The Story

The Story of the Stop Loss

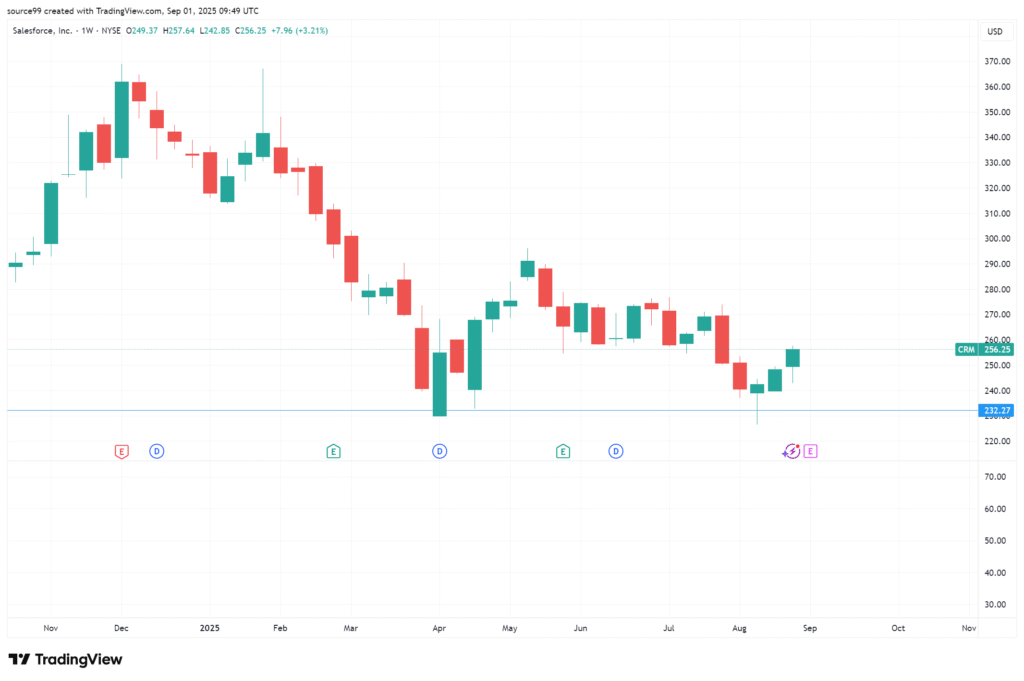

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

The Sacred Panic Button: A Stop-Loss Story

Captain Eva “Steady” Reynolds had seen it all: bull markets that made millionaires out of teenagers, and bear markets that could clear a trading floor faster than a faulty fire alarm. But Eva’s secret weapon wasn’t a complex algorithm; it was her unshakeable devotion to the stop-loss order.

She viewed the stop-loss not as a sign of defeat, but as her personal, automated bodyguard—the final, sacred panic button. “A professional trader’s only job is to protect capital,” she would tell her team. “The profits will follow if the losses don’t bankrupt you. Think of the stop-loss as your relationship therapist: it forces you to cut ties with bad trades before they take all your money and the furniture.”

Today, Eva had entered a perfectly reasonable long position on Quantum Quinoa (QQ), a promising health stock. The charts looked solid, momentum was building, and the volume was confirming the move. As a professional, she immediately placed her stop-loss at the price where her original trade thesis would be fundamentally invalidated. This specific price point, she explained, was her Maximum Acceptable Risk (MAR)—the point of “No Return, Only Pain.”

Then, things went sideways. A competitor released a study claiming that regular quinoa makes you mildly allergic to kittens. The stock market, predictably, threw a tantrum worthy of a toddler missing nap time. QQ’s price plummeted, not because of fundamentals, but pure, unadulterated panic.

Eva watched the numbers cascade down, a dizzying vertical drop that made her coffee mug tremble. She felt the primal human urge to interfere—to pull the stop-loss lower, to “give it room,” to pray for a reversal. “Just one dollar more, baby,” the little devil on her shoulder whispered.

But before she could click, the stop-loss executed perfectly. The order, pre-programmed, sold her position instantly at her predetermined MAR, locking in a small, completely acceptable loss of 1.5%.

Minutes later, the stock continued its freefall, hitting a 10% decline before stabilizing. Eva sighed, but it was a sigh of relief, not defeat. She hadn’t been right on the direction, but she had been right on the risk management.

