marvel, with a chuckle or two:

Your Designated Party Pooper (for Losses): Think of your stop loss as that incredibly responsible friend who drags you away from the casino table before you put your house keys on black. It’s designed to be the buzzkill for losing trades, ensuring your portfolio doesn’t go full ‘Titanic’ and sink to the bottom. “No, seriously, we’re done here, even if you feel like it’s about to turn around!”

The Emotional Firewall (Because You’re Human): Let’s be honest, trying to trade solely on logic when your money’s on the line is like trying to have a calm conversation with a toddler who just discovered permanent markers. Fear screams “SELL EVERYTHING!” Greed whispers “Hold on! It’s going to the moon!” Your stop loss just quietly says, “Order executed. You’re welcome.” It’s your anti-meltdown button.

Capital Preservation: Keeping Your Ammo Dry: You wouldn’t go to war with one bullet, right? The stop loss ensures you don’t empty your entire financial clip on one bad skirmish. It’s about taking small, strategic retreats so you have enough gunpowder left for the next battle. Think of it as your wallet’s personal bodyguard.

The “Get Out of Jail Free” Card (for Your Cash): Ever had money stuck in a terrible trade, just sitting there, glaring at you, doing nothing useful? A stop loss frees that capital like a financial parole officer. “Alright, you lost a bit, but now you’re free to go play in another sandbox. Go forth and potentially make money elsewhere!”

Sleep Insurance (Priceless): Knowing that a rogue news headline or an alien invasion won’t obliterate your entire trading account overnight is, frankly, worth its weight in gold. Your stop loss whispers sweet nothings like, “Go to sleep, my child. I’ll take care of it if things go south. Probably.”

It Forces You to Be Smart (Even When You Don’t Feel Like It): Setting a stop loss before a trade makes you actually think: “Where am I wrong here? How much am I willing to lose on this brilliant idea?” It’s like having a little financial sensei tapping you on the head, demanding you have a plan, not just a prayer.

In short, the stop loss is your sensible, often unappreciated, trading partner who ensures you survive the market’s wild rides, even if it means kicking you off the rollercoaster just as it might have gone back up. Better safe than sorry, and certainly better than broke!

no stoploss cons with a funny tone

Alright, let’s dive into the hilarious (until it’s not) saga of trading without a stop loss. It’s like watching a financial horror-comedy unfold in slow motion.

No Stop Loss: The YOLO Trading Strategy (You Only Lose Once… Everything)

So, you’ve decided to go full maverick, a financial daredevil, shunning the humble stop loss. “Who needs a safety net?” you declare, as your portfolio prepares for a high-wire act without one. Here are the truly side-splitting (from a distance, usually) cons of this bold approach:

Unlimited Downside: The “How Low Can It Go?” Challenge: You know that limbo game? Well, without a stop loss, your account isn’t just doing the limbo; it’s digging to the Earth’s core. Your “small loss” quickly morphs into a “wow, that’s a lot of zeros” loss, then a “where did my retirement fund go?” loss, and eventually, a “honey, about that second mortgage…” loss. It’s the gift that keeps on taking!

Emotional Rollercoaster: The Express Lane to Therapy: Your trading screen becomes a psychological warfare zone. Every red tick is a tiny stab to your soul. You’ll experience the five stages of grief in real-time, sometimes hourly: denial (“It’ll bounce back!”), anger (“Stupid market!”), bargaining (“Just break even, please!”), depression (“I’m a financial failure!”), and finally, acceptance (of bankruptcy). Your therapist will love you, though!

Capital Imprisonment: Your Money’s on a Permanent Vacation (Without You): That cash sitting in your losing trade? It’s gone on a long, extended holiday to “Negative-ville” and isn’t sending postcards. While other traders are out there making new money, your funds are essentially incarcerated, doing hard time in the land of unfulfilled potential. It’s the ultimate FOMO, but for your own money!

The “Margin Call” — Your Broker’s Rude Awakening: If you’re using leverage, not having a stop loss is like setting your alarm clock to “Financial Ruin.” Your broker, bless their heart, will eventually call to politely inform you that you owe them more money, or they’re going to liquidate your position. It’s the market’s way of saying, “Surprise! Your account just evaporated like morning dew!”

Discipline? What Discipline?: Who needs a plan when you have hope? This strategy trains you to ignore all the sensible rules of trading. You become a financial gambler, relying on luck and sheer willpower. It’s the trading equivalent of believing that if you just click your heels three times, your losing trade will magically turn green. (Spoiler: It rarely works outside of Oz.)

