The Story of the Chart

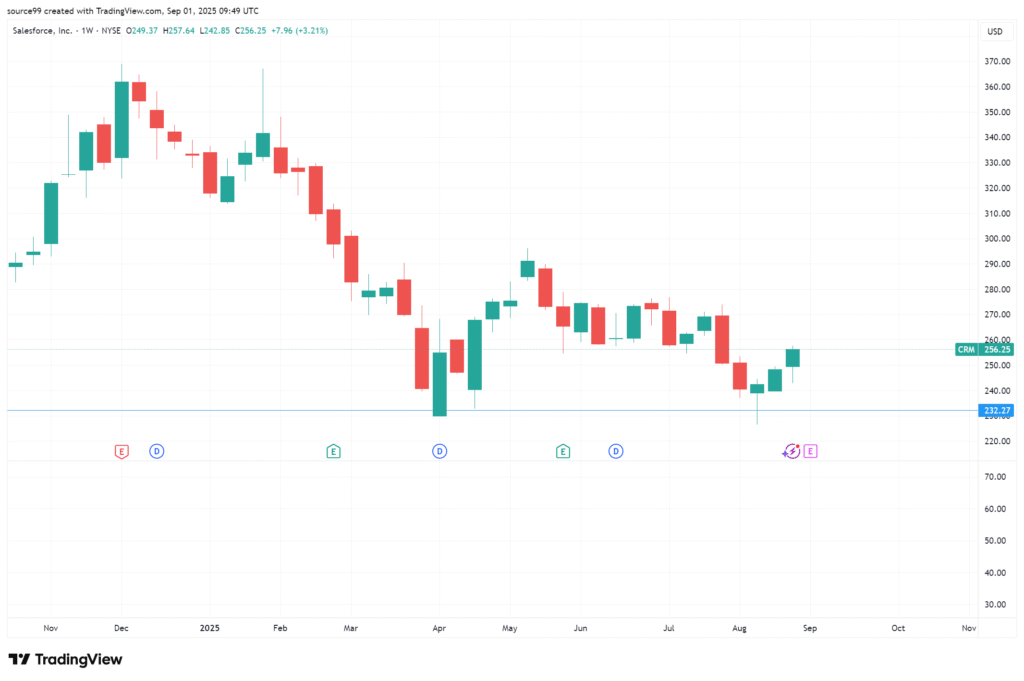

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰 “The story of the price action chart”

refers to the narrative or sequence of events that the price movement of a financial asset tells over a specific period, as depicted visually on a chart.

It’s an interpretive way of understanding market dynamics by observing:

-

Who’s in control: Are buyers (bulls) dominant, driving prices up? Or are sellers (bears) in charge, pushing prices down?

-

Key turning points: Where did the sentiment shift? Where did prices reverse, consolidate, or accelerate?

-

Areas of strength and weakness: At what price levels did the asset find support (a floor) or resistance (a ceiling)?

-

Market psychology: The patterns formed by the candlesticks (or bars) and their wicks (shadows) reflect the collective emotions and decisions of market participants—fear, greed, indecision, conviction, and panic.

Price Action: Read the Chart, Skip the Financial Novel!

Tired of listening to endless financial news and confusing analysts? Throw out the complicated economic novels! The most successful traders know the chart itself is telling a high-stakes, exciting, and profitable story—and it’s called Price Action Trading.

The candles aren’t just colored blocks; they are characters in a drama, constantly revealing the emotional battle between the confident buyers (bulls) and the desperate sellers (bears). Your job is to read the clues and predict the final act!

The Power of the Visual Narrative

Candles as Confessions: Each candle is a direct confession of market behavior for that period. A large, full-bodied green candle isn’t just a price move; it’s the buyers delivering a beat-down to the sellers! A long wick shows where a side tried to go but spectacularly failed—a massive sign of rejection and a clue about the next move.