“That, ladies and gentlemen,” she announced to the silent floor, “was the sound of our risk budget being successfully protected.” Trend traders are patient, swing traders are quick, but the stop-loss trader is the one who survives to fight the next day. It’s the ultimate professional excitement: knowing you stared into the abyss of a major loss and walked away with a scratch.

The Story of the Chart

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

The Sacred Panic Button: A Stop-Loss Story

Captain Eva “Steady” Reynolds had seen it all: bull markets that made millionaires out of teenagers, and bear markets that could clear a trading floor faster than a faulty fire alarm. But Eva’s secret weapon wasn’t a complex algorithm; it was her unshakeable devotion to the stop-loss order.

She viewed the stop-loss not as a sign of defeat, but as her personal, automated bodyguard—the final, sacred panic button. “A professional trader’s only job is to protect capital,” she would tell her team. “The profits will follow if the losses don’t bankrupt you. Think of the stop-loss as your relationship therapist: it forces you to cut ties with bad trades before they take all your money and the furniture.”

Today, Eva had entered a perfectly reasonable long position on Quantum Quinoa (QQ), a promising health stock. The charts looked solid, momentum was building, and the volume was confirming the move. As a professional, she immediately placed her stop-loss at the price where her original trade thesis would be fundamentally invalidated. This specific price point, she explained, was her Maximum Acceptable Risk (MAR)—the point of “No Return, Only Pain.”

Then, things went sideways. A competitor released a study claiming that regular quinoa makes you mildly allergic to kittens. The stock market, predictably, threw a tantrum worthy of a toddler missing nap time. QQ’s price plummeted, not because of fundamentals, but pure, unadulterated panic.

Eva watched the numbers cascade down, a dizzying vertical drop that made her coffee mug tremble. She felt the primal human urge to interfere—to pull the stop-loss lower, to “give it room,” to pray for a reversal. “Just one dollar more, baby,” the little devil on her shoulder whispered.

But before she could click, the stop-loss executed perfectly. The order, pre-programmed, sold her position instantly at her predetermined MAR, locking in a small, completely acceptable loss of 1.5%.

Minutes later, the stock continued its freefall, hitting a 10% decline before stabilizing. Eva sighed, but it was a sigh of relief, not defeat. She hadn’t been right on the direction, but she had been right on the risk management.

“That, ladies and gentlemen,” she announced to the silent floor, “was the sound of our risk budget being successfully protected.” Trend traders are patient, swing traders are quick, but the stop-loss trader is the one who survives to fight the next day. It’s the ultimate professional excitement: knowing you stared into the abyss of a major loss and walked away with a scratch.

The Story of the Chart

The Story of the Chart

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

The Story of the Chart

The Story of the Chart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The Story of the Chart

The Story of the Chart

The Story of the Chart

The Story of the Chart

The Story of the Chart

The Story of the Chart

The Story of the Chart

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

The Sacred Panic Button: A Stop-Loss Story

Captain Eva “Steady” Reynolds had seen it all: bull markets that made millionaires out of teenagers, and bear markets that could clear a trading floor faster than a faulty fire alarm. But Eva’s secret weapon wasn’t a complex algorithm; it was her unshakeable devotion to the stop-loss order.

She viewed the stop-loss not as a sign of defeat, but as her personal, automated bodyguard—the final, sacred panic button. “A professional trader’s only job is to protect capital,” she would tell her team. “The profits will follow if the losses don’t bankrupt you. Think of the stop-loss as your relationship therapist: it forces you to cut ties with bad trades before they take all your money and the furniture.”

Today, Eva had entered a perfectly reasonable long position on Quantum Quinoa (QQ), a promising health stock. The charts looked solid, momentum was building, and the volume was confirming the move. As a professional, she immediately placed her stop-loss at the price where her original trade thesis would be fundamentally invalidated. This specific price point, she explained, was her Maximum Acceptable Risk (MAR)—the point of “No Return, Only Pain.”

Then, things went sideways. A competitor released a study claiming that regular quinoa makes you mildly allergic to kittens. The stock market, predictably, threw a tantrum worthy of a toddler missing nap time. QQ’s price plummeted, not because of fundamentals, but pure, unadulterated panic.