Catching Falling Knives… with Your Face: Ever heard the saying “Don’t catch a falling knife”? Without a stop loss, you’re not just trying to catch it; you’re actively trying to hug it. You become convinced that “this time it’s the bottom!” right before it finds a new, deeper bottom. Repeatedly.

So, while not using a stop loss might sound adventurous, it’s typically an express ticket to the “Trader’s Hall of Shame,” where the exhibits are empty accounts and very, very sad faces. Stick with the safety net; your future self (and your therapist) will thank you.

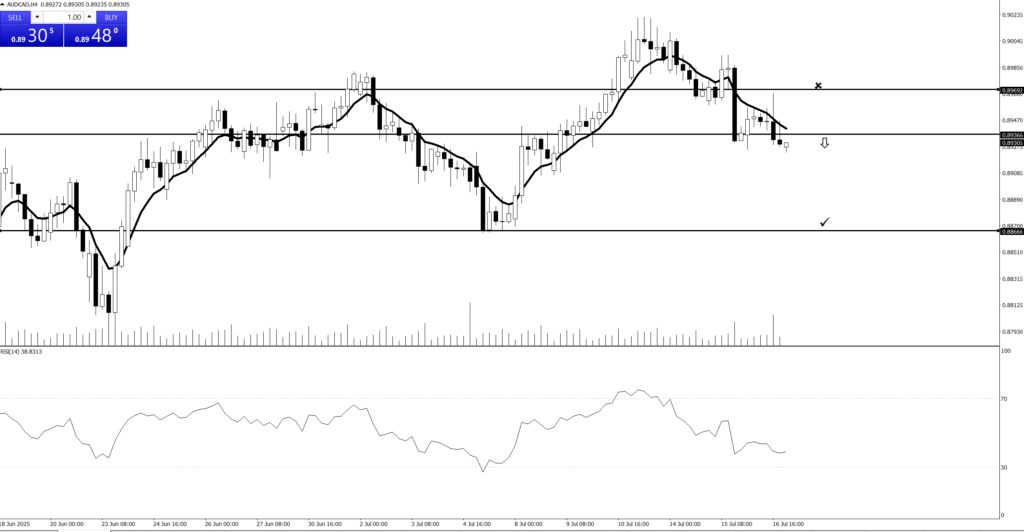

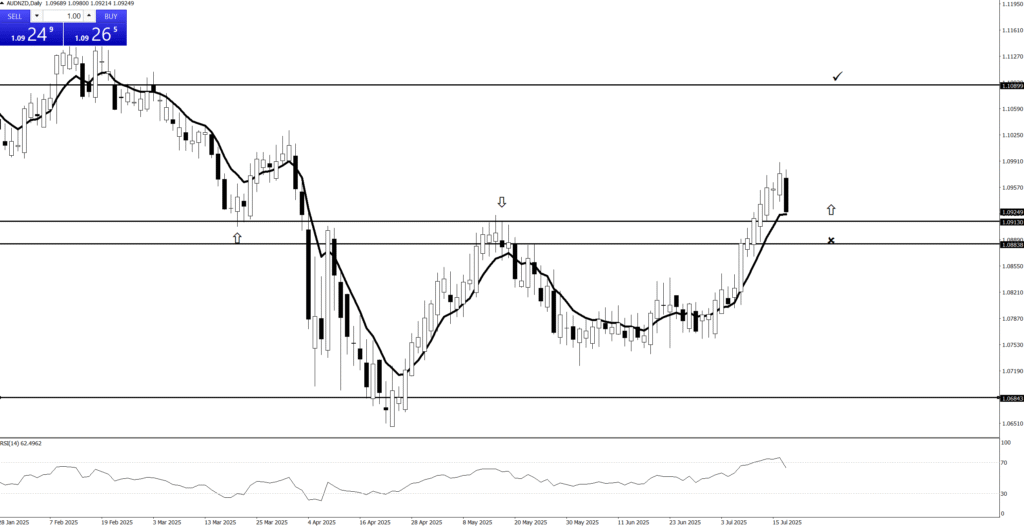

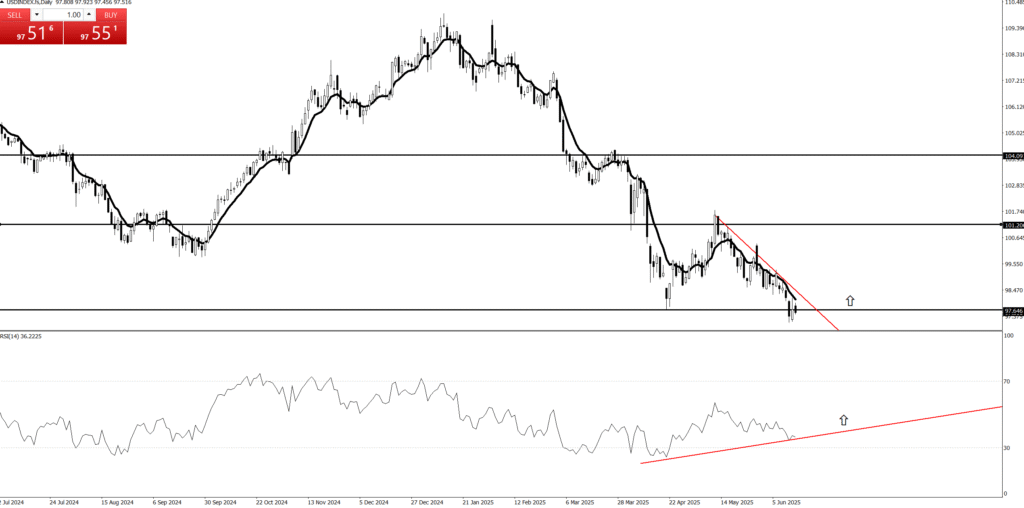

Price Action Charts

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

Crypto Chart

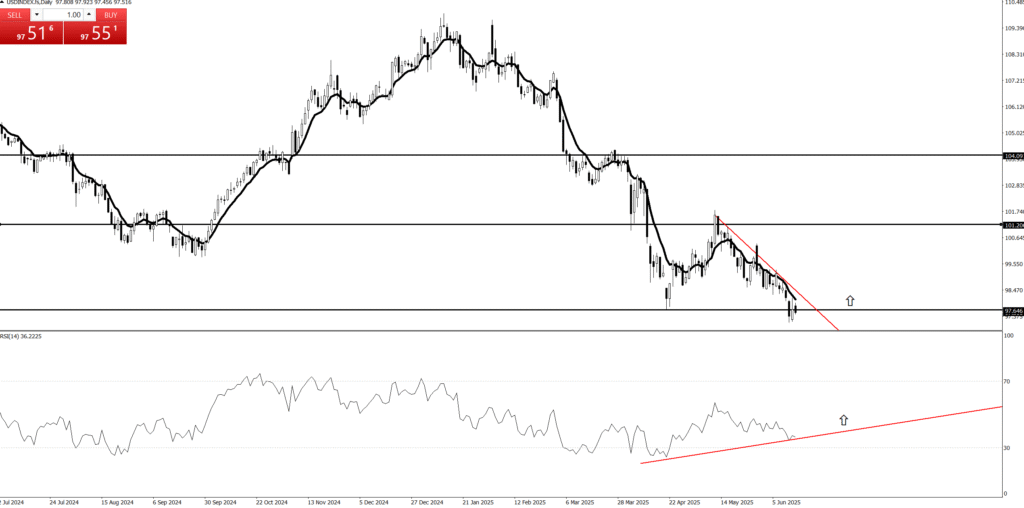

Forex Chart

Stock Chart

Metal Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Crypto Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Stock Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Forex Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Gold Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Price Action Charts

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

Price action trading charts involve the analysis of raw price movement displayed directly on a chart, typically using candlesticks or bars. This method prioritizes the visual interpretation of how buyers and sellers are interacting, without the immediate reliance on secondary indicators.

By observing patterns in price highs, lows, opens, and closes, traders aim to understand market psychology, identify key support and resistance levels, and discern potential trends or reversals. It’s a direct approach to market analysis, where the price itself is considered the most comprehensive and reliable source of information for making trading decisions.

Trading Charts: Your Market Decoder Ring (and Reality Show!)

Ever stare at a bunch of flickering numbers and think, “There has to be a better way to understand this chaos?” Well, my friend, say hello to Trading Charts!

These aren’t just fancy graphs; they’re the market’s own reality show, condensed into a visual story. Each bar or candlestick is a tiny drama playing out, showing you exactly where the price opened, closed, and briefly went crazy, all over a specific period.

Think of it as your personal decoder ring for the financial world. Instead of trying to guess what’s happening, you’re literally seeing the market’s past behavior laid out before you. Are prices skyrocketing like a cat on a trampoline? Or are they plummeting like a lead balloon? Your chart tells all!