Levels as Battlegrounds: Key Support and Resistance levels aren’t arbitrary lines; they are confirmed, historical battlegrounds. When the price hits an established level, the chart is telling you: “A decisive fight is about to break out right here!” You watch for the price action at that level—the bounce or the break—to tell you who won the war.

Patterns as Plot Twists: Price patterns (like a clear head and shoulders or a simple continuation triangle) are the chart’s plot twists. They signal a collective shift in market sentiment, revealing the likely direction of the next major move. You don’t need indicators to predict the outcome; the characters (the price bars) have already revealed the climax!

Trading the Drama, Ignoring the Noise

The beauty of Price Action is its simplicity. It strips away all the confusing, lagging indicators and external noise, forcing you to focus on the pure, raw truth: What is the price doing right now, and why?

By learning to read the story told by the wicks (rejection!), the bodies (conviction!), and the key levels (the battle!), you gain a massive advantage. You stop reacting to market gossip and start trading the verified, unfolding narrative. Read the chart’s story, and let its drama become your profitable reality!

Price Action: Read the Chart, Skip the Financial Novel!

Tired of listening to endless financial news and confusing analysts? Throw out the complicated economic novels! The most successful traders know the chart itself is telling a high-stakes, exciting, and profitable story—and it’s called Price Action Trading.

The candles aren’t just colored blocks; they are characters in a drama, constantly revealing the emotional battle between the confident buyers (bulls) and the desperate sellers (bears). Your job is to read the clues and predict the final act!

The Power of the Visual Narrative

Candles as Confessions: Each candle is a direct confession of market behavior for that period. A large, full-bodied green candle isn’t just a price move; it’s the buyers delivering a beat-down to the sellers! A long wick shows where a side tried to go but spectacularly failed—a massive sign of rejection and a clue about the next move.

Levels as Battlegrounds: Key Support and Resistance levels aren’t arbitrary lines; they are confirmed, historical battlegrounds. When the price hits an established level, the chart is telling you: “A decisive fight is about to break out right here!” You watch for the price action at that level—the bounce or the break—to tell you who won the war.

Patterns as Plot Twists: Price patterns (like a clear head and shoulders or a simple continuation triangle) are the chart’s plot twists. They signal a collective shift in market sentiment, revealing the likely direction of the next major move. You don’t need indicators to predict the outcome; the characters (the price bars) have already revealed the climax!

Trading the Drama, Ignoring the Noise

The beauty of Price Action is its simplicity. It strips away all the confusing, lagging indicators and external noise, forcing you to focus on the pure, raw truth: What is the price doing right now, and why?

By learning to read the story told by the wicks (rejection!), the bodies (conviction!), and the key levels (the battle!), you gain a massive advantage. You stop reacting to market gossip and start trading the verified, unfolding narrative. Read the chart’s story, and let its drama become your profitable reality!

“The story of the price action chart”

refers to the narrative or sequence of events that the price movement of a financial asset tells over a specific period, as depicted visually on a chart.

It’s an interpretive way of understanding market dynamics by observing:

Who’s in control: Are buyers (bulls) dominant, driving prices up? Or are sellers (bears) in charge, pushing prices down?

Key turning points: Where did the sentiment shift? Where did prices reverse, consolidate, or accelerate?

Areas of strength and weakness: At what price levels did the asset find support (a floor) or resistance (a ceiling)?

Market psychology: The patterns formed by the candlesticks (or bars) and their wicks (shadows) reflect the collective emotions and decisions of market participants—fear, greed, indecision, conviction, and panic.

Instead of relying on mathematical indicators (like moving averages, RSI, MACD) to filter or interpret the price, price action analysis focuses on the raw price data itself. Each candlestick (or bar) is seen as a “message” from the market, telling you what happened during that specific time interval (e.g., 5 minutes, 1 hour, 1 day).

So, when someone asks for “the story of the price action chart,” they’re asking for:

A historical account: What has the price done?

An analysis of supply and demand: Where did buyers step in? Where did sellers dominate?

Identification of patterns: Are there recurring shapes or behaviors that suggest future possibilities?