Eva watched the numbers cascade down, a dizzying vertical drop that made her coffee mug tremble. She felt the primal human urge to interfere—to pull the stop-loss lower, to “give it room,” to pray for a reversal. “Just one dollar more, baby,” the little devil on her shoulder whispered.

But before she could click, the stop-loss executed perfectly. The order, pre-programmed, sold her position instantly at her predetermined MAR, locking in a small, completely acceptable loss of 1.5%.

Minutes later, the stock continued its freefall, hitting a 10% decline before stabilizing. Eva sighed, but it was a sigh of relief, not defeat. She hadn’t been right on the direction, but she had been right on the risk management.

“That, ladies and gentlemen,” she announced to the silent floor, “was the sound of our risk budget being successfully protected.” Trend traders are patient, swing traders are quick, but the stop-loss trader is the one who survives to fight the next day. It’s the ultimate professional excitement: knowing you stared into the abyss of a major loss and walked away with a scratch.

The Story of the Stop Loss

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

The Sacred Panic Button: A Stop-Loss Story

Captain Eva “Steady” Reynolds had seen it all: bull markets that made millionaires out of teenagers, and bear markets that could clear a trading floor faster than a faulty fire alarm. But Eva’s secret weapon wasn’t a complex algorithm; it was her unshakeable devotion to the stop-loss order.

She viewed the stop-loss not as a sign of defeat, but as her personal, automated bodyguard—the final, sacred panic button. “A professional trader’s only job is to protect capital,” she would tell her team. “The profits will follow if the losses don’t bankrupt you. Think of the stop-loss as your relationship therapist: it forces you to cut ties with bad trades before they take all your money and the furniture.”

Today, Eva had entered a perfectly reasonable long position on Quantum Quinoa (QQ), a promising health stock. The charts looked solid, momentum was building, and the volume was confirming the move. As a professional, she immediately placed her stop-loss at the price where her original trade thesis would be fundamentally invalidated. This specific price point, she explained, was her Maximum Acceptable Risk (MAR)—the point of “No Return, Only Pain.”

Then, things went sideways. A competitor released a study claiming that regular quinoa makes you mildly allergic to kittens. The stock market, predictably, threw a tantrum worthy of a toddler missing nap time. QQ’s price plummeted, not because of fundamentals, but pure, unadulterated panic.

Eva watched the numbers cascade down, a dizzying vertical drop that made her coffee mug tremble. She felt the primal human urge to interfere—to pull the stop-loss lower, to “give it room,” to pray for a reversal. “Just one dollar more, baby,” the little devil on her shoulder whispered.

But before she could click, the stop-loss executed perfectly. The order, pre-programmed, sold her position instantly at her predetermined MAR, locking in a small, completely acceptable loss of 1.5%.

Minutes later, the stock continued its freefall, hitting a 10% decline before stabilizing. Eva sighed, but it was a sigh of relief, not defeat. She hadn’t been right on the direction, but she had been right on the risk management.

“That, ladies and gentlemen,” she announced to the silent floor, “was the sound of our risk budget being successfully protected.” Trend traders are patient, swing traders are quick, but the stop-loss trader is the one who survives to fight the next day. It’s the ultimate professional excitement: knowing you stared into the abyss of a major loss and walked away with a scratch.