So, grab your popcorn. By learning to read these visual diaries, you’ll start spotting patterns, understanding the market’s moods, and maybe even predicting its next dramatic plot twist. It’s less guesswork, more “aha!” moments.

Price action trading charts emphasize the study of a financial instrument’s price movements over time as the primary source of trading signals. This analytical method focuses on the patterns, structure, and behavior of candlesticks or bars, along with their relationship to key price levels.

The core idea is to understand what the market is communicating directly through its price, without the potential lag or complexity introduced by technical indicators. Traders interpret the battle between buyers and sellers, identify momentum, and anticipate potential shifts by closely observing how price unfolds and reacts within different timeframes, offering a streamlined approach to market analysis.

Trading Charts: Your Crystal Ball (That Only Shows the Past)

Ever wish you had a crystal ball to predict where the market’s going next? Well, you’re in luck! Meet Trading Charts – they’re exactly like a crystal ball, except they only show you what already happened!

But don’t scoff! By carefully examining these squiggly lines and colorful bars, you’re actually reading the market’s historical footprint. Each little flicker, each rise and fall, is a clue. You’re basically a financial detective, piecing together the market’s past crimes (and triumphs) to figure out its likely next move.

So, while they won’t tell you tomorrow’s lottery numbers, charts give you the visual evidence you need to understand the market’s moods, patterns, and probable next steps. They turn the chaotic noise of prices into a readable story. Get ready to put on your detective hat and see what secrets the market’s been keeping!

Take Profit Vs. Not Taking Profit

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

4. Take Profit Vs. Not Taking Profit

Taking profit is a crucial component of any trading strategy, and its benefits, when executed properly, are significant. Here are the key advantages, or “pros,” of using a take-profit target:

Guaranteed Realized Gains: This is the most obvious benefit. A take-profit order ensures that you lock in your gains at a predefined level. Without it, a profitable trade could easily reverse and turn into a losing one, or at least significantly reduce your unrealized profits. It turns potential profit into actual cash in your account.

Emotional Discipline: Just as a stop loss removes emotion from cutting losses, a take profit removes emotion from greed. It prevents you from holding onto a trade for “just a little bit more” hoping for unrealistic gains, only to see the market reverse and erase your profits. It enforces your pre-planned exit strategy.

Risk Management Enhancement: By defining your profit target alongside your stop loss, you establish a clear risk-reward ratio for every trade. This allows for proper position sizing and ensures that your potential gains justify your potential losses, contributing to a positive expectancy over time.

Capital Rotation/Opportunity Cost: Realizing profits frees up your capital. This cash can then be deployed into new, potentially more promising trading opportunities, rather than being tied up in an existing trade that might consolidate or reverse.

Reduces Exposure to Market Volatility: Once your profit target is hit, you are out of the market for that particular trade. This reduces your exposure to sudden, unpredictable price swings or news events that could otherwise erode your open profits.

Psychological Reinforcement: Consistently hitting your take-profit targets, even if they are modest, provides positive psychological reinforcement. It builds confidence in your strategy and discipline, contributing to a more sustainable and less stressful trading journey.

Systematic Approach: Using take-profit orders is a cornerstone of a systematic and rules-based trading approach. It means you’re not guessing when to exit but following a predefined plan, which is essential for consistent results and backtesting.

Okay, let’s explore the “cons” of not taking profit, which essentially means letting your winning trades run indefinitely without ever cashing out at a predefined target. It sounds bold, but it comes with its own set of unique frustrations and risks.

Here are the downsides, or “cons,” of choosing to forgo a take-profit strategy:

“Paper Profits” Can Vanish: This is the most common and painful drawback. You might see your trade up by 5%, then 10%, then 20% on paper, feeling like a genius. But without a specific exit point, the market can (and often does) reverse, wiping out all your unrealized gains and potentially turning a significant winner into a breakeven trade, or even a loss. The satisfaction of “being up” is meaningless until you’ve actually closed the position.

Emotional Stress and Greed Creep: Continuously watching your profits fluctuate can be incredibly stressful. Greed can set in, making you hold on for more and more, even when signs of a reversal appear. This can lead to irrational decisions, like ignoring valid exit signals because you’re convinced it will go “just a little bit higher.”

Capital Imprisonment in Stagnant Trades: Even if a trade doesn’t fully reverse, it might enter a prolonged period of consolidation or slow pullback after making significant gains. If you don’t take profit, your capital remains tied up in this stagnant position, missing out on new, potentially faster-moving opportunities elsewhere. Your money isn’t working as efficiently as it could be.