A qualitative understanding: Beyond just numbers, what does the visual pattern feel like in terms of market sentiment?

In essence, it’s about reading the chart directly, like a book, to understand the market’s past behavior and infer its potential future trajectory based on pure price movements.

Price Action: Read the Chart, Skip the Financial Novel!

Tired of listening to endless financial news and confusing analysts? Throw out the complicated economic novels! The most successful traders know the chart itself is telling a high-stakes, exciting, and profitable story—and it’s called Price Action Trading.

The candles aren’t just colored blocks; they are characters in a drama, constantly revealing the emotional battle between the confident buyers (bulls) and the desperate sellers (bears). Your job is to read the clues and predict the final act!

The Power of the Visual Narrative

Candles as Confessions: Each candle is a direct confession of market behavior for that period. A large, full-bodied green candle isn’t just a price move; it’s the buyers delivering a beat-down to the sellers! A long wick shows where a side tried to go but spectacularly failed—a massive sign of rejection and a clue about the next move.

Levels as Battlegrounds: Key Support and Resistance levels aren’t arbitrary lines; they are confirmed, historical battlegrounds. When the price hits an established level, the chart is telling you: “A decisive fight is about to break out right here!” You watch for the price action at that level—the bounce or the break—to tell you who won the war.

Patterns as Plot Twists: Price patterns (like a clear head and shoulders or a simple continuation triangle) are the chart’s plot twists. They signal a collective shift in market sentiment, revealing the likely direction of the next major move. You don’t need indicators to predict the outcome; the characters (the price bars) have already revealed the climax!

Trading the Drama, Ignoring the Noise

The beauty of Price Action is its simplicity. It strips away all the confusing, lagging indicators and external noise, forcing you to focus on the pure, raw truth: What is the price doing right now, and why?

By learning to read the story told by the wicks (rejection!), the bodies (conviction!), and the key levels (the battle!), you gain a massive advantage. You stop reacting to market gossip and start trading the verified, unfolding narrative. Read the chart’s story, and let its drama become your profitable reality!

The Story of the Chart

💰

Price Action: Read the Chart, Skip the Financial Novel!

Tired of listening to endless financial news and confusing analysts? Throw out the complicated economic novels! The most successful traders know the chart itself is telling a high-stakes, exciting, and profitable story—and it’s called Price Action Trading.

The candles aren’t just colored blocks; they are characters in a drama, constantly revealing the emotional battle between the confident buyers (bulls) and the desperate sellers (bears). Your job is to read the clues and predict the final act!

The Power of the Visual Narrative

Candles as Confessions: Each candle is a direct confession of market behavior for that period. A large, full-bodied green candle isn’t just a price move; it’s the buyers delivering a beat-down to the sellers! A long wick shows where a side tried to go but spectacularly failed—a massive sign of rejection and a clue about the next move.

Levels as Battlegrounds: Key Support and Resistance levels aren’t arbitrary lines; they are confirmed, historical battlegrounds. When the price hits an established level, the chart is telling you: “A decisive fight is about to break out right here!” You watch for the price action at that level—the bounce or the break—to tell you who won the war.

Patterns as Plot Twists: Price patterns (like a clear head and shoulders or a simple continuation triangle) are the chart’s plot twists. They signal a collective shift in market sentiment, revealing the likely direction of the next major move. You don’t need indicators to predict the outcome; the characters (the price bars) have already revealed the climax!

Trading the Drama, Ignoring the Noise

The beauty of Price Action is its simplicity. It strips away all the confusing, lagging indicators and external noise, forcing you to focus on the pure, raw truth: What is the price doing right now, and why?

By learning to read the story told by the wicks (rejection!), the bodies (conviction!), and the key levels (the battle!), you gain a massive advantage. You stop reacting to market gossip and start trading the verified, unfolding narrative. Read the chart’s story, and let its drama become your profitable reality!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The Story of the Chart

💰What in the Kraken’s Name is Price Action?