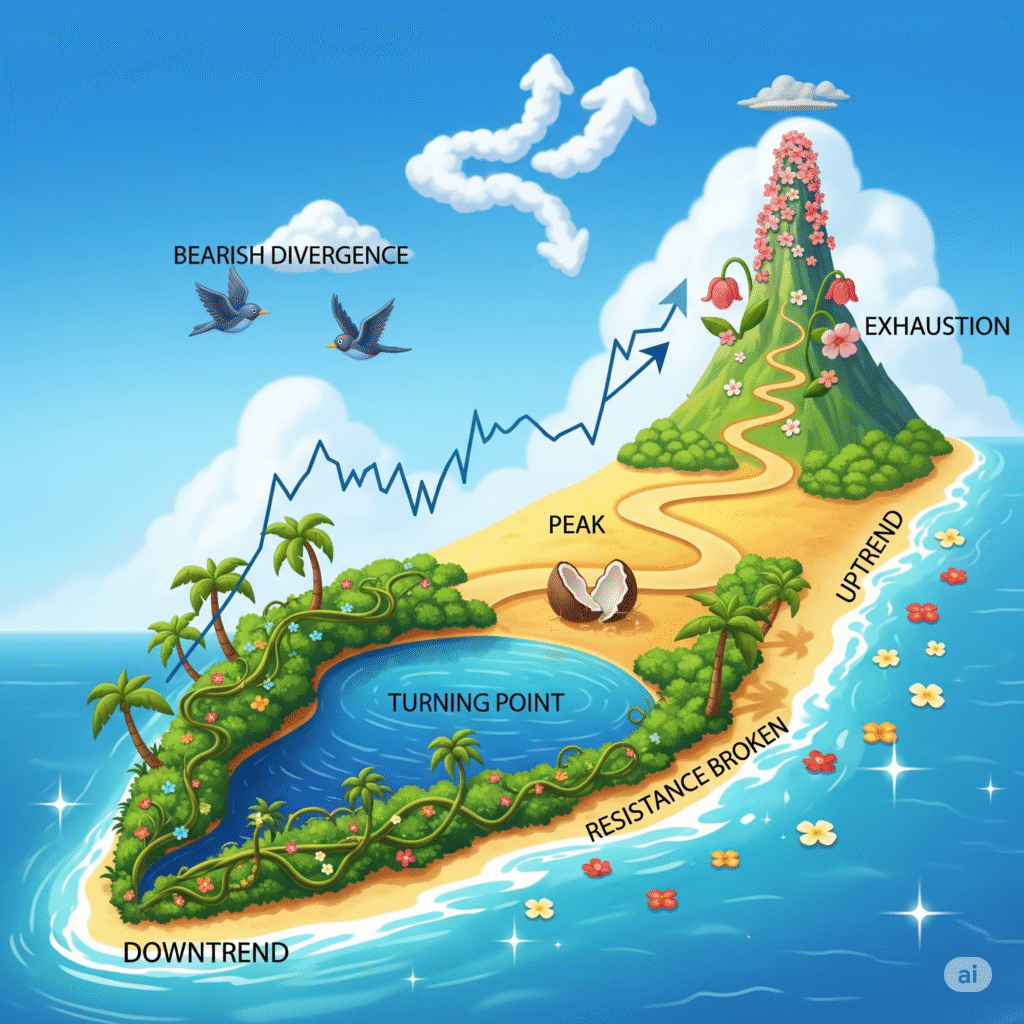

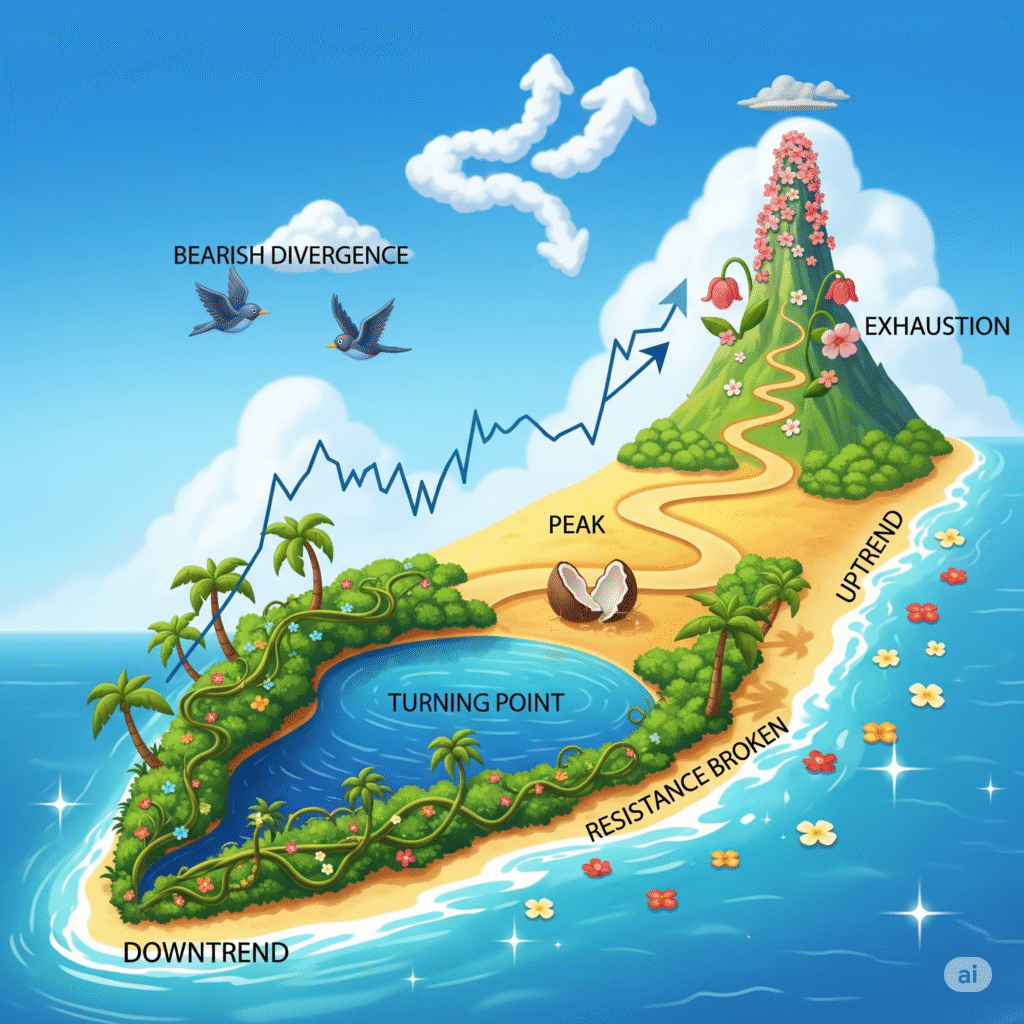

The Story of the Trend

- Is the current trend bullish or bearish?

2. Is the main trend bullish or bearish on selected timeframe?

3. Where is price now? where are the keylevels?

4. Are there any Price Action?

5. Are there any failed Price Action?

6. Is there evidence that the market is getting rid of buyers or sellers?

💰“The Power of Price Action”

Quotes:

“Let Price Tell the Story.”

“Price Never Lies – Everything Else Might.”

“Trade What You See, Not What You Think.”

“Candles Speak Louder Than Indicators.”

- “The Truth is in the Candles.”

The Sacred Panic Button: A Stop-Loss Story

Captain Eva “Steady” Reynolds had seen it all: bull markets that made millionaires out of teenagers, and bear markets that could clear a trading floor faster than a faulty fire alarm. But Eva’s secret weapon wasn’t a complex algorithm; it was her unshakeable devotion to the stop-loss order.

She viewed the stop-loss not as a sign of defeat, but as her personal, automated bodyguard—the final, sacred panic button. “A professional trader’s only job is to protect capital,” she would tell her team. “The profits will follow if the losses don’t bankrupt you. Think of the stop-loss as your relationship therapist: it forces you to cut ties with bad trades before they take all your money and the furniture.”