Missed Opportunity to Re-enter or Reallocate: By staying in one trade indefinitely, you might miss a chance to take profits, let the market pull back (or consolidate), and then re-enter the same asset at a better price, effectively getting “more shares” for the same capital. Or, you miss opportunities in entirely different, more promising assets.

Difficulty in Strategy Backtesting/Optimization: If you don’t have clear rules for taking profit, it becomes very hard to systematically test or optimize your trading strategy. Without defined profit exits, your strategy becomes discretionary and less quantifiable.

Psychological Burnout: Constantly being “in” the market and managing open profits (and their inevitable drawdowns) without the satisfaction of locking in gains can lead to mental fatigue and burnout. The psychological reward of closing a winning trade is important for sustained trading discipline.

Exposure to Unexpected Events: The longer you hold an open position, the greater your exposure to unforeseen “black swan” events, sudden news, or significant market shifts that can rapidly erase even substantial accumulated profits.

In essence, while letting winners run can be a powerful concept in very strong, sustained trends, the absence of any profit-taking mechanism means you’re leaving the door wide open for the market to snatch back your hard-earned (or paper-earned) gains. It sacrifices guaranteed profit for the chance of greater profit, which often turns into regret.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

💰🔐 What is a Stop Loss?

A Stop Loss is a risk management tool used in trading. It’s a predefined price level where your position will automatically close if the market moves against you — to limit your losses..

💰📌 Example:

You buy EUR/USD at 1.1000, and set a Stop Loss at 1.0950.

If the price drops to 1.0950 → the trade closes automatically → you limit your loss.

💰Why It’s Important:

Protects your capital

It limits the amount of money you can lose on a trade.Removes emotion

Keeps you from holding on to losing positions out of hope or fear.Disciplined trading

Forces you to define risk before entering a trade.- Saves time and stress – no need to watch every move.

💰🎯 Stop Loss Tips:

Don’t place it too tight – it might trigger too early.

Don’t place it too wide – it might risk too much.

Use technical levels – like below support or above resistance.

Follow a risk percentage rule – for example: never risk more than 1-2% of your account on a single trade.

4. Take Profit Vs. Not Taking Profit

Alright, let’s talk about the sheer, unadulterated joy (and quiet smugness) of taking profit! This isn’t just a trading strategy; it’s a moment of triumph, a tiny victory dance in your brain, and the universe’s way of telling you, “Good job, you magnificent financial beast!”

Here are the glorious “pros” of actually clicking that “close trade” button and locking in your gains, delivered with a chuckle:

Turning “Paper Gains” into “Actual Money” (Mind Blown!): You know those elusive “paper profits”? They’re like Bigfoot – everyone talks about them, but have you actually seen one in your bank account? Taking profit is the magical act that transforms those ethereal, fleeting numbers on your screen into tangible, spendable cash. It’s the moment your P&L sheet stops being a theoretical exercise and starts paying for that extra guacamole.

Greed’s Kryptonite (Because Greed is a Jerk): Let’s face it, greed is that little devil on your shoulder, constantly whispering, “Just one more tick! It’s going higher! Don’t be a chicken!” Taking profit is your inner financial superhero swooping in, punching Greed in the face, and saying, “Nope! We got what we came for. Now step away from the keyboard before you ruin everything!” It’s the ultimate self-intervention.

The “I Told You So!” Moment (to the Market and Yourself): You set your target. The market wiggled, maybe tried to scare you, but you held firm. When that take-profit hits, it’s like the market finally concedes, “Alright, alright, you win this round. Take your money and go.” And to your inner critic, it’s a triumphant, “See?! I’m not entirely useless!”

Instant Stress Reduction (Like a Financial Spa Day): Having open, profitable trades can be almost as stressful as losing ones. You’re constantly checking, wondering if it’ll reverse. But when that take-profit hits, a wave of calm washes over you. No more monitoring! No more worrying! It’s pure, unadulterated financial zen. Ahhh, liberation!

Re-Arming Your Account (For the Next Financial Adventure): Locked-in profits mean fresh capital ready for action! It’s like reloading your laser gun for the next level of the game. Instead of having your money tied up indefinitely in a trade that might be consolidating or pulling back, it’s now free to hunt for the next golden opportunity. Go forth, my money, and multiply again!