Imagine you’re on a bustling market street, and everyone’s shouting their prices for pineapples. You don’t need a fancy economist with a spreadsheet to tell you if pineapples are getting more popular or less. You just watch what people are doing: are they eagerly snatching them up at higher prices, or are the vendors struggling to give them away?

Price action is exactly that, but for stocks and other assets! It’s simply reading the story the market is telling you directly through the price itself. No need for complicated, lagging indicators that are always a step behind, like a tired parrot squawking old news. You’re looking at the raw, unfiltered moves on your chart – the ultimate truth of supply and demand, fear and greed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The Story of the Chart

💰What in the Kraken’s Name is Price Action?

Imagine you’re on a bustling market street, and everyone’s shouting their prices for pineapples. You don’t need a fancy economist with a spreadsheet to tell you if pineapples are getting more popular or less. You just watch what people are doing: are they eagerly snatching them up at higher prices, or are the vendors struggling to give them away?

Price action is exactly that, but for stocks and other assets! It’s simply reading the story the market is telling you directly through the price itself. No need for complicated, lagging indicators that are always a step behind, like a tired parrot squawking old news. You’re looking at the raw, unfiltered moves on your chart – the ultimate truth of supply and demand, fear and greed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Price Action: From Chaos to Clarity

The Story of the Chart

“The story of the price action chart”

refers to the narrative or sequence of events that the price movement of a financial asset tells over a specific period, as depicted visually on a chart.

It’s an interpretive way of understanding market dynamics by observing:

Who’s in control: Are buyers (bulls) dominant, driving prices up? Or are sellers (bears) in charge, pushing prices down?

Key turning points: Where did the sentiment shift? Where did prices reverse, consolidate, or accelerate?

Areas of strength and weakness: At what price levels did the asset find support (a floor) or resistance (a ceiling)?

Market psychology: The patterns formed by the candlesticks (or bars) and their wicks (shadows) reflect the collective emotions and decisions of market participants—fear, greed, indecision, conviction, and panic.

Instead of relying on mathematical indicators (like moving averages, RSI, MACD) to filter or interpret the price, price action analysis focuses on the raw price data itself. Each candlestick (or bar) is seen as a “message” from the market, telling you what happened during that specific time interval (e.g., 5 minutes, 1 hour, 1 day).

So, when someone asks for “the story of the price action chart,” they’re asking for:

A historical account: What has the price done?

An analysis of supply and demand: Where did buyers step in? Where did sellers dominate?

Identification of patterns: Are there recurring shapes or behaviors that suggest future possibilities?

A qualitative understanding: Beyond just numbers, what does the visual pattern feel like in terms of market sentiment?

In essence, it’s about reading the chart directly, like a book, to understand the market’s past behavior and infer its potential future trajectory based on pure price movements.

Price Action: Read the Chart, Skip the Financial Novel!

Tired of listening to endless financial news and confusing analysts? Throw out the complicated economic novels! The most successful traders know the chart itself is telling a high-stakes, exciting, and profitable story—and it’s called Price Action Trading.

The candles aren’t just colored blocks; they are characters in a drama, constantly revealing the emotional battle between the confident buyers (bulls) and the desperate sellers (bears). Your job is to read the clues and predict the final act!

The Power of the Visual Narrative

Candles as Confessions: Each candle is a direct confession of market behavior for that period. A large, full-bodied green candle isn’t just a price move; it’s the buyers delivering a beat-down to the sellers! A long wick shows where a side tried to go but spectacularly failed—a massive sign of rejection and a clue about the next move.

Levels as Battlegrounds: Key Support and Resistance levels aren’t arbitrary lines; they are confirmed, historical battlegrounds. When the price hits an established level, the chart is telling you: “A decisive fight is about to break out right here!” You watch for the price action at that level—the bounce or the break—to tell you who won the war.

Patterns as Plot Twists: Price patterns (like a clear head and shoulders or a simple continuation triangle) are the chart’s plot twists. They signal a collective shift in market sentiment, revealing the likely direction of the next major move. You don’t need indicators to predict the outcome; the characters (the price bars) have already revealed the climax!