Today, Eva had entered a perfectly reasonable long position on Quantum Quinoa (QQ), a promising health stock. The charts looked solid, momentum was building, and the volume was confirming the move. As a professional, she immediately placed her stop-loss at the price where her original trade thesis would be fundamentally invalidated. This specific price point, she explained, was her Maximum Acceptable Risk (MAR)—the point of “No Return, Only Pain.”

Then, things went sideways. A competitor released a study claiming that regular quinoa makes you mildly allergic to kittens. The stock market, predictably, threw a tantrum worthy of a toddler missing nap time. QQ’s price plummeted, not because of fundamentals, but pure, unadulterated panic.

Eva watched the numbers cascade down, a dizzying vertical drop that made her coffee mug tremble. She felt the primal human urge to interfere—to pull the stop-loss lower, to “give it room,” to pray for a reversal. “Just one dollar more, baby,” the little devil on her shoulder whispered.

But before she could click, the stop-loss executed perfectly. The order, pre-programmed, sold her position instantly at her predetermined MAR, locking in a small, completely acceptable loss of 1.5%.

Minutes later, the stock continued its freefall, hitting a 10% decline before stabilizing. Eva sighed, but it was a sigh of relief, not defeat. She hadn’t been right on the direction, but she had been right on the risk management.

“That, ladies and gentlemen,” she announced to the silent floor, “was the sound of our risk budget being successfully protected.” Trend traders are patient, swing traders are quick, but the stop-loss trader is the one who survives to fight the next day. It’s the ultimate professional excitement: knowing you stared into the abyss of a major loss and walked away with a scratch.