The Advantages of The Trend is Your Friend

Trend is Your Friend: The Ultimate Trading Buddy!

If you’re tired of fighting the market, it’s time to make a new, high-net-worth buddy: The Trend! The old saying, “The trend is your friend,” isn’t a cliché; it’s the professional’s lazy way to make money.

The advantages are delightfully simple:

Low-Effort Profits: When a clear trend is established, the market is essentially driving itself. You just need to hop on the back of the momentum bus and enjoy the ride. Why fight against a financial hurricane when you can sail with it?

Increased Win Rate: Trading with the prevailing momentum drastically increases your odds of success. You’re aligning your trade with the path of least resistance—and highest profitability.

Clear Directional Bias: The trend instantly tells you whether you should be buying (uptrend) or selling (downtrend). It eliminates 50% of your decision-making, allowing you to focus on the perfect entry and exit.

Stop trying to be a hero who catches every reversal! Trade with your friend the trend until it inevitably ghosts you. Until then, enjoy the easy, exciting flow of profits!

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of the Trend

What is Price Action?!

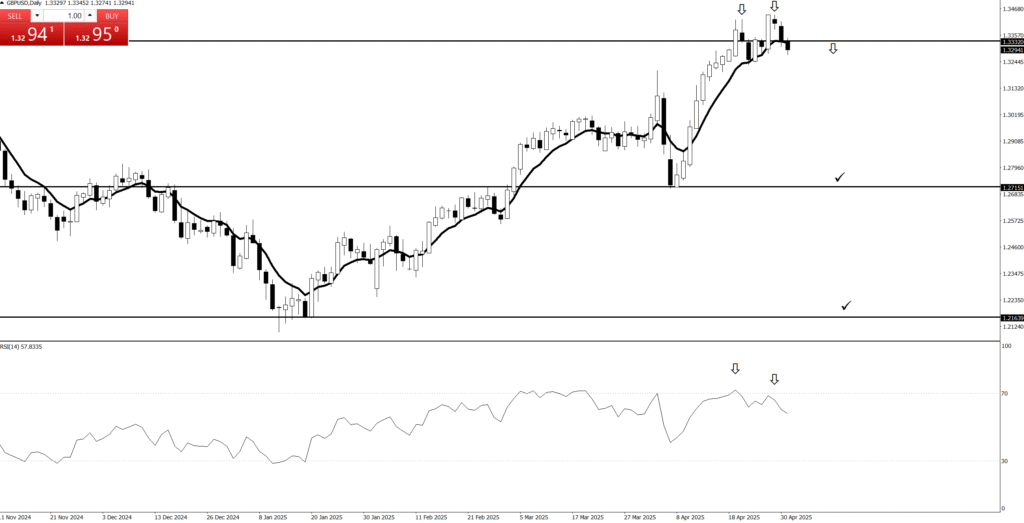

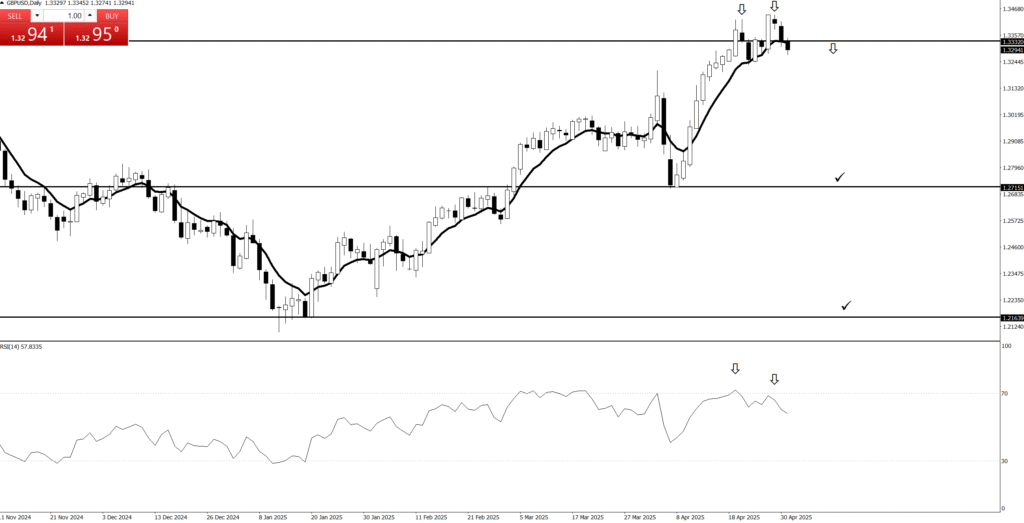

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

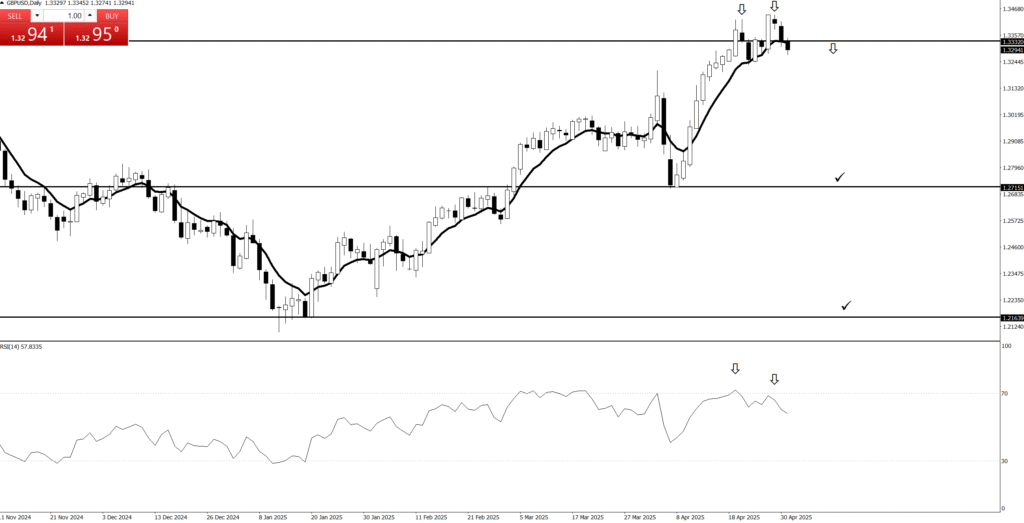

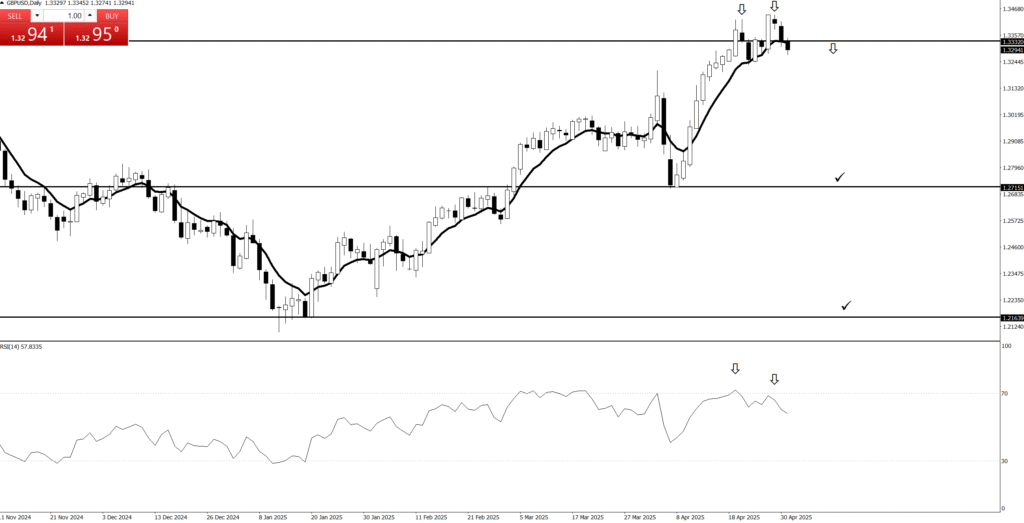

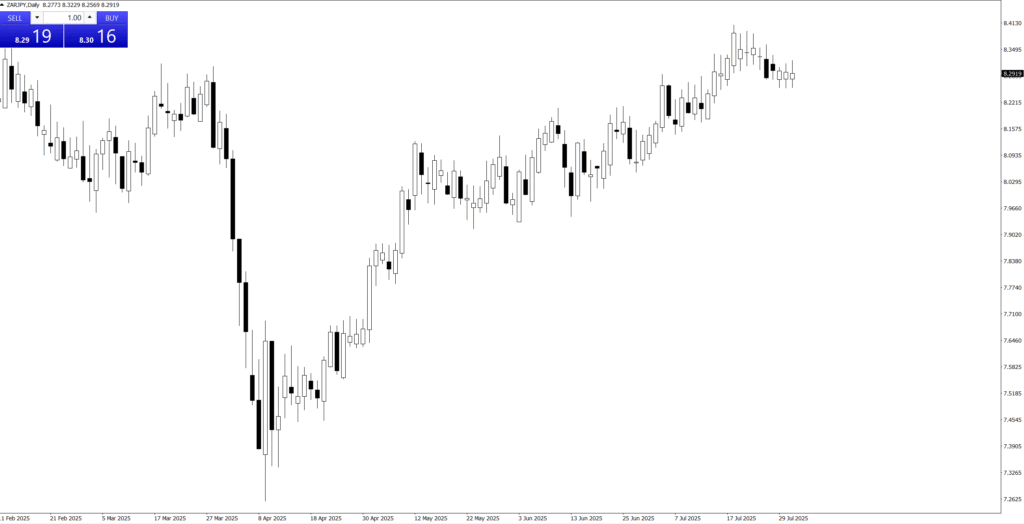

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of the Trend

What is Price Action?!

Trend is Your Friend (Until the Inevitable Breakup)

In the thrilling, often chaotic world of trading, there’s one piece of ancient wisdom that gets passed down from seasoned veteran to wide-eyed newbie: “The trend is your friend… until the end.”

It’s a phrase that sounds like a cheesy bumper sticker but contains the single most powerful principle in directional trading.

The Party Bus of Profits

Imagine the market is a massive party bus, and the trend is the direction it’s driving. When a stock is in a clear uptrend, it means the bus is heading uphill, filled with enthusiastic buyers who keep pushing the price (and the volume) higher.

As a savvy trader, your job is simple: Get on the bus!

You don’t fight the trend. Trying to short-sell a stock that is clearly in a powerful uptrend is like standing in the middle of a freeway with a “Stop” sign. It’s dangerous, foolhardy, and probably going to end in a bad way for your account balance.

The power of the trend lies in momentum. Once a large group of investors decides that a stock is going up (or down), that collective momentum tends to keep the movement going. Your primary strategy should be to identify these established trends and ride them for profit, using the momentum to do the heavy lifting for you.

The Inevitable, Hilarious Breakup

Now, for the “until the end” part. Like any good friendship—or dramatic relationship—the trend will eventually end. It won’t send you a polite text message; it will likely just ghost you, leaving you with a sudden, painful loss if you aren’t paying attention.

The secret to profiting is recognizing the signs that your “friend” is about to turn into an ex.

The Warning Signs: Your “friend” starts acting erratically. The stock’s price movements become choppy. It fails to make a new high. It breaks below a major support level. These are technical signals—the market equivalent of your friend starting to wear suspiciously dark sunglasses indoors.