The Bragging Rights (Even if Just to Your Pet): Who cares if it was a small profit? You made money! You stuck to your plan! You beat the market (at least for a moment)! You can tell your dog about your strategic prowess, and it’ll look at you with proud, unwavering admiration (or just wonder if you’re holding a treat).

In essence, taking profit is the vital act that turns your trading hobby into an actual, income-generating endeavor. It’s the sweet, satisfying closure that prevents “paper rich” from becoming “actually broke.”

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

Alright, let’s explore the utterly hilarious (if you’re not the one doing it) downsides of refusing to take profit. It’s like finding a winning lottery ticket, deciding to wait for the jackpot to get even bigger, and then watching it blow away in the wind.

Not Taking Profit: The “Paper Billionaire” Path (Where Riches Are Just a Cruel Joke)

You’ve got a winner! The market’s moving your way, your screen is green, and you’re mentally picking out your yacht. “Why would I take profit now?” you scoff, “It’s going higher! I’m a visionary, a genius, a market whisperer!” And that, my friends, is when the market decides to play its favorite game: “How quickly can I make your paper profits vanish?”

Here are the delightful “cons” of letting your winners run, run, run… often straight back to zero:

The “Paper Profits” Mirage: Now You See It, Now You’re Sad: Oh, the joy of seeing your trade up 10%, 20%, even 50% on paper! You tell your friends, you gloat a little. But because you didn’t click that “close” button, those profits are like a unicorn – beautiful, fantastical, and utterly non-existent in your bank account. Then, faster than you can say “margin call,” the market does a dramatic U-turn, and your paper kingdom crumbles. You went from “rich” to “mildly annoyed” to “why am I like this?” in warp speed.

Greed’s Insidious Whisper (and Loud Scream): That little voice inside your head that whispers “just a little more profit” quickly escalates to a full-blown shouting match: “WHY ARE YOU THINKING OF SELLING?! IT’S GOING TO THE MOOOOON! YOU’LL REGRET IT FOREVER!” This internal monologue leads you to ignore all rational signs of a reversal, until you’re left holding the bag of tears and what used to be a very nice profit.

The “Boomerang Effect”: Your Profits Come Back… to Hit You in the Face: You watch your trade soar, feeling smug. Then it pulls back a bit. “Just a healthy retrace!” you tell yourself. It pulls back more. “Still going higher, I swear!” Then, WHOOSH! It’s back to breakeven. Or worse, it plunges into a loss. Your beautiful profits didn’t just disappear; they came back with a vengeance to mock your indecision.

Capital Hostage Situation: Your Money’s on Permanent Vacation in Limbo-land: While your winning trade is slowly bleeding back to mediocrity, your capital is tied up, unable to participate in new, potentially fantastic opportunities. It’s like having your star player stuck on the bench watching everyone else score goals, because you refused to substitute him when he was on fire. Your money is just sitting there, glaring at you.

The “Woulda, Coulda, Shoulda” Symphony of Regret: This is the post-trade concert you never want to attend. Every time you see the chart of that trade you didn’t close, you’ll hear the mournful violins of “I woulda had €500!” followed by the booming drums of “I coulda paid off that bill!” and the piercing flutes of “I shoulda just taken the money, you idiot!” It’s a psychological torture unique to non-profit-takers.

In short, while the idea of an unlimited profit sounds like a dream, in reality, not taking profit is often a hilarious (for observers) exercise in turning potential triumphs into spectacular displays of self-sabotage. It teaches you that sometimes, good enough is perfectly glorious, especially when it turns into actual cash!

Gemini can make mistakes, including about people, so double-check it. Your privacy & Ge

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”

💰🔐 What is a Stop Loss?

A Stop Loss is a risk management tool used in trading. It’s a predefined price level where your position will automatically close if the market moves against you — to limit your losses..

💰📌 Example:

You buy EUR/USD at 1.1000, and set a Stop Loss at 1.0950.

If the price drops to 1.0950 → the trade closes automatically → you limit your loss.

💰Why It’s Important:

Protects your capital

It limits the amount of money you can lose on a trade.Removes emotion

Keeps you from holding on to losing positions out of hope or fear.Disciplined trading

Forces you to define risk before entering a trade.- Saves time and stress – no need to watch every move.

💰🎯 Stop Loss Tips:

Don’t place it too tight – it might trigger too early.

Don’t place it too wide – it might risk too much.

Use technical levels – like below support or above resistance.

Follow a risk percentage rule – for example: never risk more than 1-2% of your account on a single trade.