Trading the Drama, Ignoring the Noise

The beauty of Price Action is its simplicity. It strips away all the confusing, lagging indicators and external noise, forcing you to focus on the pure, raw truth: What is the price doing right now, and why?

By learning to read the story told by the wicks (rejection!), the bodies (conviction!), and the key levels (the battle!), you gain a massive advantage. You stop reacting to market gossip and start trading the verified, unfolding narrative. Read the chart’s story, and let its drama become your profitable reality!

The Story of the Chart

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

“The story of the price action chart”

refers to the narrative or sequence of events that the price movement of a financial asset tells over a specific period, as depicted visually on a chart.

It’s an interpretive way of understanding market dynamics by observing:

Who’s in control: Are buyers (bulls) dominant, driving prices up? Or are sellers (bears) in charge, pushing prices down?

Key turning points: Where did the sentiment shift? Where did prices reverse, consolidate, or accelerate?

Areas of strength and weakness: At what price levels did the asset find support (a floor) or resistance (a ceiling)?

Market psychology: The patterns formed by the candlesticks (or bars) and their wicks (shadows) reflect the collective emotions and decisions of market participants—fear, greed, indecision, conviction, and panic.

Instead of relying on mathematical indicators (like moving averages, RSI, MACD) to filter or interpret the price, price action analysis focuses on the raw price data itself. Each candlestick (or bar) is seen as a “message” from the market, telling you what happened during that specific time interval (e.g., 5 minutes, 1 hour, 1 day).

So, when someone asks for “the story of the price action chart,” they’re asking for:

A historical account: What has the price done?

An analysis of supply and demand: Where did buyers step in? Where did sellers dominate?

Identification of patterns: Are there recurring shapes or behaviors that suggest future possibilities?

A qualitative understanding: Beyond just numbers, what does the visual pattern feel like in terms of market sentiment?

In essence, it’s about reading the chart directly, like a book, to understand the market’s past behavior and infer its potential future trajectory based on pure price movements.

Price Action: Read the Chart, Skip the Financial Novel!

Tired of listening to endless financial news and confusing analysts? Throw out the complicated economic novels! The most successful traders know the chart itself is telling a high-stakes, exciting, and profitable story—and it’s called Price Action Trading.

The candles aren’t just colored blocks; they are characters in a drama, constantly revealing the emotional battle between the confident buyers (bulls) and the desperate sellers (bears). Your job is to read the clues and predict the final act!

The Power of the Visual Narrative

Candles as Confessions: Each candle is a direct confession of market behavior for that period. A large, full-bodied green candle isn’t just a price move; it’s the buyers delivering a beat-down to the sellers! A long wick shows where a side tried to go but spectacularly failed—a massive sign of rejection and a clue about the next move.

Levels as Battlegrounds: Key Support and Resistance levels aren’t arbitrary lines; they are confirmed, historical battlegrounds. When the price hits an established level, the chart is telling you: “A decisive fight is about to break out right here!” You watch for the price action at that level—the bounce or the break—to tell you who won the war.

Patterns as Plot Twists: Price patterns (like a clear head and shoulders or a simple continuation triangle) are the chart’s plot twists. They signal a collective shift in market sentiment, revealing the likely direction of the next major move. You don’t need indicators to predict the outcome; the characters (the price bars) have already revealed the climax!

Trading the Drama, Ignoring the Noise

The beauty of Price Action is its simplicity. It strips away all the confusing, lagging indicators and external noise, forcing you to focus on the pure, raw truth: What is the price doing right now, and why?

By learning to read the story told by the wicks (rejection!), the bodies (conviction!), and the key levels (the battle!), you gain a massive advantage. You stop reacting to market gossip and start trading the verified, unfolding narrative. Read the chart’s story, and let its drama become your profitable reality!

The Story of the Chart

The Story of the Chart

The Story of the Chart

The Story of the Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The Story of the Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The Story of the Chart

The Story of the Chart

The Story of the Chart

The Story of the Chart