The Exit Strategy (The Importance of Stop-Loss): Professional traders know that the friendship is purely transactional. They don’t fall in love with the stock. They set an emergency exit door—the stop-loss order—to automatically jump off the bus before it drives off a cliff.

The Exciting Takeaway

The power of the trend is your ability to make money easily by aligning yourself with the market’s dominant direction. It simplifies trading by giving you a clear bias: Go with the flow!

Just remember to keep an eye on that exit door. Because while the trend is your friend, it’s a fair-weather one that will ditch you the second the market gets bored. Trade smart, ride the trend, and always prepare for the inevitable, dramatic finale!

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of the Trend

What is Price Action?!

Attention Traders: Your New Best Friend Is Also a Bit Flaky

Listen up! Forget those complicated, 100-step trading strategies. The real secret to making money without pulling your hair out can be boiled down to four magical words: “The trend is your friend!”

Yes, it sounds like something your eccentric uncle embroidered on a pillow, but in the chaotic market jungle, the trend is your most reliable guide—until it completely and utterly betrays you.

The Power of the Herd (and Why You Should Join It)

What is a trend? It’s simply the market’s collective, ongoing decision. When a stock is in a clear uptrend, it means the majority of serious money managers and enthusiastic retail investors have decided this stock is going up. They’ve formed a massive, profitable convoy, and the only logical thing for you to do is hop on board.

You don’t fight this. Trying to short-sell a powerful uptrend is the financial equivalent of arguing with a concrete wall—it’s futile, painful, and messy. The power of the trend lies in momentum. Once the herd starts stampeding in one direction, the sheer inertia keeps the price moving, often beyond what seems logical.

Your job? Identify the trend early, ride the momentum with a big, professional grin, and collect the cash. This isn’t genius; it’s smart opportunism.

The Funny But Critical “Until the End”

Here’s the plot twist: your “friend” the trend is fundamentally unreliable. It will not last forever, and it certainly won’t call ahead to let you know it’s leaving.

This is where you graduate from amateur spectator to professional trader. You must have an exit strategy for when your friend starts acting shady.

The Breakup Signs: The market will give you visual cues. The stock stops making higher highs. It slips below a critical support level (a price floor). It’s the trend’s way of saying, “I’ve peaked, and now I’m going to take a nap… possibly forever.”

The Ultimate Tool: The Stop-Loss: Because you’re a professional (and value your sanity), you use a stop-loss order. This is the non-negotiable insurance policy. It automatically sells your position the instant the price confirms the trend has cracked. This ensures that when your fair-weather friend ditches you, you get off the bus with your profits mostly intact, rather than riding it straight into the ditch.

Master the art of riding the trend, but never, ever trust it unconditionally. Go with the flow, but keep your hand on the emergency brake!

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The Power of the Trend

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of PriceAction

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

The Power of the Trend

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

The Power of the Trend

What is Price Action?!

Price action is a trading methodology that analyzes the movement of an asset’s price over time to make trading decisions. It is the foundation of technical analysis and operates on the principle that all relevant market information—including economic news, investor sentiment, and fundamental data—is already reflected in the asset’s price.

Instead of relying on lagging technical indicators, traders who use price action focus on a “naked” or clean chart. By observing historical price data, they identify patterns, trends, and key levels to predict future price direction.The core concepts of price action analysis include:Support and Resistance

These are price levels where an asset’s price has historically paused or reversed direction. A support level is a price floor where buying pressure is strong enough to prevent the price from falling further. A resistance level is a price ceiling where selling pressure is sufficient to stop the price from rising higher.

Candlestick Patterns

Candlestick charts are a primary tool for price action traders. Each candlestick represents a specific period and shows the open, high, low, and closing prices. The shape and color of the candlesticks form patterns (e.g., Doji, Hammer, Engulfing) that provide insights into market sentiment and can signal potential reversals or continuations.

Trend Analysis

Price action traders identify the market’s trend by observing the sequence of highs and lows. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend is marked by lower highs and lower lows. A break in this sequence can indicate a potential trend reversal.

💰Quotes:

“Price action is the only truth on the chart.”

“Everything you need to know is written in the candles.”

“Indicators lag, price action leads.”

“Trade what you see, not what you think.”

“Every candle tells a story. Learn to read it.”

💰Quotes:

“Support and resistance are the footprints of money.”

“A closed candle is a fact, an open candle is only a possibility.”

“The market doesn’t hide; it leaves clues in price action.”

“The best trades look obvious… after you’ve learned to see them.”

“Patterns are just human emotions drawn on a chart.”

3. The Power of The Trend

You’ve heard it whispered in the hallowed halls of finance, scrawled on bathroom stalls in trading firms, and probably even mumbled by your grandma if she’s secretly a forex guru: “The trend is your friend.”

And let me tell you, it’s not just a catchy little rhyme your mentor uses to sound smart. It’s the absolute, unadulterated truth. Because trying to trade against the trend is like trying to convince a toddler that broccoli is delicious: you’re going to lose, you’re going to get messy, and you’re going to end up crying into your pint of ice cream.

Why the Trend is Your Bestie (and the Counter-Trend is a Frenemy with Benefits)

Imagine you’re at a crowded party. The trend? That’s the cool, popular person everyone wants to hang out with. They’re effortlessly moving in one direction, and everyone’s following. Do you:

Join the popular kid and have a good time (and maybe even get some free snacks)? (That’s trend trading.)

Try to push against the flow of people, constantly bumping into elbows and getting dirty looks, all while trying to reach that one obscure corner of the room that might have a single, stale chip? (That’s counter-trend trading.)

Exactly. One sounds like a party; the other sounds like a bad day at the mall on Black Friday.

The Siren Song of the Reversal (and Why You Should Plug Your Ears)

We’ve all felt it. That little voice in your head, whispering sweet nothings like, “But it has to turn around! It’s gone too far!” That, my friends, is the siren song of the reversal, luring innocent traders onto the jagged rocks of their stop-loss orders.

Here’s the deal: Trends are like those annoying relatives who just keep talking. They might pause for breath, they might even take a sip of water, but they’re generally going to keep going in the same direction until they’ve exhausted themselves or someone physically pulls them away. Trying to pick the exact moment they’ll shut up is a fool’s errand.

So, How Do You Befriend the Trend?

It’s simple, really:

Don’t fight it: If the market’s going up, don’t short it just because you feel it’s “too high.” If it’s plummeting, don’t try to catch a falling knife unless you enjoy emergency room visits.

Ride the wave: Identify the direction the market wants to go, and then hop on for the ride. It’s like catching a bus – much easier than trying to push it uphill yourself.

Know when to get off: Even your best friend eventually leaves the party. Trends reverse. Learn to spot the signs of exhaustion, take your profits, and look for the next popular person to hang out with.

In conclusion, attempting to outsmart the trend is a recipe for tears, frustration, and probably a very unhealthy relationship with your trading platform. So, instead of being the rebellious teenager of the markets, be the smart, agreeable one. Embrace the trend. It’s your friend, your guide, and potentially, your path to less stress and more actual money.

💰Quotes:

“Enter the trade — then sit on your hands like a monk!”

“We don’t click and panic. We click and chill.”

“Traders who wait, get paid. Traders who fidget… donate!”

“We enter the trade, then do absolutely nothing like pros.”

“Let the market work. You’re not its boss.”

💰Normal Tone Slogans:

“Enter with a plan, then let the trade play out.”

“The work is in the setup — the result comes with patience.”

“We don’t babysit trades. We trust our edge.”

“Entry is action. Waiting is discipline.”

“After entry, emotion has no place — only patience.”